Australians are gearing up to turbocharge their retirement savings as the Superannuation Guarantee rises to 12%. This gradual increase is set to boost workers’ nest eggs, paving the way for a more secure and comfortable retirement

Browsing: finance

B.P. Marsh & Partners, alongside two dynamic UK firms on the rise, are rapidly carving out a powerful presence in the market. Their innovative strategies and steady growth are capturing keen investor interest amid a transforming industry landscape

Argentina made a daring move toward financial stability by unveiling a high-stakes $1 billion debt auction, determined to restore investor confidence amid persistent economic challenges, Reuters reports

Argentina triumphantly secured $1 billion in a high-stakes international bond auction, igniting fresh investor confidence and propelling momentum behind President Javier Milei’s ambitious economic agenda, the Financial Times reports

Argentina is poised for a thrilling surge in mergers and acquisitions under President Milei, with the energy sector shining as a prime hotspot for eager investors, according to PwC. The market buzzes with anticipation as fresh reforms pave the way for an exciting wave of investment opportunities

Germany is reportedly gearing up to introduce a 10% digital tax aimed at tech giants like Alphabet and Meta, seeking to boost revenue from their massive online activities within the country, sources reveal

Brazil’s economy stunned analysts by posting robust growth despite high interest rates. Bloomberg reports that strong consumer demand and export gains are fueling a surprising economic surge.

Japan’s net external assets have soared to an all-time high, yet the nation has relinquished its title as the world’s top creditor for the first time in more than ten years. This pivotal change underscores the evolving landscape of global economics and the hurdles confronting Japan’s economy

In a bold move, six provinces in Argentina are uniting to demand more than US$9 billion from the national government. They argue that financial commitments have been overlooked and stress the urgent need for enhanced funding. This escalating dispute underscores the growing tensions between regional authorities and the federal administration.

In a bold move against crime, French authorities have dismantled a chilling new kidnapping scheme tied to cryptocurrency, leading to the arrest of more than 20 suspects. As reported by France 24, this operation underscores the alarming rise of organized crime’s connection with digital currency.

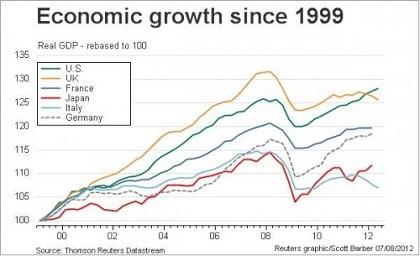

In a surprising turn of events, Japan has relinquished its title as the world’s top creditor nation to Germany, marking the end of a remarkable 34-year reign. This significant shift highlights Japan’s mounting debts and sluggish economic growth, while Germany’s thriving exports continue to strengthen its financial prowess on the global stage.

According to a recent report by the Taipei Times, an astonishing 250 exchanges have been recorded in China over the past month, showcasing a remarkable surge in trade activity amidst escalating geopolitical tensions. Analysts are raising alarms about the potential repercussions for regional markets and overall economic stability.

German Finance Minister Christian Lindner emphasized the urgent need for the United States to swiftly address tariff issues, highlighting their crucial role in fostering global trade stability. His comments arrive at a pivotal moment as discussions continue around trade policies that significantly impact the economies of both nations.

Argentina’s black market for dollars is witnessing a notable decline as the government takes steps to relax stringent currency controls. This strategic shift is designed to bring stability to the economy, yet hurdles remain. With inflation and economic uncertainty still looming large, public confidence continues to waver.

In a bold and thought-provoking analysis, a prominent strategist takes aim at the prevailing narrative that India is simply playing catch-up with Japan in economic performance. He asserts that India’s astonishing growth trajectory not only sets the stage for it to match Japan but also positions it to surpass its rival, fundamentally transforming global economic dynamics.

As global tensions rise, Germany stands at a crossroads, grappling with pivotal decisions that will shape its economic destiny. Yet, leading economists caution that Friedrich Merz’s plans for rearmament and austerity might fall short in tackling the deeper issues of sustainable growth.

In Italy, the spotlight on “lo spread”—the interest rate gap between Italian and German bonds—has started to fade as fresh priorities take center stage. Analysts suggest that this change signals deeper worries, emphasizing the importance of stability that goes beyond just figures

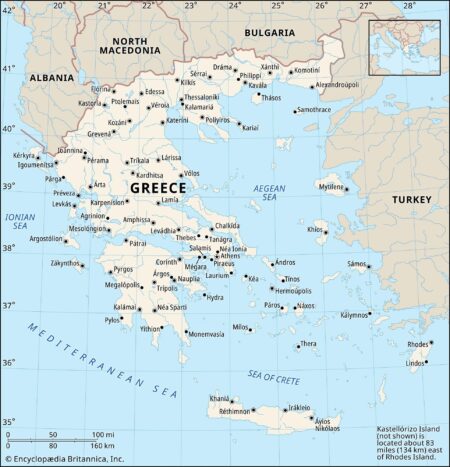

In an intriguing cultural shift, Bloomberg highlights the blossoming fascination with Greek culture in Japan. Although historical ties may be sparse, a vibrant enthusiasm for Greek cuisine, philosophy, and art reveals an unexpected bond forming between these two nations.

Japan and the United States are set to draw from their previous foreign exchange agreement in their upcoming discussions, as revealed by Finance Minister Shunichi Kato. This strategic approach highlights a strong commitment to fostering currency stability and enhancing trade relations between the two nations

In a bold move, Brazil has scrapped its contentious offshore tax on investment funds after facing intense pushback from investors. This pivotal decision is set to rejuvenate confidence in the financial sector and draw in foreign capital, signaling a transformative shift in the government’s fiscal strategy.