A controversial Brazilian credit product that once led to significant investor losses is making a surprising comeback, drawing renewed attention as market conditions shift. Experts warn investors to proceed with caution and thoroughly evaluate the risks before diving in

Browsing: emerging markets

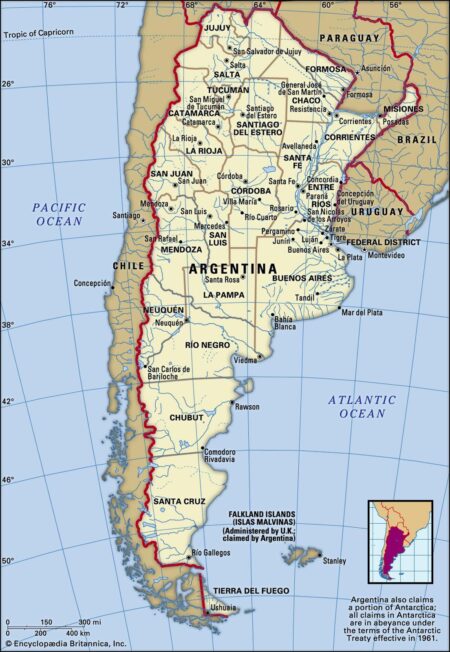

Argentina made a daring move toward financial stability by unveiling a high-stakes $1 billion debt auction, determined to restore investor confidence amid persistent economic challenges, Reuters reports

Bruegel’s latest report uncovers ten urgent challenges facing China’s economy-from slowing growth and rising debt risks to dramatic demographic shifts-highlighting major hurdles that threaten the nation’s economic stability and its role on the global stage

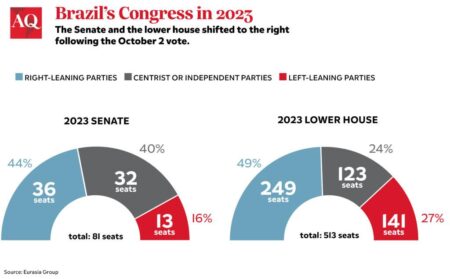

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

Argentina is facing a growing debt crisis that is straining its economy and edging the nation dangerously close to default. Experts warn that without rapid and far-reaching structural reforms, the country’s financial stability may be severely threatened

Argentina triumphantly secured $1 billion in a high-stakes international bond auction, igniting fresh investor confidence and propelling momentum behind President Javier Milei’s ambitious economic agenda, the Financial Times reports

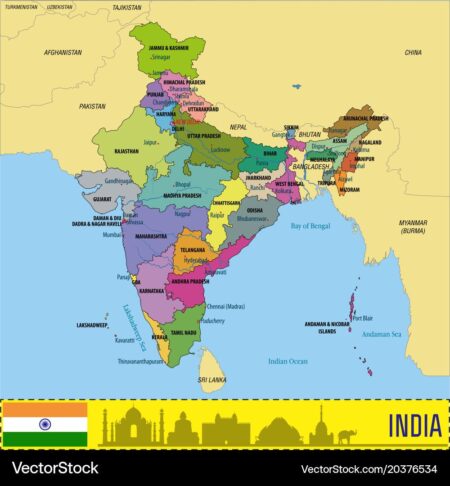

India is surging ahead of China, the US, EU, and Germany in economic growth, driven by robust domestic demand, lightning-fast digital adoption, and groundbreaking manufacturing reforms-signaling a powerful shift in the global economic landscape

Brazil has just secured an impressive $2.75 billion in its second dollar bond offering of 2025, Reuters reports. This robust demand reflects a surge in investor confidence, as the country’s credit default swaps (CDS) have fallen to their lowest level in a year, signaling optimism about Brazil’s financial future

Brazil’s economy stunned analysts by posting robust growth despite high interest rates. Bloomberg reports that strong consumer demand and export gains are fueling a surprising economic surge.

In a bold and thought-provoking analysis, a prominent strategist takes aim at the prevailing narrative that India is simply playing catch-up with Japan in economic performance. He asserts that India’s astonishing growth trajectory not only sets the stage for it to match Japan but also positions it to surpass its rival, fundamentally transforming global economic dynamics.

China and Brazil have boldly reaffirmed their dedication to a multipolar world order, even as economic tensions simmer due to lingering Trump-era tariffs. In their recent meeting, the leaders passionately emphasized the importance of collaboration to combat protectionism and foster global trade stability

China is making a bold move by committing billions in investments to Latin America and the Caribbean, all in a bid to strengthen its foothold in the region as competition with the United States intensifies. This ambitious initiative underscores China’s strategic vision to broaden its global influence and forge deeper connections across continents.

In an exciting development, China is poised to boost its investments in Brazil by a staggering $27 billion, as revealed by President Lula. This strategic initiative is designed to fortify economic connections and elevate collaboration in key areas such as infrastructure and energy, marking a significant step towards a dynamic partnership.

India is set to overtake Japan as the world’s fourth largest economy by 2025, as revealed by the International Monetary Fund (IMF). This remarkable achievement highlights India’s swift economic ascent, driven by robust consumer demand and innovative reforms.

Argentina’s recent $20 billion financial rescue has sparked crucial discussions about its economic trajectory. Experts are diving deep into pressing topics like debt sustainability, strategies for controlling inflation, and the potential effects on social stability as the nation navigates ongoing challenges.

BRICS nations are embarking on an exciting new initiative to strengthen the global economy, as revealed by a Brazilian official. This groundbreaking mechanism is designed to boost financial collaboration among member countries, marking a strategic step towards amplifying their collective impact in international markets.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

In a recent statement, JPMorgan CEO Jamie Dimon advised former President Trump to consider the resilience of countries like India as the U.S. faces potential recession risks. Dimon emphasized the importance of global economic dynamics amid domestic challenges.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

Brazil and Vietnam have engaged in discussions focused on enhancing trade relations, particularly in the aviation and beef sectors. The dialogue comes ahead of the upcoming BRICS summit, highlighting a shared commitment to strengthen economic ties and cooperation.