Nigerian President has called for the swift return of Brazil’s Petrobras to Nigerian oil projects, signaling an exciting new chapter of collaboration and investment in the energy sector, Reuters reports

Browsing: energy sector

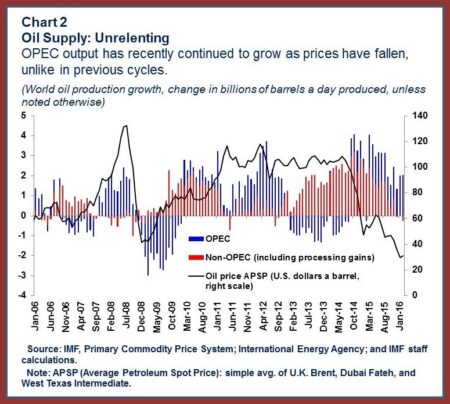

Oil prices dipped as the US sharply criticized India’s newest energy policies, sparking concerns over a potential global supply glut. Market watchers remain on high alert, bracing for volatility amid geopolitical tensions and shifting demand forecasts

Prysmian’s cable-laying vessels have embarked on an exciting mission to install two crucial subsea interconnections off Spain’s coast, marking a significant milestone in expanding the country’s offshore energy network

Mitsubishi Heavy Industries has stepped away from Japan’s offshore wind projects, citing soaring costs and challenging conditions. This move raises serious questions about the future of the country’s bold renewable energy ambitions

A U.S. appeals court has handed a significant victory to Argentina, blocking the sale of shares in YPF, the state-backed oil powerhouse. This ruling puts a temporary stop to any shifts in ownership as the fierce legal battles over control of YPF continue to escalate

DOF Group ASA has secured an exciting new offshore contract in Brazil, signaling a major leap forward in its regional footprint. This achievement highlights the company’s swiftly rising impact in the Brazilian offshore engineering sector

Brazil’s National Petroleum Agency (ANP) has just announced a thrilling offshore auction with seven brand-new blocks, poised to spark a wave of exploration and boost production in the nation’s abundant pre-salt and deepwater basins

A massive swarm of jellyfish has forced a nuclear power plant in France to shut down temporarily, halting operations and revealing serious vulnerabilities in seawater-dependent cooling systems. Authorities are now racing to assess the full scope of the disruption

Sanctions-hit Indian refiner Nayara Energy is in active talks with the government, seeking vital support to navigate mounting financial challenges and keep its operations running smoothly, Reuters reports. These discussions aim to secure a stable and sustainable future for the company

Germany’s Uniper is gearing up to unleash a massive $5.8 billion investment by 2030 in a bold strategic transformation aimed at turbocharging renewable energy expansion and dramatically cutting reliance on fossil fuels, Reuters reports

YPF CEO announced a deliberate slowdown in drilling at Argentina’s Vaca Muerta shale, citing tough market conditions and soaring costs. This cautious approach highlights the company’s strategic response to the unpredictable global energy landscape

Brazil’s Petrobras has hinted that extra dividends this year are unlikely, citing market uncertainties and urgent investment needs, Reuters reports. The state-controlled oil giant is prioritizing capital expenditure as energy prices continue to fluctuate unpredictably

Argentina’s YPF experienced a dramatic nearly 90% drop in Q2 profits, battered by plunging fuel prices. The state-run oil giant faces mounting challenges as global market turmoil and softening demand weigh heavily on its performance, Reuters reports

TotalEnergies (TTE:NYSE) is shaking up the South American energy scene with a bold $500 million deal, selling its stakes in two Argentina oil and gas blocks to YPF. This strategic move is designed to sharpen its focus and streamline its portfolio for greater impact

TotalEnergies has taken a bold step in South America, selling its 45% stake in Argentina oil blocks to YPF for $500 million. This move marks a significant strategic shift in the company’s regional operations, TradingView reports

Spain’s Cox has made a daring move by acquiring Iberdrola’s Mexican assets in a $4.2 billion deal, significantly boosting its footprint in Latin America’s vibrant energy market. This groundbreaking transaction marks a pivotal change in the ownership landscape of the region’s power sector

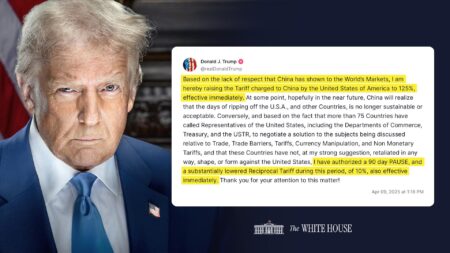

President Trump’s latest order removes tariffs on aircraft, orange juice, and energy products imported from Brazil. This bold step aims to ease trade tensions while maintaining pressure on other sectors, Reuters reports

Spain’s Cox is targeting Iberdrola’s Mexican assets and other strategic opportunities to supercharge growth, the CEO reveals. The energy powerhouse is on a mission to expand its footprint across Latin America, leveraging key acquisitions to strengthen its market leadership

Australia’s Viva Energy shares plunged 11% after an unexpected slump in convenience store sales. This sharp decline has raised concerns about the company’s near-term profitability amid shifting consumer behaviors, Reuters reports

Spotlight: Argentina’s electric power sector is electrified with fresh investment, fueled by groundbreaking renewable energy projects and state-of-the-art grid modernization. This vibrant landscape presents incredible growth opportunities for local pioneers and global investors alike