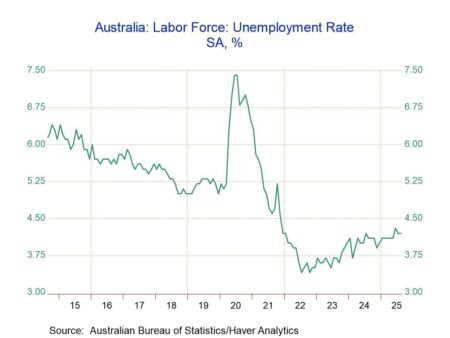

Australia’s unemployment rate has surged to its highest point in four years, raising fresh concerns about the country’s economic future. To revive the struggling job market, the Reserve Bank of Australia is now considering a cut in interest rates

Browsing: interest rates

Australia’s central bank labels its monetary policy as “little restrictive,” showcasing strong confidence in the nation’s economic growth despite persistent inflation concerns. This cautious stance signals potential future moves designed to sustain a steady and resilient recovery

Analysis reveals that while Takaichi’s win as Japan’s leader may delay Bank of Japan rate hikes, it won’t halt them entirely. Market watchers remain vigilant as the policy outlook stays unpredictable

The Bank of Canada caught markets off guard by slashing interest rates, despite ongoing uncertainty surrounding the inflation outlook, according to minutes from the latest meeting. Officials weighed economic risks with caution before deciding to ease monetary policy

Asia stocks soared on Tuesday, powered by a strong rally in the tech sector, even as Japan’s market slipped amid mounting concerns over looming rate hikes. Investors remain cautious, navigating the uncertain waters as central banks signal tighter monetary policies on the horizon

Interest rates on revolving credit cards in Brazil have soared to a staggering 451.5% per year, highlighting the country’s escalating credit cost crisis, Eurasia Review reports. This sharp increase underscores the growing financial strain burdening consumers across the nation

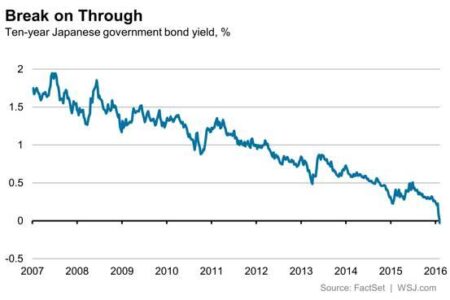

Japan’s bond yields have surged to a 16-year high, igniting a wave of speculation about a potential interest rate hike. Investors are on edge, closely watching the Bank of Japan’s next move as inflation pressures steadily mount

The Bank of Japan is gearing up for a pivotal rate hike as inflationary pressures intensify. Markets are buzzing with anticipation, bracing for a landmark policy shift that could finally bring an end to decades of ultra-loose monetary easing

The Bank of Japan is preparing to accelerate the sale of its asset holdings, signaling a decisive shift away from its ultra-loose monetary policy amid rising inflationary pressures, The Wall Street Journal reports

Brazil’s central bank decided to hold interest rates steady, signaling a strategic pause designed to fuel economic recovery as inflation eases. This choice reflects cautious optimism amid persistent global uncertainties

PGIM highlights a dramatic surge in France’s bond yields, revealing an exciting tactical buy opportunity for savvy investors. Market experts encourage staying alert to this yield spike, as it may uncover hidden value within French debt assets

France now faces the startling prospect of borrowing costs overtaking those of Italy, highlighting growing investor concerns about its fiscal outlook. This surprising development reveals changing tides in the Eurozone debt markets, reports Le Monde.fr

Japan’s government has strongly dismissed allegations that the U.S. is pressuring the Bank of Japan to raise interest rates. Yet, as global inflation concerns intensify, investors remain on high alert, scrutinizing every decision from the BOJ and keeping markets tense

Scott Bessent, a renowned investor, raises a red flag, warning that Japan is dangerously “behind the curve” on interest rates. As global central banks accelerate their monetary tightening, he shines a spotlight on the growing risks tied to Japan’s slow pace in raising rates

Japan’s 10-year government bond yield soared, driven by the Bank of Japan’s surprisingly hawkish signals. This unexpected shift toward tightening has sparked a surge of market excitement on TradingView

The Bank of Canada has just revealed its 2026 calendar for policy interest rate announcements and key publications, providing markets and policymakers with clear, reliable guidance throughout the year

Banks in Argentina are grappling with a severe liquidity crunch as soaring peso yields, fueled by rising inflation and economic uncertainty, intensify pressure on the financial sector, Bloomberg reports

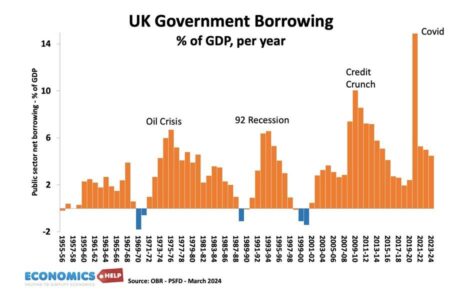

UK borrowing has surged dramatically as soaring inflation drives debt servicing costs to unprecedented levels, Reuters reports. With interest rates climbing steadily, the government is under increasing fiscal strain, raising serious concerns about the country’s long-term economic future

China held its benchmark lending rates steady on Wednesday, exactly as markets anticipated. This move highlights Beijing’s cautious approach amid economic uncertainties, aiming to fuel growth while keeping inflation under control

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions