U.K. stocks closed in the red on Thursday, with the Investing.com United Kingdom 100 index dropping 4.99%. Investors reacted to mixed economic signals and ongoing geopolitical tensions, prompting a cautious trading environment across major sectors.

Browsing: financial news

U.K. stocks finished lower as trading closed, with the Investing.com United Kingdom 100 index declining by 0.34%. Economic uncertainties continue to weigh on investor sentiment, reflecting a cautious outlook in the markets.

Enphase Energy (NasdaqGM:ENPH) has introduced its IQ System Controller in France, enhancing solar energy management with a capacity increase to 20 kWh. This launch aims to optimize energy efficiency and reliability for residential users.

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.

Spain’s private sector growth has shown signs of moderation, according to a recent TradingView report. Economic uncertainties and rising costs are impacting businesses, leading to a slowdown in expansion efforts across various industries.

Italy’s service sector growth waned in March, according to the latest PMI data released by Reuters. The index fell, reflecting sluggish demand and rising costs, raising concerns over the resilience of the economy amid ongoing challenges.

Italy is grappling with a historic low in birth rates, prompting Premier Giorgia Meloni to address the nation’s population crisis. Despite government initiatives aimed at encouraging families, demographic decline remains a pressing challenge.

Argentina has formally requested the first tranche of over 40% of its $20 billion loan program from the International Monetary Fund (IMF). This financial assistance aims to stabilize the country’s economy amid ongoing fiscal challenges and inflation concerns.

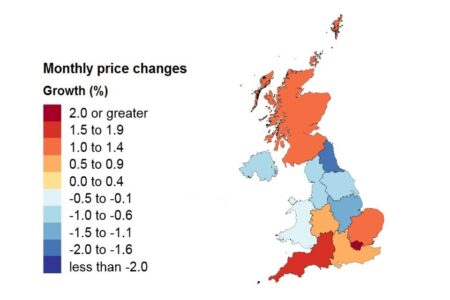

UK house prices have surged the most in two years, according to the Office for National Statistics (ONS). The increase reflects growing demand amid limited housing supply, signaling a potential recovery in the property market.

Czech Prime Minister Petr Fiala has declared France and the UK as the new leaders of hard power in Europe. His remarks highlight a shifting geopolitical landscape, with the two nations taking a more assertive role in regional security and defense strategy.

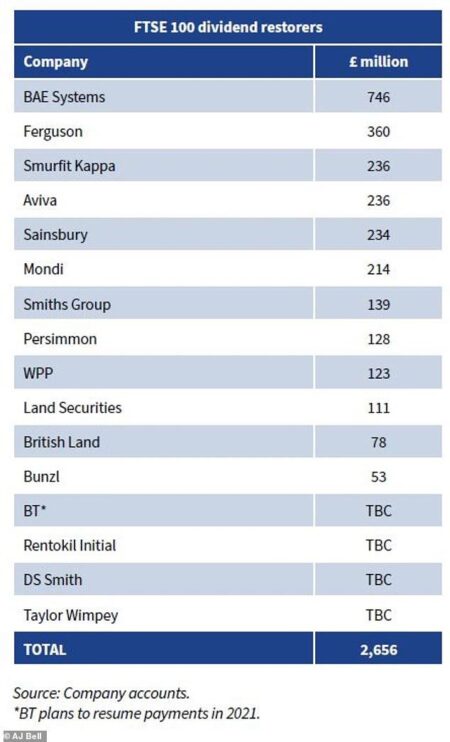

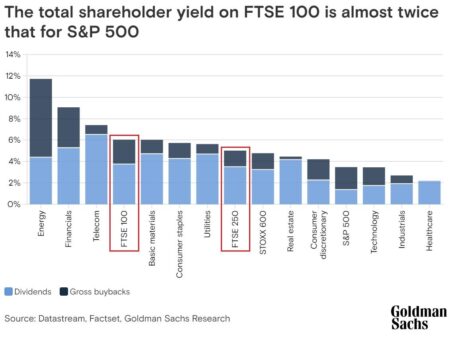

As March 2025 approaches, investors are eyeing top UK dividend stocks for reliable income. Companies such as BP, Unilever, and GlaxoSmithKline stand out, offering attractive yields and stability amid market fluctuations. Consider these options for a robust portfolio.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

Beazer Homes USA (BZH) is generating buzz as analysts predict potential growth amid a recovering housing market. With recent financial reports signaling stability and strategic land acquisitions, investors are keenly watching for signs of an upswing.

In the ever-evolving landscape of investment, small-cap stocks often offer hidden potential. This article explores three promising UK-based small-cap stocks that could become undiscovered gems, attracting savvy investors seeking growth opportunities.

Coca-Cola announced plans to invest over $1.4 billion in Argentina, aiming to enhance production and distribution capabilities. This strategic move underscores the company’s commitment to the region’s economic growth and job creation amidst challenging market conditions.

Bloomberg explores the current state of India’s stock market, raising concerns about a potential bubble. As valuations soar and investor enthusiasm surges, experts weigh in on whether the growth is sustainable or on the brink of a correction.

Japan’s stock market is poised to open in the red, following mixed signals from global markets and concerns over economic data. Analysts anticipate a cautious trading session as investors weigh potential implications for domestic growth.

In a recent statement, Deutsche Bank Chairman revealed that Germany received approximately $1 trillion in financial support without cost. This significant figure highlights the country’s economic strategies and the ongoing impact of fiscal policies in Europe.

Former Bank of Canada governor, Stephen Poloz, has cautioned that Canada is at a significant disadvantage in the ongoing trade war, stating, “We’re seriously outgunned.” His remarks highlight the challenges facing Canada’s economy amidst escalating global tensions.