Chinese inflation surged to a 34-month high in April, driven largely by soaring food prices, Bloomberg reports. This striking data underscores ongoing supply challenges amid shifting demand patterns in the world’s second-largest economy

Browsing: inflation rate

Spain’s final 12-month EU-harmonised inflation rate dipped slightly to 3.2% in November, offering a glimmer of relief amid persistent price pressures. This number underscores the ongoing economic challenges confronting the eurozone

China’s deflationary challenges continue to loom large, even as consumer inflation soars to a 21-month high, Reuters reports. Service prices are on the rise, yet factory-gate and wholesale goods stubbornly lag behind, highlighting the intricate economic obstacles that lie ahead

Italy’s EU-harmonised Consumer Price Index (CPI) for November dipped to 1.1% year-on-year, coming in below expectations, according to TradingView data. This cooling trend signals a welcome easing of inflationary pressures as the year winds down

Spain’s inflation rate jumped from 2.9% to 3.1% in October, spotlighting the relentless upward pressure on prices. This increase highlights the continuing economic hurdles driven by volatile global markets

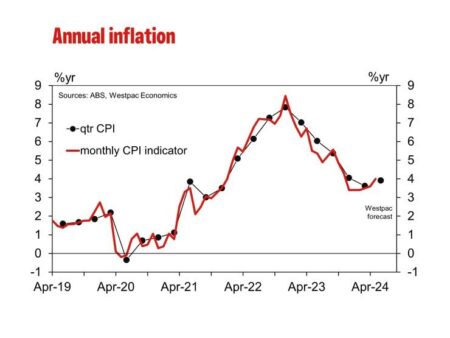

Australia’s annual inflation surged dramatically to 3.2% in the September quarter, up from 2.1% in June. This steep climb, driven by soaring fuel and food prices, underscores the growing cost-of-living challenges facing households, the Australian Broadcasting Corporation reports

Italy’s July EU-harmonised CPI slowed to 1.7% year-on-year, according to Reuters. Meanwhile, ‘core’ inflation remained steady, signaling persistent underlying price pressures despite the easing headline growth

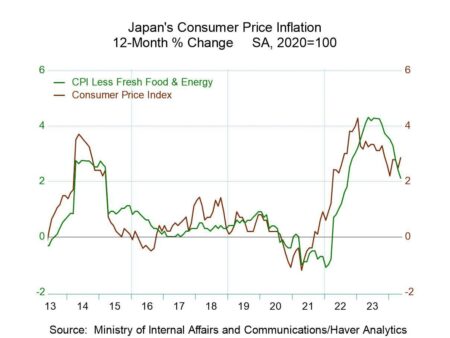

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

Argentina’s inflation inched up slightly in April, rising less than market expectations, Bloomberg reports. This modest rise offers a promising sign of stability amid the country’s ongoing economic challenges

Inflation skyrocketed to its highest level since January 2024 in June, ramping up the pressure on consumer prices. Experts warn that this sharp rise could significantly shape upcoming monetary policy decisions

UK inflation has soared to its highest level since January 2024, intensifying pressure on the Bank of England as it weighs potential rate cuts. Markets are navigating cautiously, with policymakers walking a delicate tightrope between curbing inflation and supporting economic growth

Canada’s annual inflation rate surged to 1.9% in June, surpassing expectations as soaring energy and food prices dominated the headlines, Reuters reports. This increase underscores ongoing economic challenges despite recent policy measures aimed at stabilizing the market

Japan’s wholesale inflation took a breather in April, easing concerns over skyrocketing prices and reducing the urgency for the Bank of Japan to hike interest rates, Reuters reports. This cooling trend could signal a shift in the future path of monetary policy

Inflation in France and Spain edged higher for the first time in 2025, signaling new hurdles for eurozone policymakers. Surging prices in key sectors are beginning to rattle consumer confidence, the WSJ reports

Australia’s CPI inflation slowed more than expected in May, easing pressure on the Reserve Bank and sparking renewed market optimism about potential rate cuts. Investors are now eagerly watching upcoming economic data for new clues

Japan’s corporate service inflation soared to 3.3% in May, driven by climbing costs in transportation and communications. This striking rise underscores ongoing price pressures that are reshaping the business landscape

Germany’s inflation rate held firm at 2.1% in May, reflecting steady consumer prices amid ongoing economic challenges. This encouraging data sparks cautious optimism for Europe’s largest economy. (NYSEARCA:EWG)

Argentina’s inflation is set to ease to 28.6% by year-end, Reuters reveals. This encouraging decline marks a significant shift from earlier highs, showcasing the government’s relentless efforts to stabilize the economy amid ongoing challenges

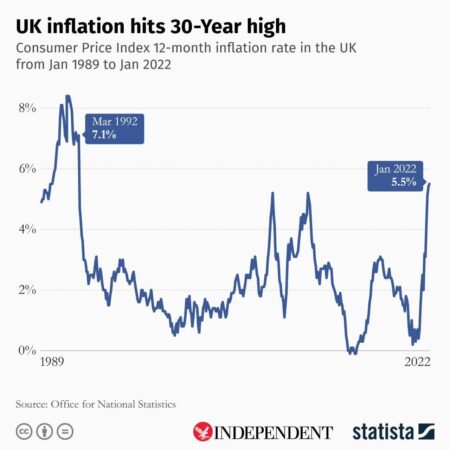

UK inflation rates have skyrocketed, sparking worries about the rising cost of living. Recent data reveals that prices are climbing at an alarming rate, affecting everything from your weekly grocery shop to soaring energy bills. As families prepare for tighter budgets, experts are weighing in on the potential economic fallout.

In April, German inflation dipped to 2.2%, just shy of what analysts had anticipated. This decrease offers a glimmer of hope in easing price pressures, yet it also underscores the ongoing hurdles facing the economy as policymakers strive to steer recovery through a landscape marked by persistent volatility.