Indian shares dipped on Monday, dragged down by escalating tensions in the Middle East and cautious investor sentiment as all eyes focus on the Federal Reserve’s upcoming policy decision. Traders are on high alert, searching for clear signals amid a storm of global uncertainties

Browsing: global markets

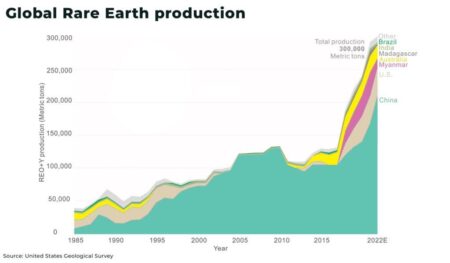

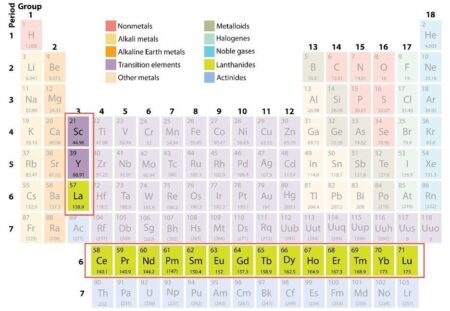

China has dramatically tightened export controls on rare earth minerals-crucial building blocks for the electronics and defense industries. This bold strategy highlights Beijing’s growing influence amid rising global trade tensions, sending shockwaves through supply chains worldwide, Reuters reports

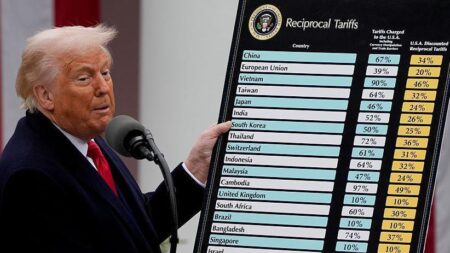

President Trump intensifies his drive for fresh trade agreements amid rising concerns that tariffs could disrupt the global economy. Stay with Yahoo Finance for the latest updates on unfolding negotiations and market reactions

Exclusive: Indian billionaire Gautam Adani is facing intensified scrutiny from U.S. prosecutors, who are escalating their investigations into his vast business empire, the Wall Street Journal reveals. These mounting legal challenges could dramatically impact his global ventures

Toto’s cutting-edge toilets, adored in Japan for their remarkable features, are now on a mission to charm American consumers. As they unveil their state-of-the-art models in the U.S. market, the big question remains: will these luxurious bathroom innovations win over American hearts just as they have across the Pacific?

German Finance Minister Christian Lindner emphasized the urgent need for the United States to swiftly address tariff issues, highlighting their crucial role in fostering global trade stability. His comments arrive at a pivotal moment as discussions continue around trade policies that significantly impact the economies of both nations.

Asia’s stock markets showcased a patchwork of performances as the shadow of Trump’s tariffs casts uncertainty over global trade. In a bright spot, Japan’s indices surged ahead, fueled by robust economic data, while other regional markets grappled with a wave of cautious investor sentiment.

In an intriguing cultural shift, Bloomberg highlights the blossoming fascination with Greek culture in Japan. Although historical ties may be sparse, a vibrant enthusiasm for Greek cuisine, philosophy, and art reveals an unexpected bond forming between these two nations.

Today, Spain’s benchmark IBEX 35 index took a dip, closing down by 0.30%. This decline highlights the growing concerns among investors as market sentiment remains shaky. With uncertainties looming over European markets, traders are treading carefully in anticipation of crucial economic data on the horizon.

Brazil and China are embarking on exciting trade discussions focused on boosting sustainability. By harnessing their agricultural prowess and cutting-edge technological innovations, these two nations are poised to harmonize economic growth with environmental objectives, paving the way for a new era of global cooperation.

Amid rising trade tensions with the U.S., China is encouraging its exporters to explore new markets beyond their traditional boundaries. Although this shift to alternative regions appears simple on the surface, experts warn that navigating logistical hurdles and regulatory complexities could pose significant challenges for a seamless transition.

Spain’s sales agents are buzzing with optimism as the film industry makes a vibrant comeback after the pandemic. With a surge in international interest and an exciting lineup of new productions, industry leaders are eagerly anticipating a revitalized market that positions Spain as a dynamic force in global cinema.

Australian beef exports are experiencing a remarkable surge, particularly in China and the United States, as they take advantage of ongoing trade tensions. This impressive growth highlights a savvy shift by Australian producers who are actively exploring new markets in response to global trade uncertainties.

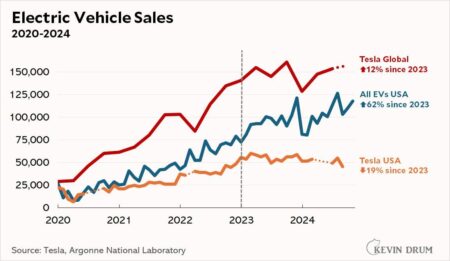

Tesla’s sales have taken another hit in France and Denmark, as recent reports reveal. This decline coincides with escalating protests against CEO Elon Musk, shedding light on the rising dissatisfaction among consumers in these regions as their sentiments evolve

European markets are experiencing a surge of volatility as political unrest in France and Germany sends ripples of concern through the investment community. With proposed reforms hanging in the balance and government stability under scrutiny, traders across the continent are adopting a more cautious approach.

Japanese and Australian markets bounced back with a surge of positive momentum after a rollercoaster session on Wall Street, as investors embraced a sense of cautious optimism. Meanwhile, most Asian markets took a breather for the holiday, resulting in limited trading activity across the broader region.

China has skillfully navigated the challenges posed by U.S. tariffs implemented during former President Trump’s administration, ensuring that its economic recovery remains robust. Officials assert that a combination of strong domestic resilience and surging global demand is fueling this growth, even as trade tensions persist and continue to influence the economic landscape

Gina Rinehart, Australia’s wealthiest woman, has built a staggering $800 million portfolio in rare earths. This savvy investment places her at the cutting edge of a rapidly expanding industry that is crucial for technology and green energy. It highlights the surging demand for these indispensable minerals!

In a surprising twist, China has quietly lifted tariffs on select U.S.-made semiconductors, a strategic decision that may help to cool the simmering tensions between the two countries amidst ongoing trade disputes. The potential impact on the tech industry and the future of bilateral relations is yet to unfold.

As pivotal trade discussions with the U.S. loom, UK Treasury chief James Reeves has taken a moment to address the concerns voiced by former President Trump about the state of the global economy. Reeves underscored that working together is essential to tackle our shared economic hurdles.