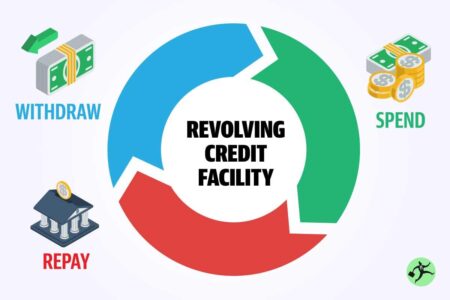

Interest rates on revolving credit cards in Brazil have soared to a staggering 451.5% per year, highlighting the country’s escalating credit cost crisis, Eurasia Review reports. This sharp increase underscores the growing financial strain burdening consumers across the nation

Browsing: financial news

Brazil’s Ambipar has made a daring move by securing court protection amid a fierce debt battle, paving the way to overhaul its financial commitments. This bold step, however, sent shockwaves through the market, triggering a sharp plunge in the company’s shares as investors wrestled with concerns over its financial stability

Moody’s has elevated Spain’s credit rating, highlighting the country’s rising economic power and resilience. This upgrade opens the door to exciting growth prospects and enhanced fiscal stability, boosting investor confidence like never before

Murray Cod Australia has just secured a remarkable A$17 million in funding, turbocharging its ambitious growth plans. This major capital injection will dramatically increase production capacity and expand market presence, cementing the company’s position as a trailblazer in the aquaculture industry

Brazil may extend tax exemptions on select investments, a government official revealed, aiming to boost market confidence and attract foreign capital amid these uncertain economic times, TradingView reports

Indian shares plunged dramatically after a US visa crackdown triggered a staggering $10-billion sell-off in IT stocks, Reuters reported. This unexpected upheaval sent shockwaves across the market, delivering a severe blow to the sector’s overall value

Australia’s staggering $336,000 income gap has been revealed, offering a striking glimpse into what it truly means to be ‘rich.’ New data exposes the widening wealth divide reshaping the nation

Argentina has proudly achieved its 21st consecutive trade surplus, MercoPress reports. This remarkable streak highlights the nation’s growing export strength, standing out boldly amid global economic challenges

U.K. stocks soared to a powerful close, with the Investing.com United Kingdom 100 index jumping 0.73%. The market rallied across the board, driven by rising investor confidence in key sectors as trading came to an end

Japan Gold (CVE:JG) soared an impressive 50%, ignited by a surge of investor excitement driven by rising gold prices and groundbreaking new exploration discoveries. MarketBeat explores the key factors propelling this miner’s extraordinary rally

Berlin is closely monitoring France’s mounting debt crisis, a government minister revealed, underscoring rising concerns about its potential ripple effects on the eurozone’s economy. Officials are urging swift fiscal reforms to restore stability and avert deeper turmoil

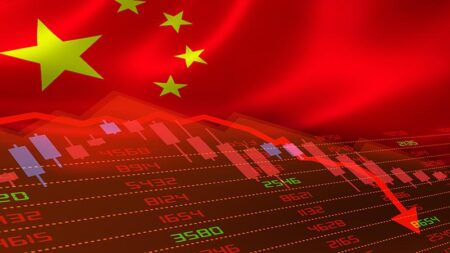

China’s $19 trillion stock market, once seen as off-limits to investors, is now capturing global attention like never before. With sweeping regulatory reforms and the country’s reopening fueling renewed confidence, excitement is building around the world’s second-largest equity market

Oracle Japan’s shares soared over 10% in just one week, sparking a fiery debate: is this impressive rally fueled by strong fundamentals or just market hype? Even with the sharp rise, investors remain cautious, navigating a maze of mixed earnings forecasts and persistent sector hurdles

Businesses aiming for success in China must prepare for mounting deflation risks, experts warn. As demand wanes and prices continue to fall, profit margins and investment strategies could come under serious pressure-underscoring the importance of a well-crafted approach to thrive in the world’s second-largest economy

Argentina’s stocks and peso plunged sharply after unexpected economic data shook investor confidence, igniting concerns over the country’s financial stability. Now, all attention is focused on government moves and potential signals of a market recovery

Japan has just upgraded its Q2 GDP growth figures, powered by an unexpected surge in consumer spending, Reuters reports. This revision shines a spotlight on a revitalized economic momentum, driven by a strong rebound in domestic demand

Here are five can’t-miss developments in the Canadian business world this week, spotlighting major earnings reports, key economic data releases, and policy updates set to shake up markets and sway investor sentiment

Rising inflation and climbing unemployment rates are raising new alarms for Europe’s largest economy. Experts warn that these mounting challenges could slow growth and fuel greater uncertainty in the months ahead

India’s economic growth skyrocketed in the latest quarter, shattering all expectations and showcasing a remarkable surge in domestic demand. Experts highlight booming exports and lively consumer spending as the driving forces behind this extraordinary momentum

U.S. stocks slipped on Friday as investors turned cautious ahead of the Labor Day weekend, digesting a blend of economic signals. Despite the dip, major indexes closed the month with impressive gains, highlighting the market’s remarkable resilience