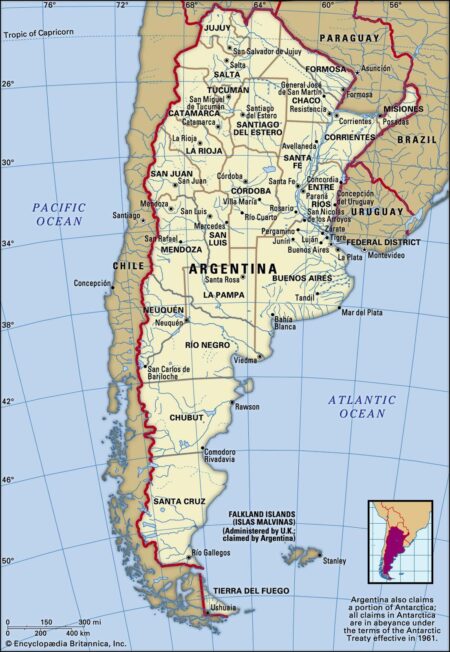

Argentina made a daring move toward financial stability by unveiling a high-stakes $1 billion debt auction, determined to restore investor confidence amid persistent economic challenges, Reuters reports

Browsing: economic recovery

Germany is set to make a strong comeback with economic growth in 2024, following two tough years of decline, economists told Reuters. This resurgence is driven by a powerful upswing in industrial production and a vibrant surge in export demand

UK Chancellor Jeremy Reeves spotlights encouraging signs of economic recovery, but he also acknowledges rising public frustration over soaring inflation and stagnant wage growth-underscoring the tough challenges that lie ahead for government policy

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse

Australia witnessed an impressive boost in employment during April, with job opportunities soaring across multiple sectors. At the same time, the unemployment rate held firm at 3.5%, showcasing a resilient labor market as the economy continues its path to recovery.

Private equity firms are buzzing with excitement about Spain, driven by its impressive economic growth and the country’s growing allure as a top tourist hotspot. This upbeat outlook signals a dynamic shift in the investment scene, positioning Spain as an irresistible destination for savvy investors.

In a daring shift, Argentine President Javier Milei’s revolutionary economic reforms, often described as a “chainsaw,” are making waves as inflation takes a nosedive and investments flourish. While critics voice their apprehensions, supporters passionately contend that it’s high time for bold measures to revitalize the faltering economy.

China has skillfully navigated the challenges posed by U.S. tariffs implemented during former President Trump’s administration, ensuring that its economic recovery remains robust. Officials assert that a combination of strong domestic resilience and surging global demand is fueling this growth, even as trade tensions persist and continue to influence the economic landscape

Argentina’s recent $20 billion financial rescue has sparked crucial discussions about its economic trajectory. Experts are diving deep into pressing topics like debt sustainability, strategies for controlling inflation, and the potential effects on social stability as the nation navigates ongoing challenges.

The IMF and World Bank have greenlit exciting new bailout packages for Argentina, designed to bolster its economy in the face of persistent inflation challenges. These vital measures are set to offer essential support as the nation charts a course through financial uncertainty.

Argentina’s recent IMF deal marks a critical financial maneuver aimed at stabilizing its economy. Negotiations involved stringent fiscal reforms and commitments to reduce inflation, showcasing the government’s resolve to navigate ongoing economic challenges.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

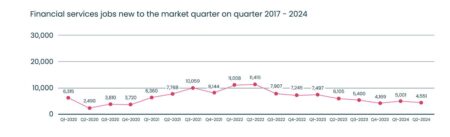

The UK jobs market has witnessed its most significant surge in job seekers since 2020, signaling renewed confidence amid economic recovery. Analysts attribute this rise to easing pandemic restrictions and increased hiring across various sectors.

In a significant move for his administration, President Javier Milei announced Argentina’s new deal with the IMF, marking a pivotal step towards economic stabilization. The agreement coincides with the removal of most capital controls, signaling a shift towards greater financial freedom.

Italy’s Prime Minister Giorgia Meloni has vowed to aid businesses affected by tariffs imposed during the Trump administration. She emphasized the need for solidarity among European nations to counter the financial strain and foster economic resilience.

Beijing’s long-anticipated decree is poised to bolster China’s private sector, offering critical support for economic recovery. Analysts suggest that this policy shift may restore investor confidence and stimulate growth in an increasingly competitive landscape.

Germany, facing an economic downturn, is set to relax its strict debt brake rules, potentially allowing for increased government spending. This shift aims to stimulate growth and address pressing social and infrastructure needs amidst rising geopolitical tensions.

China’s new plan to boost consumer spending focuses on increasing household incomes, enhancing social security, and promoting digital payment systems. This multifaceted approach aims to stimulate domestic demand and support economic growth amid global uncertainties.

European stocks surged and the euro rallied following Germany’s landmark debt agreement, signaling renewed investor confidence. The deal is expected to bolster economic stability across the Eurozone, prompting optimism among markets and analysts alike.