German business confidence has surged to its highest point since 2022, igniting renewed optimism as supply chain hurdles ease and inflation holds steady. Experts see this upswing as a strong sign of hope for Europe’s largest economy

Browsing: financial news

The Nikkei 225 skyrocketed past the 50,000 mark for the very first time, marking a historic breakthrough in Japan’s stock market. Investors erupted with excitement, driven by strong corporate earnings and a surge of economic optimism

The UK government is gearing up to dramatically cut the tax-free savings allowance in the upcoming November budget, Reuters reports, citing The Telegraph. This bold strategy aims to increase revenue amid mounting economic challenges

India’s RBI is gearing up to roll out fresh limits on banks’ exposure to capital markets and acquisition financing, aiming to tighten risk controls and strengthen financial stability, Reuters reports. Stay tuned for the latest updates!

Italy’s vital economic data and political developments on October 24 are poised to seize investors’ full focus. Market reactions could send ripples through the euro and Italian stocks, with TradingView highlighting the essential factors shaping market sentiment

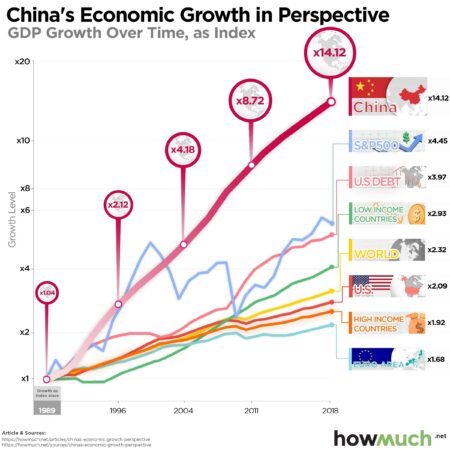

China’s economy continues its steady march forward with consistent growth, but beneath the surface, consumer confidence is starting to waver amid persistent uncertainties. Analysts point to cautious spending habits as households grapple with rising costs and increasing pressures from global markets

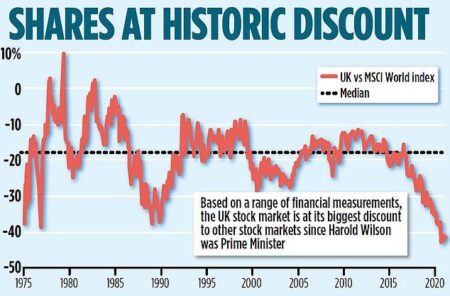

U.K. stocks closed the day on an upbeat note, with the Investing.com United Kingdom 100 index rising 0.23% by the final bell. A surge of positive market sentiment boosted investor confidence, driving gains across major sectors throughout the session

The Bank of Canada uncovers a cautious atmosphere among businesses and consumers ahead of its upcoming rate decision, spotlighting rising concerns over economic growth amid persistent inflation challenges

Bitcoin skyrocketed as renewed hopes for easing U.S.-China tensions reignited investor confidence, Barron’s reports. The cryptocurrency surged ahead, driven by fading geopolitical concerns and a fresh surge of market optimism

The U.S. is considering a massive support package for Argentina that could reach $40 billion, aiming to stabilize the South American country’s economy as it battles rising debt and soaring inflation, NBC News reports

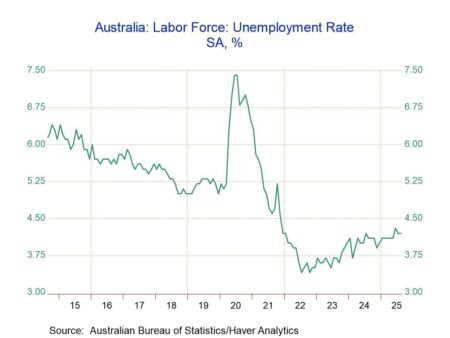

Australia’s unemployment rate has surged to its highest point in four years, raising fresh concerns about the country’s economic future. To revive the struggling job market, the Reserve Bank of Australia is now considering a cut in interest rates

Former U.S. Treasury Secretary Larry Summers raises concerns about Bessent’s proposed rescue plan for Argentina, highlighting the unpredictable challenges of the nation’s deepening economic crisis, Bloomberg reports

Wall Street plunged sharply in its steepest slide since April, as former President Trump’s threat to impose new tariffs on China escalated trade tensions, sending shockwaves through the market and stoking fears of an impending economic slowdown

Fintel and two other UK penny stocks are sparking excitement among investors with their impressive growth potential. Analysts highlight these budget-friendly shares as prime opportunities in a turbulent market, urging a smart blend of optimism and careful strategy

Japan markets surged with volatility following the stunning victory of Abe-disciple Sanae Takaichi, reigniting investor concerns over policy stability and the nation’s economic outlook. This unexpected win sent powerful shockwaves through market confidence amid a backdrop of ongoing political shifts

Italy is firmly committed to keeping its budget deficit at 3% of GDP this year, showcasing a resolute dedication to fiscal discipline amid ongoing economic challenges. This goal aligns seamlessly with EU guidelines, carefully balancing the drive for growth with prudent debt management

Asia stocks soared on Tuesday, powered by a strong rally in the tech sector, even as Japan’s market slipped amid mounting concerns over looming rate hikes. Investors remain cautious, navigating the uncertain waters as central banks signal tighter monetary policies on the horizon

LG Electronics is gearing up to raise a staggering $8.7 billion by taking its India unit public in an upcoming IPO, Bloomberg reports. This bold move is set to tap into the booming Indian market and supercharge the company’s growth across the region

China’s AI sector is revolutionizing global markets at breakneck speed, driven by powerhouse companies spearheading a wave of groundbreaking innovation and massive investment. Yahoo Finance explores how this explosive growth is disrupting tech giants and reshaping the future of international trade

Interest rates on revolving credit cards in Brazil have soared to a staggering 451.5% per year, highlighting the country’s escalating credit cost crisis, Eurasia Review reports. This sharp increase underscores the growing financial strain burdening consumers across the nation