Deutsche Bank is shaking up advisory roles at its global investment bank, determined to sharpen leadership and elevate client services, Reuters reports. This bold move underscores the bank’s commitment to boosting efficiency amid ongoing market challenges

Browsing: finance news

Spain has hit the pause button on the legal merger of BBVA and Sabadell for up to five years, citing serious anti-competitive concerns, the Wall Street Journal reveals. This decision puts a hold on what might have been one of Spain’s most groundbreaking banking mergers

The Bank of Canada held its key interest rate steady at 2.75%, underscoring ongoing uncertainties tied to tariff negotiations. With trade talks remaining unpredictable, the central bank chose a cautious approach amid a clouded economic outlook

The EU has issued a strong warning to Spain’s government, urging them not to block BBVA’s ambitious bid to acquire Banco Sabadell. Highlighting the importance of fair competition and regulatory neutrality, Reuters reports this move could shape the future of Spain’s banking landscape

The Commonwealth Bank of Australia (CBA) has announced an impressive surge in cash profit for the third quarter, fueled by dynamic lending growth and steady margins. These results not only highlight the bank’s resilience in the face of economic challenges but also solidify its stronghold in the market.

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

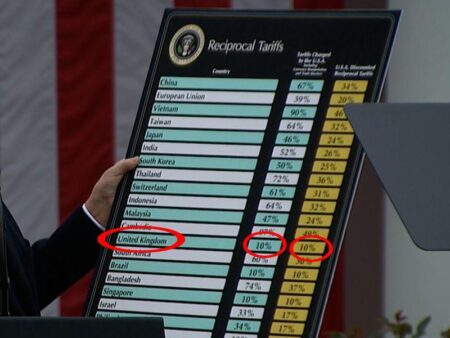

In a bold statement, former President Donald Trump declared that the U.S. doesn’t need a formal trade deal to thrive. He pointed to the successful partnerships between the UK and India as shining examples of how effective trade relations can flourish even without direct U.S. involvement

The Biden administration announced that tariffs on Chinese imports have reached a staggering 145%, a significant escalation in trade tensions between the two nations. This move aims to address ongoing concerns over China’s trade practices and economic policies.

Bakkavor Group emerges as a standout in the UK penny stock landscape, offering potential for savvy investors. In our latest analysis, we explore three promising penny stock opportunities that align with Bakkavor’s growth strategy, highlighting their market potential.

Australia is ramping up its regulatory framework for cryptocurrencies, as exchanges expand amid rising interest. This move aims to enhance consumer protection and financial stability, testing the industry’s adaptability to stricter oversight.

The Commonwealth Bank of Australia has announced a new dividend distribution, signaling confidence in its financial stability. Investors can expect the payout to enhance returns, reflecting the bank’s robust performance amid a fluctuating market environment.

The UK economy showed signs of stagnation in January, highlighting the growing challenges for Shadow Chancellor Rachel Reeves. This downturn raises critical questions about the government’s economic strategy and its impact on future growth.

Warren Buffett announced that Berkshire Hathaway plans to further increase its investments in Japan’s trading houses, highlighting the country’s economic stability and growth potential. This strategic move underscores Buffett’s confidence in Japan’s market resilience.