At Davos 2026, Canadian PM Mark Carney delivered a compelling speech that electrified the World Economic Forum, passionately advocating for sustainable growth and calling for enhanced global economic collaboration amid rising geopolitical tensions

Browsing: global finance

Japan’s bond market turmoil is sending shockwaves through global finance, igniting shifts in interest rates and rattling investor confidence worldwide. Understanding the full impact of this unfolding drama is essential, as it holds the potential to reshape economic policies and markets far beyond Asia

Beijing is dramatically ramping up funding for its Belt and Road Initiative, channeling unprecedented resources into global projects. This ambitious move aims to secure essential supplies and expand China’s strategic influence worldwide like never before

Global bonds plunged sharply following hawkish remarks from the Bank of Japan, signaling potential shifts in monetary policy. Investors reacted swiftly, driving yields higher as uncertainty surged

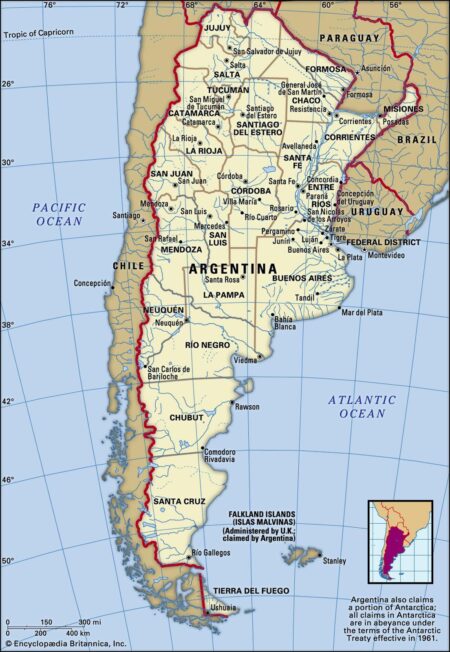

Argentina has just landed a crucial lifeline from the US amid ongoing economic turmoil, aiming to stabilize its currency and reignite investor confidence. This fresh wave of support underscores a growing global commitment to bolstering Latin America’s third-largest economy

The Trump administration has approved a massive $20 billion bailout to pull Argentina out of its worsening financial crisis. This bold initiative aims to stabilize the nation’s currency and spark renewed confidence among investors

The U.S. has unveiled an unprecedented bailout package for Argentina, stepping in to stabilize its fragile economy amid soaring inflation and escalating debt challenges. This bold initiative signals a new era of financial partnership between the two nations

China’s $19 trillion stock market, once seen as off-limits to investors, is now capturing global attention like never before. With sweeping regulatory reforms and the country’s reopening fueling renewed confidence, excitement is building around the world’s second-largest equity market

France’s soaring debt and political unrest have sparked growing fears of an imminent financial crisis. Experts warn that if these issues remain unresolved, France could trigger a domino effect, shaking markets throughout Europe and beyond

Japanese banks are boldly extending their footprint in global asset management, seizing exciting growth opportunities far beyond their domestic borders. This dynamic expansion aims to capitalize on the skyrocketing demand for diverse and innovative investment solutions worldwide

Deutsche Bank is shaking up advisory roles at its global investment bank, determined to sharpen leadership and elevate client services, Reuters reports. This bold move underscores the bank’s commitment to boosting efficiency amid ongoing market challenges

Argentina is facing a growing debt crisis that is straining its economy and edging the nation dangerously close to default. Experts warn that without rapid and far-reaching structural reforms, the country’s financial stability may be severely threatened

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.

Asian markets saw a retreat from earlier gains following optimistic reactions to China’s rate cuts and ongoing talks between U.S. officials. Investors remain cautious amid global economic uncertainties, reflecting a complex landscape for regional stocks.

China is making a strategic move to lessen its dependence on US Treasuries, redirecting its investments towards more dynamic options like commodities and emerging markets. This shift not only showcases a savvy financial strategy but also underscores China’s commitment to bolstering its financial stability in the face of rising geopolitical tensions

Goldman Sachs is making waves in the Asia ex-Japan mergers and acquisitions scene with two pivotal appointments, marking a bold strategic move in the region. These changes reflect the firm’s commitment to strengthening its foothold in Asia’s vibrant and ever-evolving financial landscape

In February, foreign investors ramped up their investments in U.S. Treasury securities, with heavyweights like China, Japan, Canada, and the Euro Area leading the charge. This notable surge highlights a growing confidence in U.S. debt as a reliable haven amidst swirling global uncertainties

In a surprising analysis, strategists suggest that Japan, rather than China, may have strong incentives to reduce its U.S. Treasury holdings. This shift could be driven by Japan’s need to stabilize its currency amidst ongoing economic challenges.

Argentina’s President Javier Milei achieved a significant milestone by securing a deal with the IMF, marking a pivotal step towards economic stabilization. The agreement allows for the removal of most capital controls, signaling a shift towards fiscal reform and investor confidence.

The recent discussions at the Council on Foreign Relations highlight the intricate relationship between the iPhone’s global supply chain, the IMF’s fiscal policies, and China’s shifting balance of payments, signaling potential implications for international trade dynamics.