The Indian rupee’s dramatic plunge against the dollar has ignited a wave of investor enthusiasm for India-focused ETFs. As currency risks climb, these three standout India ETFs are emerging as exciting opportunities for growth and diversification

Browsing: Forex

Japan’s Prime Minister has vowed to take rapid action against speculative market swings following a sharp surge in the yen. Officials are committed to curbing currency volatility and protecting economic stability, CNBC reports

The Nikkei 225 surged an impressive 3% following Japan’s announcement of a snap election, driven by a softer yen against major currencies. Investors are eagerly embracing market-friendly policies, igniting fresh optimism and momentum in the equity markets, IG.com reports

The Brazilian Real surged dramatically following upbeat labor market data that highlighted the economy’s impressive strength. Traders quickly seized the opportunity, igniting a surge of optimism across currency markets-vividly reflected in real-time TradingView analytics

The Bank of Japan is signaling a bold shift from its ultra-loose monetary policy, hinting at possible rate hikes as the yen weakens and inflation concerns mount. Markets are buzzing with anticipation, closely watching for policy moves and their potential impact on the economy

The Japanese yen surged dramatically against G-10 currencies after Japan’s Finance Minister teased potential policy shifts. Traders sprang into action, propelling the yen upward amid a flurry of global currency activity

Profit remittances are poised to put intense pressure on Brazil’s real this December, as investors scramble to repatriate earnings amid growing global uncertainty. Bloomberg reports that the currency is facing substantial strain due to persistent capital outflows

The Indian rupee teeters on the edge of sharp declines as upcoming liquidity and growth reports threaten to rattle market confidence. At the same time, bond yields are set to move, reflecting investors’ changing economic outlook

The dollar soared even higher against the yen on Tuesday, fueled by traders’ keen anticipation of the upcoming U.S. jobs report-a crucial indicator poised to influence Federal Reserve decisions and drive market movements, Reuters reports

Japan Finance Minister Katayama emphasized the crucial role of maintaining stable currency movements, highlighting how this stability fuels economic strength and inspires greater investor confidence, during a recent statement to InvestingLive

BREAKING: France’s industrial production soars past expectations, showcasing robust economic momentum. This positive surge boosts market confidence, driving EURUSD slightly upward amid growing investor optimism. – XTB.com

The euro edged higher against the dollar as the greenback softened, dragged down by cautious U.S. economic data. Meanwhile, France’s recent policy shifts ignited fresh investor confidence, boosting optimism for the eurozone’s economic outlook

The week ahead in FX and bonds is charged with excitement as the Federal Reserve prepares to unveil a long-anticipated rate cut, while pivotal U.S.-China trade talks take center stage. Investors are on high alert, hungry for clues on monetary policy changes and geopolitical developments that could reshape market dynamics

Italy’s vital economic data and political developments on October 24 are poised to seize investors’ full focus. Market reactions could send ripples through the euro and Italian stocks, with TradingView highlighting the essential factors shaping market sentiment

Japan’s likely next finance minister is signaling possible shifts in monetary policy, sparking both excitement and uncertainty among yen bears. Market experts are gearing up for moves that could strengthen the yen, challenging the recent downward momentum

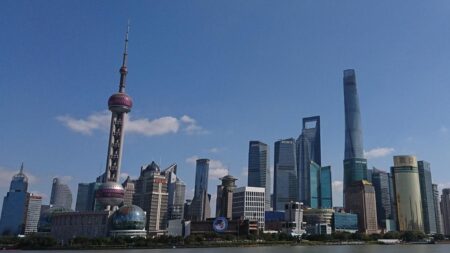

China’s central bank has subtly boosted the yuan, riding a surge of economic optimism and signaling robust confidence in the country’s growth prospects. This calculated step aims to stabilize the currency and attract foreign investment, Bloomberg reports

The U.S. dollar exchange rate in Argentina has soared to an unprecedented AR$1,380, underscoring the nation’s escalating economic crisis. This sharp plunge in the peso’s value is fueling soaring inflation and putting immense pressure on everyday budgets, reports the Buenos Aires Herald

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

The yen soared after forecasts showed Japan’s ruling LDP coalition is set to lose its parliamentary majority. Market watchers view this shift as a strong signal that major policy changes could be on the way

Shares soared on renewed optimism about China-US trade talks, igniting a surge of investor excitement. Meanwhile, the dollar slipped against major currencies, reflecting a cautious atmosphere amid ongoing geopolitical uncertainties