The BRICS summit has launched in Brazil amid rising tensions sparked by Trump’s tariff policies and intensifying conflicts in the Middle East, casting a powerful shadow over this pivotal gathering of emerging economic powerhouses

Browsing: global economy

BRICS leaders are set to gather in Brazil with a bold mission: to strengthen their alliance and push back against the rising wave of trade protectionism. This summit is poised to ignite deeper economic partnerships and fuel unprecedented collaboration among member nations

China has fiercely condemned former President Donald Trump’s recent trade deal with Vietnam, warning that it endangers regional stability and undermines long-standing economic partnerships, the Financial Times reports

Spain and Brazil have joined forces to urge the UN to implement global taxes on the super-rich, aiming to tackle skyrocketing inequality and unlock vital funding for sustainable development projects worldwide, officials announced at a recent UN summit

In a dramatic twist, former President Trump has once again taken a strong stance on tariffs, urging India to take bold and decisive action in the ongoing US trade talks. All eyes are now on India as it prepares for these crucial negotiations that could shape the future of international trade

Former President Donald Trump announced that the US has sealed a groundbreaking new trade deal with China, aimed at easing tensions and sparking a powerful wave of economic collaboration between the two global giants, according to Al Jazeera reports

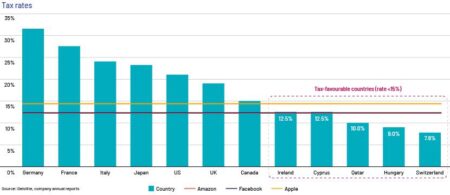

The G7 has introduced a groundbreaking side-by-side tax proposal that liberates American and UK companies from global tax rules, poised to revolutionize international taxation and spark dynamic debates on fairness and economic impact

France’s Evian has been selected as the dynamic host city for the 2026 G7 summit. This breathtaking Alpine gem will open its doors to world leaders, uniting them to address urgent global economic, political, and environmental challenges

Bruegel’s latest report uncovers ten urgent challenges facing China’s economy-from slowing growth and rising debt risks to dramatic demographic shifts-highlighting major hurdles that threaten the nation’s economic stability and its role on the global stage

In the ongoing U.S.-China trade talks, Beijing masterfully balances boldness with diplomacy, aiming to secure favorable terms while carefully managing tensions. This strategic approach highlights China’s commitment to maintaining the delicate economic partnership without sparking disruption

G7 leaders convene in Canada to confront soaring US tariffs under Trump, ongoing Middle East conflicts, and urgent global economic challenges. This summit aims to spark collaboration and foster unity amid escalating geopolitical tensions

The IMF has applauded Argentina’s recent reform efforts, calling them a promising sign as the much-anticipated visit at the end of June approaches. These bold moves showcase the country’s strong commitment to meeting the vital economic targets set out in the bailout agreement

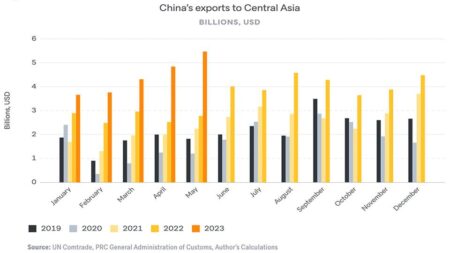

China has uncovered a critical vulnerability in global trade networks and plans to leverage this insight to expand its strategic influence, signaling potential major shifts in the future of international commerce, Bloomberg reports

Former President Donald Trump enthusiastically hailed a breakthrough “deal” with China, highlighting major progress on tariffs and promising ongoing talks. Yet, skeptics remain doubtful about the real impact and long-term value of the agreement

India is surging ahead of China, the US, EU, and Germany in economic growth, driven by robust domestic demand, lightning-fast digital adoption, and groundbreaking manufacturing reforms-signaling a powerful shift in the global economic landscape

A Trump economic adviser expressed strong confidence Monday that a trade deal with China is on the verge of being finalized, highlighting significant progress in the talks despite ongoing tensions. While key details are still being ironed out, an agreement could be reached very soon

China’s exports to the US have plunged dramatically just before critical trade talks, spotlighting rising tensions and uncertainty in this crucial economic relationship. This steep drop exposes growing challenges within the world’s largest trade partnership

Senator Lindsey Graham’s proposed sanctions bill targets Russia head-on but could unintentionally disrupt U.S. trade with major global partners, raising concerns about economic fallout and strained international ties, Politico reports

The United States and China are gearing up to meet in London on Monday for pivotal trade talks, aiming to ease ongoing tensions and explore fresh opportunities for collaboration amid persistent economic disputes, Reuters reports

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse