India’s exports to China skyrocketed in December, marking a powerful resurgence, while shipments to the U.S. dipped amid ongoing trade tensions and tariffs put in place during the Trump administration, CNBC reports

Browsing: economic trends

Inflation skyrocketed in December, surpassing November’s figures, reveals FocusEconomics. This dramatic increase underscores mounting pressure on prices fueled by ongoing supply chain disruptions and soaring energy costs

India’s remarkable GDP growth is turning heads across the globe, but experts say there’s more beneath the surface. Watch closely as five key forces drive the economy forward: inflation trends, fiscal health, export performance, job creation, and the power of domestic demand

CNBC’s The China Connection explores the future of U.S.-China relations after a decade of intense rivalry, revealing the shifting dynamics and daring new strategies in trade, technology, and geopolitics that will shape the next chapter

Soaring gold prices are igniting an exciting modern-day gold rush across Australia, attracting a new wave of fortune seekers. Adventurous prospectors are flocking to historic sites, eager to unearth hidden treasures and strike it rich as demand skyrockets and supplies grow scarce

Canada’s October GDP likely took a hit, dragged down by weaker consumer spending and challenges in the energy sector. But don’t worry-there’s a silver lining! Economic activity is poised for a strong rebound in November as supply chain snags clear up and demand picks up, Finimize reports

Deloitte’s November 2025 report highlights Brazil’s remarkable economic comeback, driven by strong commodity exports and rising domestic demand. Yet, inflation pressures and political uncertainties remain key hurdles ahead

China’s booming robotics sector is capturing global attention as worries about a potential bubble grow louder. With investments flooding in at breakneck speed and valuations soaring to new heights, many are left wondering if this explosive surge can last-and what it could mean for the future of the industry

Recent developments at Banco BBVA Argentina are reshaping its investment story, driven by bold strategic initiatives and exciting opportunities in emerging markets. Analysts are upbeat, highlighting new growth prospects in a vibrant and evolving economic environment

Argentina’s consumer confidence plunged dramatically in December, underscoring growing economic uncertainty. This steep drop reflects soaring inflation and dwindling purchasing power, dimming household optimism as the year comes to a close

China’s deflationary challenges continue to loom large, even as consumer inflation soars to a 21-month high, Reuters reports. Service prices are on the rise, yet factory-gate and wholesale goods stubbornly lag behind, highlighting the intricate economic obstacles that lie ahead

Copper prices eased off their record highs as a colder winter in China, the world’s largest consumer, dampened demand. A slowdown in industrial activity fueled concerns over sustained metal consumption, sending shockwaves through global markets

Spain’s budget deficit is set to fall below Germany’s for the first time in nearly 20 years, signaling a stunning shift in the Eurozone’s fiscal dynamics, reports the Financial Times

Argentina’s inflation surged just ahead of the pivotal midterm elections, ramping up the pressure on the government to confront soaring prices and mounting economic uncertainty, Bloomberg reports

The East of Germany is experiencing an unprecedented boom, driven by bold investments in technology, infrastructure, and education. This vibrant transformation is reshaping the region’s economic landscape and unlocking a world of exciting new business opportunities

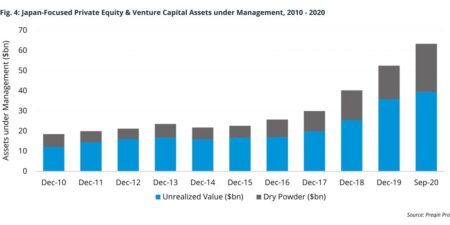

Japan is rapidly emerging as a prime destination for private equity firms, driven by an aging population and transformative corporate reforms. Investors are now setting their sights on this previously overlooked market, discovering thrilling new opportunities and heralding a promising surge of growth ahead

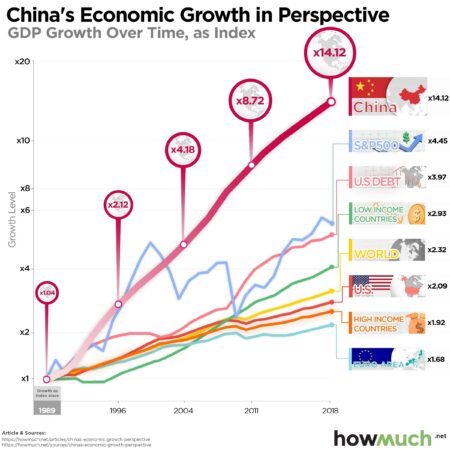

China’s economy continues its steady march forward with consistent growth, but beneath the surface, consumer confidence is starting to waver amid persistent uncertainties. Analysts point to cautious spending habits as households grapple with rising costs and increasing pressures from global markets

Europe is on edge as France faces economic uncertainty, eagerly awaiting decisive policies and renewed stability. ING Monthly highlights the high stakes for the continent as France battles to maintain growth and preserve investor confidence

More Australians are choosing to work well into their 70s, fueled by shifting attitudes toward retirement and growing financial needs. A Bloomberg.com report highlights this exciting trend of extended careers sweeping across the nation

Morgan Stanley shines a spotlight on the evolving dynamics of India-China trade, uncovering how shifting supply chains and new policies are transforming the market landscape. The report explores thrilling future opportunities arising amid rising geopolitical tensions and significant economic realignments