PwC gathered leading industry experts and analysts at its Analyst Summit 2026 in Australia, igniting vibrant discussions on emerging market trends, cutting-edge innovations, and the strategic insights shaping the future of business and technology

Browsing: financial services

The UK Financial Conduct Authority (FCA) is embarking on an ambitious journey to reshape its regulatory approach to artificial intelligence, aiming to spark innovation while fiercely protecting consumers

The Japan Embedded Finance market is set for an exhilarating rise, projected to skyrocket to $47.11 billion by 2029, fueled by a strong 7.3% CAGR from 2026 to 2029. Yahoo Finance UK highlights that the competitive landscape will evolve into a vibrant, fragmented arena, with increasing specialization across diverse verticals.

At a recent summit, the Trump administration introduced the $1,000 “Trump Accounts,” highlighting them as an exciting new way for Americans to boost their savings. This groundbreaking initiative represents a bold leap forward in building personal wealth and securing brighter financial futures

Bruchou & Funes de Rioja took center stage in a groundbreaking US$3 billion repo deal between the Central Bank of Argentina and global banks, marking a significant breakthrough for the nation’s financial market

Conduent is expanding its EMV payment solution across Italy, bringing faster, safer, and more seamless transactions to businesses nationwide. This dynamic growth promises to boost digital payment adoption and streamline operations like never before

Australia’s cyber insurance market is on the brink of a massive boom, expected to quadruple by 2034. This explosive growth is driven by escalating digital threats and a surge in business awareness. Experts highlight the skyrocketing demand for coverage as cyber risks intensify across the board

A new report reveals a persistent deadlock in the Hutchison-BlackRock-MCS deal, spotlighting fierce regulatory hurdles as China intensifies its crackdown on foreign investments in port operations

Proskauer is thrilled to be shortlisted for the Private Equity Wire European Awards 2026, recognizing its outstanding influence on the private equity scene in the United Kingdom, as highlighted by Mondaq

Argentina’s Central Bank is poised to approve crypto services for local banks, marking a groundbreaking step toward integrating digital assets into the traditional financial system, CoinDesk reports

The EU has decisively dismissed Russia’s lawsuit against Euroclear, calling it “speculative” and completely unfounded. Standing firm, the bloc rejects all claims concerning frozen Russian assets, strengthening its legal stance amid escalating geopolitical tensions

Argentina is on the brink of a groundbreaking regulatory shift that will empower domestic banks to offer cryptocurrency services. This bold initiative seeks to drive financial inclusion and ignite innovation, riding the wave of soaring crypto adoption, The Block reports

BBVA and Stellantis have just received the green light to launch their thrilling new auto financing joint venture in Argentina, poised to turbocharge vehicle sales with personalized credit solutions designed specifically for this vibrant market

Private banks in Argentina are quickly stepping up to deliver crypto services, while Kraken is expanding its presence across Colombia. These thrilling advancements showcase the fast-growing enthusiasm for digital assets sweeping through Latin America

StoneX Group is taking a bold leap in India with the launch of a state-of-the-art metals trading desk, backed by significant investments in advanced technology. This dynamic expansion aims to capture the thrilling growth potential unfolding in the nation’s rapidly expanding metals market

Italy and Spain are rapidly emerging as exciting new hotspots for direct lending deals, capturing the keen interest of alternative credit investors eager to lock in higher yields amid tightening traditional bank lending

CVC Credit has joined forces with H.I.G. Capital to acquire Rentokil Workwear France, significantly strengthening H.I.G.’s presence in the European workwear market. This exciting partnership marks a bold strategic move, unlocking new growth and opportunities for both companies

Juspay has joined forces with Mastercard to launch Click to Pay in Brazil, transforming the digital payment experience. This groundbreaking collaboration delivers quicker, more secure checkouts and is poised to ignite a surge in e-commerce growth throughout the region

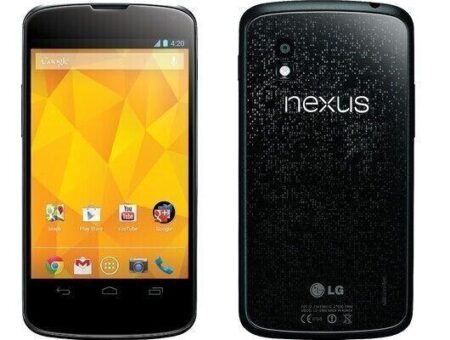

Nexus has officially launched its trade credit operations in Italy, marking an exciting leap into the European market. This bold expansion is designed to equip Italian businesses with cutting-edge credit solutions, perfectly timed to fuel their growth amid the surge in international trade

Baker Tilly Germany is considering selling a stake to private equity, Bloomberg reports. This bold strategy aims to supercharge growth and expand their service portfolio, positioning them strongly amid rising competition in the accounting industry