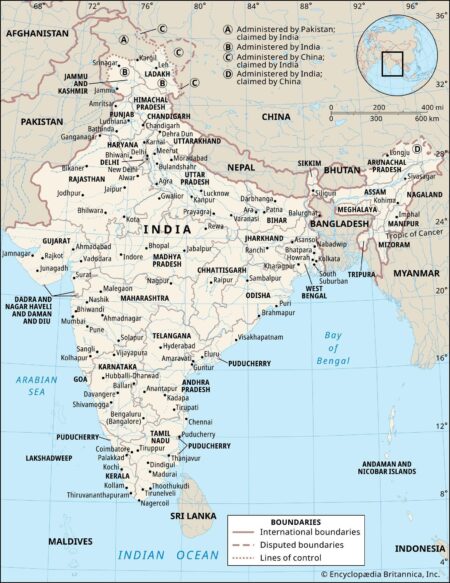

India’s economy soared with a remarkable 7.8% growth in the June quarter, driven by vibrant manufacturing and booming services sectors. This strong momentum showcases a powerful recovery amid global challenges, CNBC reports

Browsing: financial news

Murphy USA (MUSA) shares have jumped 3.3% since the last earnings report, driven by strong retail fuel sales and smart cost control. Investors are closely watching to see if this positive momentum can continue despite ongoing market volatility

Spain’s economy is skyrocketing past all expectations, powered by a thriving tourism boom, soaring exports, and lively domestic spending. Experts highlight transformative government reforms and smart use of EU recovery funds as the key engines propelling this remarkable growth

U.K. stocks edged up modestly, with the Investing.com United Kingdom 100 index rising 0.09%. Investors showed cautious optimism, carefully weighing a mix of mixed economic data alongside unfolding geopolitical developments

Italy is considering a bold new tax on banks to strengthen its budget, Bloomberg reports. This strategic move aims to boost government revenues amid economic challenges and rising fiscal pressures

PGIM highlights a dramatic surge in France’s bond yields, revealing an exciting tactical buy opportunity for savvy investors. Market experts encourage staying alert to this yield spike, as it may uncover hidden value within French debt assets

Canadian banks have posted impressive earnings, deftly sidestepping the toughest blows from tariff challenges, Reuters reports. Strong consumer spending and well-diversified portfolios were crucial in cushioning the impact

U.K. stocks closed on an upbeat note, as the Investing.com United Kingdom 100 rose by 0.18% at the end of trading. Investor confidence sparked gains across key sectors, driving a smooth and steady market rally throughout the day

USA Rare Earth stock is plunging today amid growing concerns over supply chain disruptions and skyrocketing production costs. Investors are on high alert as rising geopolitical tensions add fuel to the fire, putting extra pressure on the rare earth materials market

U.K. stocks soared today, as the Investing.com United Kingdom 100 index jumped 0.35%. Investor excitement surged, driven by strong corporate earnings and encouraging economic data

Japan’s Nikkei skyrocketed to a record-breaking high, propelled by SoftBank sparking a dynamic tech rally driven by stellar earnings and soaring investor excitement. This surge signals a renewed wave of optimism in Japan’s bright growth prospects

India is gearing up for major cuts to consumption taxes by October, aiming to ignite economic growth, Reuters reports. This bold step is designed to spark consumer spending and drive recovery in the face of global uncertainties

Asian stocks soared on Monday, riding the wave of a robust Wall Street rally, with Japan’s shares hitting an all-time record high. Investor optimism surged, fueled by easing inflation concerns and standout corporate earnings

Nvidia and AMD are gearing up to hand over 15% of their chip sales revenue in China to the US government, reveals the Financial Times. This bold move is part of new regulations aimed at tightening control over sensitive technology exports

U.K. stocks dipped slightly, with the Investing.com United Kingdom 100 index falling 0.11% by the close of trading. Investors remained cautious, carefully weighing a mix of economic signals amid persistent global uncertainties

U.K. shares edged lower today, with the Investing.com United Kingdom 100 index dropping 0.50%. Investor caution weighed on key sectors, leading to a slight pullback as trading came to a close

Three UK dividend stocks are turning heads with eye-catching yields soaring up to 5.7%, offering enticing income opportunities for savvy investors. Combining steady payouts with strong growth prospects, these shares are standout picks you won’t want to miss on Yahoo Finance

Japan is set to take the lead by approving an XRP ETF before the US, driven by SBI Holdings, the nation’s largest bank. This daring move showcases Japan’s growing enthusiasm for crypto, even as regulatory uncertainty continues to cloud the American market

Japan’s stocks are poised to slip as disappointing U.S. economic data reignites concerns over global growth. Investors remain cautious, bracing for potential ripple effects throughout Asian markets, Bloomberg reports

U.K. stocks slipped on Wednesday, with the Investing.com United Kingdom 100 index inching down by 0.06%. Investors remained cautious, carefully weighing a mix of economic signals amid ongoing global uncertainties