China is accelerating its drive to transform the renminbi into a global powerhouse, expanding its influence across international trade and finance. This ambitious move aims to challenge the dominance of the US dollar and boost China’s economic impact worldwide

Browsing: international finance

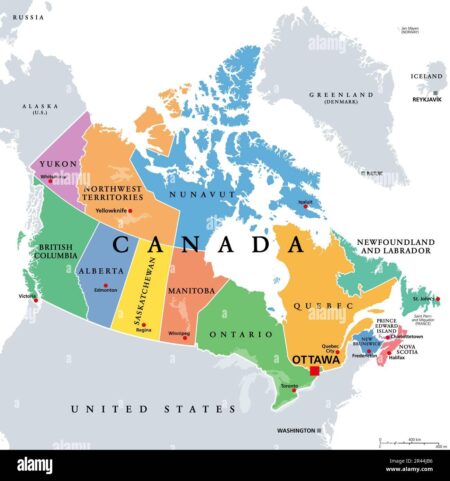

Canada has just unleashed a massive US$1.7 billion from frozen Russian assets to fuel Ukraine’s fight, delivering vital support to Kyiv amid ongoing conflict. This bold move highlights the growing global determination to strengthen Ukraine’s defense and help rebuild its future

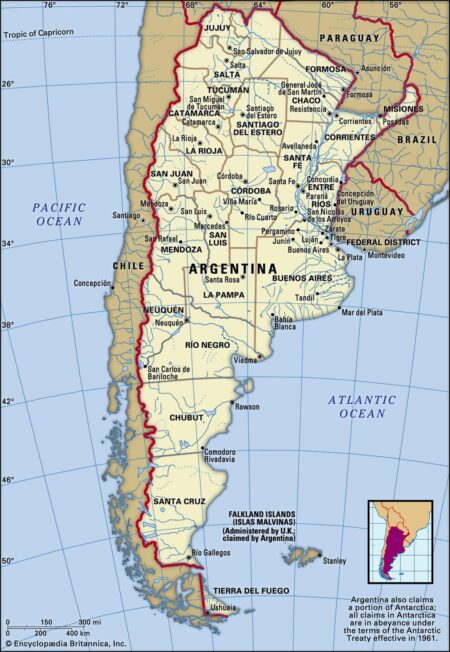

Argentina, often dubbed the IMF’s wild child, has missed its foreign exchange reserve targets but is on the brink of securing a vital waiver. This crucial move aims to propel debt relief talks forward, providing a much-needed lifeline to ease mounting financial pressures

China is gearing up to turbocharge the yuan’s global reach with an exciting new operations centre, unveiled by the People’s Bank of China. This ambitious move aims to boost the currency’s international clout and speed up cross-border transactions like never before

The IMF has applauded Argentina’s recent reform efforts, calling them a promising sign as the much-anticipated visit at the end of June approaches. These bold moves showcase the country’s strong commitment to meeting the vital economic targets set out in the bailout agreement

UK Finance Minister Bridget Phillipson is gearing up to meet China’s Vice Premier during her London visit, aiming to strengthen economic ties and unlock exciting new opportunities in bilateral trade, Reuters reports

Brazil has just secured an impressive $2.75 billion in its second dollar bond offering of 2025, Reuters reports. This robust demand reflects a surge in investor confidence, as the country’s credit default swaps (CDS) have fallen to their lowest level in a year, signaling optimism about Brazil’s financial future

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse

Former U.S. President Trump’s recent remarks have ignited fresh concerns about the safety of Germany’s gold reserves held in New York, sparking intense debates over repatriation and the protection of overseas assets, Reuters reports

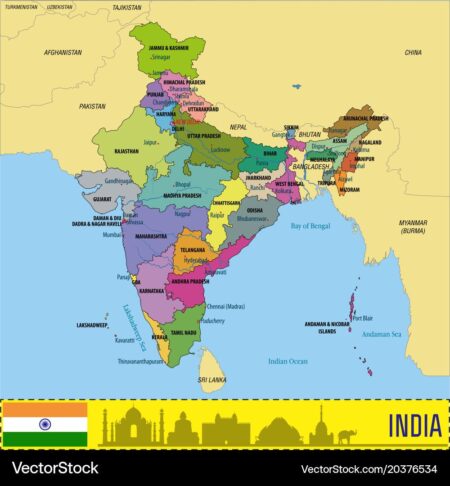

India is gearing up to champion international financial measures targeting Pakistan, as revealed by a reliable source. This strategic move underscores the rising tensions between the two nations, with India actively seeking global backing to tackle pressing issues related to terrorism financing.

In a bold move, Brazil has scrapped its contentious offshore tax on investment funds after facing intense pushback from investors. This pivotal decision is set to rejuvenate confidence in the financial sector and draw in foreign capital, signaling a transformative shift in the government’s fiscal strategy.

Goldman Sachs is reportedly eyeing an exciting expansion of its retail banking services into Ireland and Germany. This bold strategic move seeks to unlock new markets and strengthen its foothold in Europe, all while navigating a dynamic and competitive financial landscape

Ukrainian Finance Minister Serhii Marchenko is gearing up to join the G7 Finance Meeting in Canada, where global leaders will unite to tackle pressing economic challenges and rally support for Ukraine during these turbulent times. Exciting opportunities for enhanced collaboration are on the horizon!

In an exciting development, China is poised to boost its investments in Brazil by a staggering $27 billion, as revealed by President Lula. This strategic initiative is designed to fortify economic connections and elevate collaboration in key areas such as infrastructure and energy, marking a significant step towards a dynamic partnership.

Argentina has triumphantly secured a staggering $42 billion in funding from the International Monetary Fund and various other sources, signaling a bold new chapter in its economic policy. By lifting long-standing currency controls, the country is taking decisive steps to stabilize its economy amidst persistent financial challenges. This pivotal move could pave the way for renewed growth and prosperity.

India is set to overtake Japan as the world’s fourth largest economy by 2025, as revealed by the International Monetary Fund (IMF). This remarkable achievement highlights India’s swift economic ascent, driven by robust consumer demand and innovative reforms.

Argentina’s recent $20 billion financial rescue has sparked crucial discussions about its economic trajectory. Experts are diving deep into pressing topics like debt sustainability, strategies for controlling inflation, and the potential effects on social stability as the nation navigates ongoing challenges.

The IMF and World Bank have greenlit exciting new bailout packages for Argentina, designed to bolster its economy in the face of persistent inflation challenges. These vital measures are set to offer essential support as the nation charts a course through financial uncertainty.

US Treasury’s Bessent has voiced strong support for Argentina’s ambitious economic reforms, highlighting their crucial role in stabilizing the nation as worries about China’s expanding influence in the region mount. This initiative not only reflects a commitment to Argentina’s progress but also aligns seamlessly with broader U.S. interests in bolstering economic partnerships across Latin America.

The World Bank is gearing up to unveil a remarkable $12 billion financing package for Argentina, designed to give a much-needed boost to the nation’s faltering economy. This substantial investment arrives at a critical time, as the country grapples with persistent challenges like soaring inflation and currency fluctuations, according to reports from Reuters.