Argentina has just posted its biggest current account deficit since Q3 2023, reveals TradingView data. This widening gap highlights the ongoing economic challenges the nation grapples with amid volatile trade dynamics and shifting currency values

Browsing: financial analysis

B.P. Marsh & Partners, alongside two dynamic UK firms on the rise, are rapidly carving out a powerful presence in the market. Their innovative strategies and steady growth are capturing keen investor interest amid a transforming industry landscape

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse

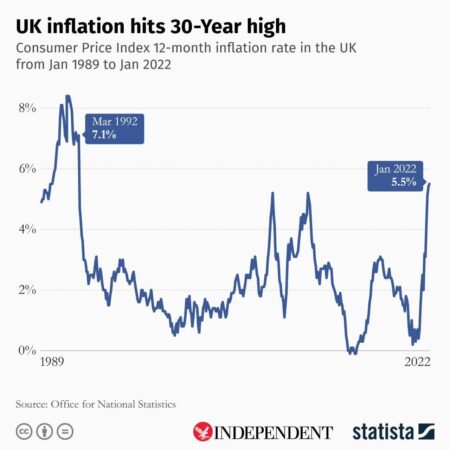

UK inflation rates have skyrocketed, sparking worries about the rising cost of living. Recent data reveals that prices are climbing at an alarming rate, affecting everything from your weekly grocery shop to soaring energy bills. As families prepare for tighter budgets, experts are weighing in on the potential economic fallout.

Economists are sounding the alarm, declaring that Canada has slipped into a recession. With consumer spending taking a hit and inflation on the rise, the outlook is concerning. Analysts predict that these persistent economic pressures may spell extended difficulties for Canadian households and businesses alike.

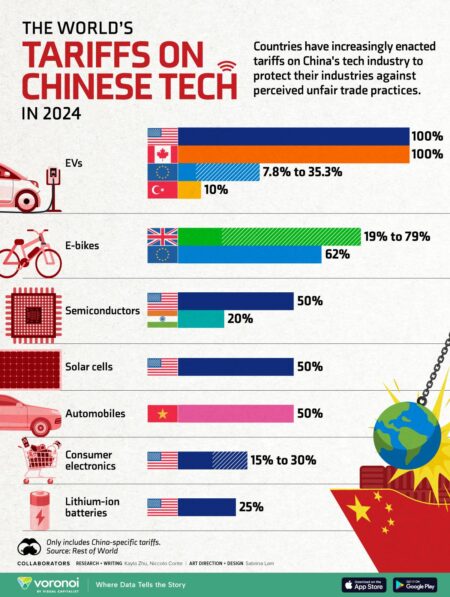

Even with tariffs slashed from a staggering 145%, small businesses caught in the whirlwind of US-China trade tensions are still grappling with formidable challenges. Experts caution that the persistent uncertainty and rising costs are putting immense pressure on their operations and pricing strategies.

The European Union has updated its growth forecasts for Italy for 2025 and 2026, highlighting worries about falling productivity and the effects of tariffs. This revision sheds light on the persistent economic hurdles the nation is grappling with as global trade dynamics continue to shift.

Following Mark Carney’s triumphant win, Canada’s economy is navigating choppy waters. Recent job statistics have unveiled the lowest employment numbers we’ve seen in almost ten years. Experts are sounding the alarm over escalating unemployment rates, urging swift policy actions to address this pressing issue.

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

China’s economy is under the microscope as vital data becomes increasingly elusive, sparking worries among analysts. The Wall Street Journal emphasizes the difficulties in gauging economic vitality when key statistics are disappearing, making it harder to predict trends and formulate effective policies

Amid rising trade tensions, India faces a crucial moment to champion equity by establishing strong safeguards for its most vulnerable sectors. As Trump’s trade war transforms the landscape of global markets, it becomes imperative to craft targeted policies that create fair opportunities for everyone.

UK equities are on the rise, fueled by a remarkable surge in bank stocks thanks to encouraging earnings reports. Investors are keenly watching the unfolding tariff discussions, carefully assessing their potential effects on trade and market stability. Across various sectors, stocks are showcasing a sense of cautious optimism as global tensions continue to simmer.

As we step into January 2025, the UK’s private capital market is navigating a vibrant and challenging macroeconomic landscape. With interest rates on the rise and inflation making its presence felt, investors are rethinking their strategies. They are on a quest for resilience in the face of market fluctuations while skillfully adapting to evolving regulatory changes.

Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

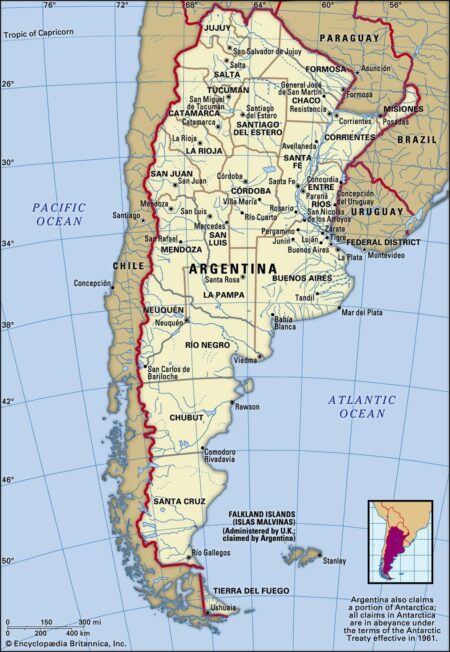

has made a bold move by acquiring , significantly strengthening its foothold in the vibrant South American energy market. This strategic acquisition not only reflects Vista’s ambitious growth plans but also enriches its portfolio and operational prowess in the region, setting the stage for exciting new opportunities ahead

Shares of India’s IndusInd Bank surged as investors reacted positively to news that the impact of a recent accounting lapse was less severe than anticipated. What initially sparked concern has now been largely addressed, calming investor anxieties and restoring confidence in the market.

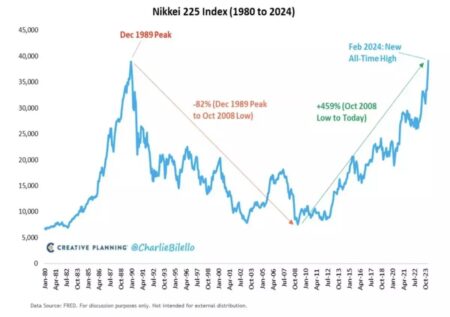

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.