AB InBev shares plunged after the company disclosed declining sales in key markets such as China and Brazil, igniting concerns over its global growth prospects. Investors quickly reacted to these warning signs of softening demand and escalating economic challenges

Browsing: financial news

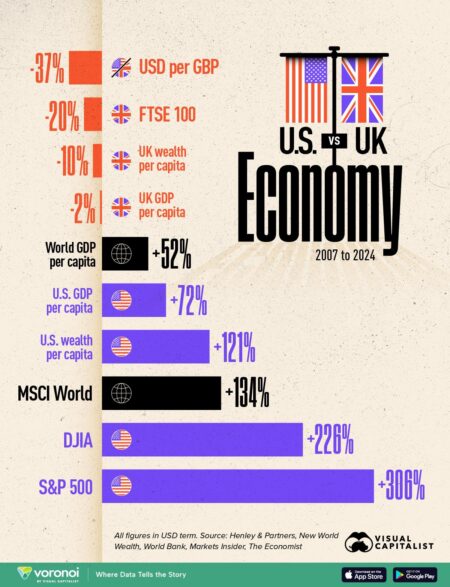

U.K. stocks soared to a powerful close, with the Investing.com United Kingdom 100 index jumping 0.65% by the end of trading. Fueled by rising investor optimism and standout corporate earnings, the market’s momentum charged ahead with confidence

Germany has slipped back into recession, with economic output contracting for the second consecutive quarter. Yet, against all odds, the DAX index is soaring, demonstrating remarkable resilience despite the wider economic downturn

Italy’s Banco BPM is actively seeking thrilling merger and acquisition opportunities, CEO Roberto Gabbiani revealed. The bank is set on expanding its market footprint and confidently steering through the dynamic financial landscape

Australia’s Viva Energy shares plunged 11% after an unexpected slump in convenience store sales. This sharp decline has raised concerns about the company’s near-term profitability amid shifting consumer behaviors, Reuters reports

China’s Premier has called for stronger price controls to combat rising deflationary pressures that pose a serious threat to the economy. This decisive move aims to stabilize markets and ignite economic growth amid these challenging times

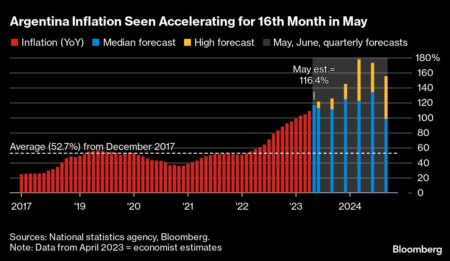

Argentina’s inflation is poised to spike once more in June after a short-lived dip in May, Reuters reports. Skyrocketing prices continue to squeeze the economy, fueled by currency instability and unyielding consumer demand

Argentina’s inflation inched up slightly in April, rising less than market expectations, Bloomberg reports. This modest rise offers a promising sign of stability amid the country’s ongoing economic challenges

Canada’s banks are on the brink of remarkable growth, fueled by a trading frenzy and a surge of investor confidence that’s electrifying the market. Experts are buzzing with predictions that the sector is set to “pop,” signaling an exciting rally in banking stocks

UK inflation has soared to its highest level since January 2024, intensifying pressure on the Bank of England as it weighs potential rate cuts. Markets are navigating cautiously, with policymakers walking a delicate tightrope between curbing inflation and supporting economic growth

Bitcoin’s recent surge throws a spotlight on Germany’s costly economic misstep, exposing missed opportunities in the thriving digital asset landscape. Experts caution this could become the nation’s most significant economic blunder of the decade, as the crypto market races to new heights

Trump’s new tax law introduces significant changes set to reshape both personal and business finances. With updated tax brackets and deductions, these key provisions take effect next tax year, revolutionizing how Americans approach their taxes

Jim Cramer shines a spotlight on Novo Nordisk A/S (NVO) as “Canada’s backdoor” in a recent Insider Monkey report, highlighting the pharma giant’s daring strategies and thrilling growth prospects throughout North America

China’s deflation is intensifying as companies dive into fierce price wars, escalating economic challenges. Plummeting prices reflect weakening demand, squeezing profits and sparking fears of a prolonged slowdown

Tariff anxiety is sweeping across Japan, the Bank of Japan’s latest report reveals. Rising trade tensions and impending tariff increases are rattling businesses, shaking economic confidence, and forcing exporters to proceed with caution

The UK economy contracted for the second consecutive month this May, raising fresh concerns about its growth outlook. Experts warn that ongoing challenges could seriously hinder future progress

Dow Jones futures slipped as President Trump announced new tariffs on Canada, rattling the market after the S&P 500’s recent record-breaking surge. Meanwhile, CoreWeave shares plunged amid growing investor concerns

Breaking: In a surprising twist that stunned markets, the Reserve Bank of Australia has chosen to keep interest rates unchanged in a split decision, going against widespread predictions of a cut amid persistent economic uncertainty

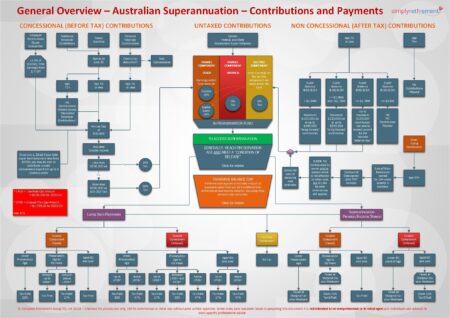

Australia’s colossal $2.7 trillion pension funds are making a bold move away from the US, Bloomberg reveals. This strategic pivot signals a dynamic effort to diversify portfolios amid rising global economic uncertainties

UK markets plunged dramatically on Thursday, echoing the intense selloff of 2022, as growing concerns over the finance minister’s policies sent shockwaves through investors. Anxiety soared amid rising fears of economic instability and surging market volatility, Reuters reports