Comfort Systems USA (FIX) shattered revenue expectations, driven by a booming demand for AI infrastructure. Analysts are now re-evaluating the company’s valuation, highlighting its impressive growth potential amid a surge in tech investments

Browsing: financial analysis

Spain Stocks Watch: Caixabank shares slipped today amid market pressure, while Aena soared on the back of a fresh buy recommendation from analysts, fueling excitement about the airport operator’s bright growth prospects

In January 2026, three UK stocks are trading far below their true value, presenting thrilling buying opportunities for savvy investors. Yahoo! Finance Canada highlights these hidden gems amid the ongoing market turbulence

Comfort Systems USA (FIX) has soared an astonishing 19-fold in just five years, captivating investors eager to tap into its explosive growth potential. This remarkable rise tells a powerful story, but now many are asking-can this momentum keep charging ahead in the face of shifting market dynamics?

India’s remarkable GDP growth is turning heads across the globe, but experts say there’s more beneath the surface. Watch closely as five key forces drive the economy forward: inflation trends, fiscal health, export performance, job creation, and the power of domestic demand

On January 6, Italy faces a pivotal moment as key economic data and political developments are poised to influence market sentiment. Watch closely for inflation figures and government stability-these elements could dramatically impact the euro and Italian stock markets

Europe is on edge as France faces economic uncertainty, eagerly awaiting decisive policies and renewed stability. ING Monthly highlights the high stakes for the continent as France battles to maintain growth and preserve investor confidence

German investor morale soared unexpectedly in September, according to the ZEW Economic Sentiment Index released on Thursday. This remarkable upswing signals a fresh wave of optimism, shining through despite persistent economic uncertainties

Germany’s business outlook has soared to its highest level since 2022, igniting fresh optimism among companies as supply chain hurdles fade and global demand gains momentum, Bloomberg reports

The UK economy showcased remarkable resilience in Q2, defying inflation and supply chain challenges, ING Think reveals. This steady growth shines as a beacon of cautious optimism amid ongoing global uncertainties

China’s latest earnings reports reveal a mixed bag, sparking fresh concerns about the fragile recovery in onshore stocks. Investors are proceeding with caution as key sectors post uneven results, threatening to derail the budding market rebound

Argentina has just posted its biggest current account deficit since Q3 2023, reveals TradingView data. This widening gap highlights the ongoing economic challenges the nation grapples with amid volatile trade dynamics and shifting currency values

B.P. Marsh & Partners, alongside two dynamic UK firms on the rise, are rapidly carving out a powerful presence in the market. Their innovative strategies and steady growth are capturing keen investor interest amid a transforming industry landscape

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse

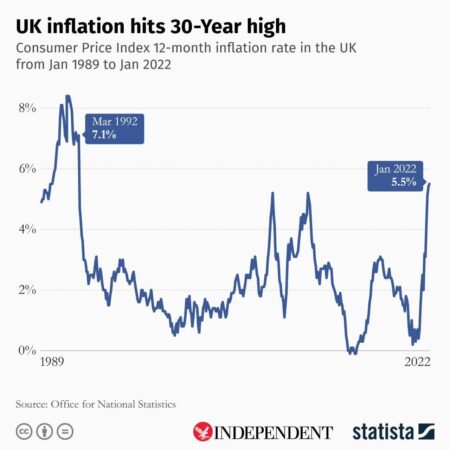

UK inflation rates have skyrocketed, sparking worries about the rising cost of living. Recent data reveals that prices are climbing at an alarming rate, affecting everything from your weekly grocery shop to soaring energy bills. As families prepare for tighter budgets, experts are weighing in on the potential economic fallout.

Economists are sounding the alarm, declaring that Canada has slipped into a recession. With consumer spending taking a hit and inflation on the rise, the outlook is concerning. Analysts predict that these persistent economic pressures may spell extended difficulties for Canadian households and businesses alike.

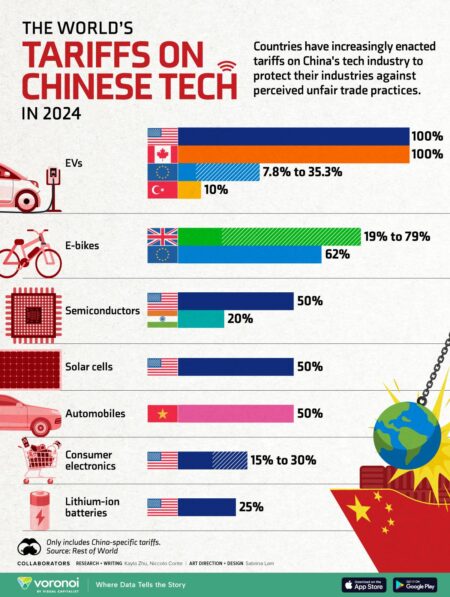

Even with tariffs slashed from a staggering 145%, small businesses caught in the whirlwind of US-China trade tensions are still grappling with formidable challenges. Experts caution that the persistent uncertainty and rising costs are putting immense pressure on their operations and pricing strategies.

The European Union has updated its growth forecasts for Italy for 2025 and 2026, highlighting worries about falling productivity and the effects of tariffs. This revision sheds light on the persistent economic hurdles the nation is grappling with as global trade dynamics continue to shift.

Following Mark Carney’s triumphant win, Canada’s economy is navigating choppy waters. Recent job statistics have unveiled the lowest employment numbers we’ve seen in almost ten years. Experts are sounding the alarm over escalating unemployment rates, urging swift policy actions to address this pressing issue.

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.