A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Browsing: financial news

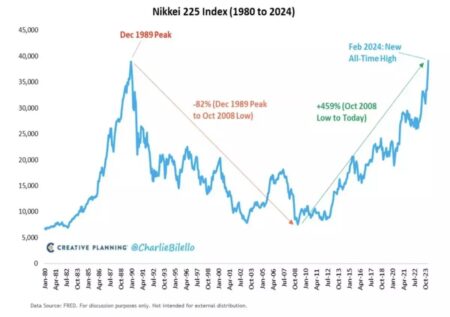

In a surprising analysis, strategists suggest that Japan, rather than China, may have strong incentives to reduce its U.S. Treasury holdings. This shift could be driven by Japan’s need to stabilize its currency amidst ongoing economic challenges.

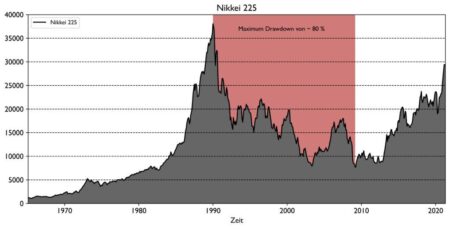

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

Australia’s median home value has surged by approximately $230,000 over the past five years, highlighting a significant shift in the housing market. This rise raises concerns over affordability and accessibility for potential buyers amidst ongoing economic challenges.

Apple, Nvidia, and Microsoft can ‘breathe a huge sigh of relief’ following the recent exemption from tariffs on key products imported from China. This development is expected to stabilize supply chains and boost profitability for these tech giants.

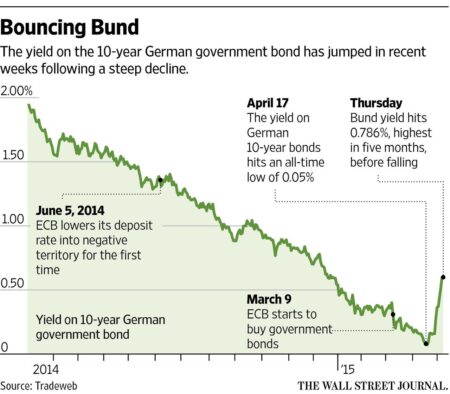

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

In a significant escalation of trade tensions, China has announced retaliatory tariffs on U.S. goods, raising duties to 125%. This move comes amid a declining dollar, signaling increased economic friction between the two nations. Continue following for live updates.

A recent map reveals the extent of gold reserves stored by various countries in the United States, highlighting Germany’s consideration of repatriating its gold. As global economic concerns rise, this move sparks debate on the security and accessibility of national assets.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

In a surprising move, President Trump announced a temporary pause on escalating tariffs, allowing for a 90-day window for negotiations. However, he simultaneously raised China’s levy to an unprecedented 125%, intensifying ongoing trade tensions.

MercadoLibre has announced a significant investment of $5.8 billion in Brazil for 2023, underscoring its commitment to expanding its operations in the region. This move aims to enhance logistics, technology, and customer service in the fast-growing e-commerce market.

Japanese stocks are poised for a significant rise following former President Trump’s decision to pause higher tariffs. Investors are optimistic, anticipating a boost in trade relations and economic stability, as markets react positively to this unexpected development.

Canada holds billions in U.S. real estate, but recent threats from former President Trump regarding border policies and trade could jeopardize these investments. Experts warn that uncertainty may deter future Canadian buyers, impacting the market significantly.

The Kremlin is experiencing heightened concern as the price of Russian Urals crude oil approaches the critical $50 threshold. This significant drop could hamper state revenues, further exacerbating the economic challenges faced amid ongoing sanctions.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

A recent central bank survey reveals that more Canadian firms anticipate a potential recession within the next year. Concerns over economic stability are rising, with business leaders increasingly wary of inflation and interest rate impacts on growth.

German officials are raising concerns about the validity of the $109 billion in U.S. gold reserves, demanding verification of bullion bars held at the New York Federal Reserve. This request could have significant implications for international gold holdings.

Starbucks is slowing its expansion plans in India as rising inflation and economic concerns lead consumers to cut discretionary spending. The decision reflects shifting market dynamics, prompting the coffee giant to reevaluate growth strategies in a challenging environment.

Russia’s economy faces a severe crisis as oil prices plummeted by 31%, marking a significant blow to President Vladimir Putin’s financial stability. The sharp decline raises concerns about the nation’s fiscal resilience and potential implications for global markets.

Azelis has announced the acquisition of Solchem Nature S.L., a Spanish company specializing in natural ingredients. This strategic buy aims to enhance Azelis’ product portfolio in the growing natural and sustainable product market.