Japan’s 40-year government bond yields have soared beyond 4% for the first time ever, marking a dramatic spike in borrowing costs amid shifting monetary policies. This landmark moment signals a pivotal change in the country’s long-term debt outlook

Browsing: government bonds

Italy attracted a staggering €190 billion in bids during its first bond sale of 2026, Bloomberg reports. This overwhelming demand showcases rising investor confidence amid persistent economic challenges

Argentina remains $2.4 billion short of meeting its January bond payments, fueling growing concerns about its escalating debt crisis. This substantial shortfall highlights the country’s ongoing financial struggles as it fights to honor its commitments, Bloomberg reports

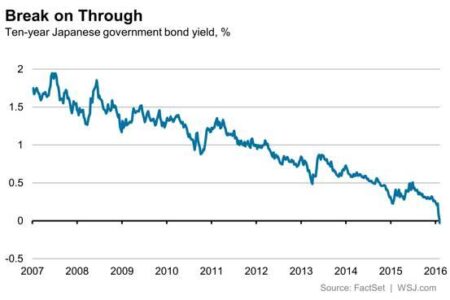

Japan’s 10-year government bond yield has soared beyond the crucial 2% mark, reaching levels unseen since 1999. This striking milestone signals a shift in investor confidence amid evolving economic conditions, according to TradingView market data.

Japan’s two-year government bond yield has surged to its highest level since 2008, driven by growing market excitement over potential rate hikes. Investors are now closely watching the Bank of Japan, eagerly awaiting its next move in shaping monetary policy

Germany’s 10-year Bund yield edged higher, reflecting a wave of global risk aversion as investors grapple with escalating geopolitical tensions and ongoing inflation concerns, TradingView data shows

Japan’s 40-year government bond sale ignited robust interest, with demand slightly surpassing average levels-showcasing steady investor confidence amid a stable economic outlook, Bloomberg reports. Even amid global uncertainties, the long-term debt auction attracted strong bids, highlighting remarkable market resilience

Japan’s bond yields have surged to a 16-year high, igniting a wave of speculation about a potential interest rate hike. Investors are on edge, closely watching the Bank of Japan’s next move as inflation pressures steadily mount

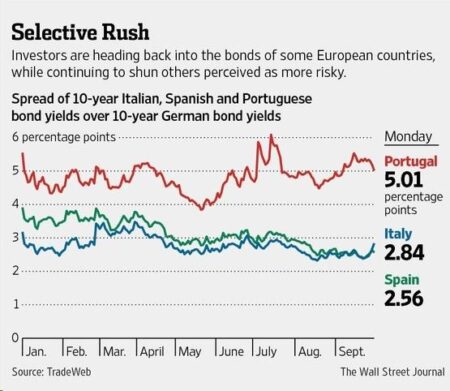

France now faces the startling prospect of borrowing costs overtaking those of Italy, highlighting growing investor concerns about its fiscal outlook. This surprising development reveals changing tides in the Eurozone debt markets, reports Le Monde.fr

Italy’s bond spread has plunged to a 15-year low, showcasing soaring investor confidence in Prime Minister Meloni’s leadership, Bloomberg reports. Traders are enthusiastically backing her economic policies as clear signs of fiscal stability take center stage

Japan is gearing up to reduce sales of super-long government bonds in its upcoming fiscal year revision, striving to better control debt issuance and foster greater stability in the market, Reuters reported via Investing.com

Japan has issued rare warnings about its bond market in the latest policy roadmap, highlighting growing concerns over rising yields and potential market turbulence, Reuters reports. This signals a careful shift in the nation’s traditionally steady monetary approach

Argentina triumphantly secured $1 billion in a high-stakes international bond auction, igniting fresh investor confidence and propelling momentum behind President Javier Milei’s ambitious economic agenda, the Financial Times reports

Fitch Ratings has warned that Germany’s coveted AAA credit rating may come under pressure if the country fails to stimulate economic growth. Analysts emphasize the need for robust policies to address stagnation and bolster investor confidence.

Japan’s Finance Minister, Shunichi Kato, cautioned that rising bond yields could put pressure on the country’s fiscal health. He emphasized the need for careful monitoring as increased borrowing costs may impact government finance and economic recovery efforts.