China is making a strategic move to lessen its dependence on US Treasuries, redirecting its investments towards more dynamic options like commodities and emerging markets. This shift not only showcases a savvy financial strategy but also underscores China’s commitment to bolstering its financial stability in the face of rising geopolitical tensions

Browsing: international trade

Argentina has taken a bold step by lifting tariffs on electric vehicles (EVs), paving the way for a dynamic and competitive environment for local manufacturers. With an influx of budget-friendly Chinese imports, this decision could revolutionize the nation’s automotive landscape, pushing homegrown brands to rise to the challenge and spark innovation like never before.

In a significant policy shift, President Javier Milei has lifted tight currency and capital controls in Argentina, aiming to stimulate economic growth. This move is expected to increase market confidence but may also raise concerns about inflation and financial stability.

In a bold and transformative policy shift, Argentina has officially scrapped export duties on thousands of manufactured goods! This exciting move is set to enhance the country’s competitiveness in global markets, breathing new life into the economy and providing a much-needed boost for local manufacturers.

As shipments from China dwindle, the effects of Trump’s tariffs are still echoing throughout the U.S. economy. Experts caution that ongoing trade tensions may stifle growth, posing challenges for both businesses and consumers as inflation worries mount.

In an exciting development, China has officially welcomed Brazilian wild caught seafood into its market! This strategic shift in sourcing aims to diversify suppliers and meet the surging global demand for seafood. With this move, Brazil is set to emerge as a significant player in the industry, bringing fresh opportunities and flavors to tables around the world.

In a captivating recent article, The Atlantic delves into the potential repercussions of Trump’s policies, suggesting we might be on the brink of a new “China shock.” This phenomenon echoes the economic upheavals experienced in the early 2000s. Experts are sounding the alarm, indicating that these shifting trade dynamics could profoundly affect American industries and job markets.

China’s bold gold-buying spree has captured global attention. In a time of economic uncertainty and currency fluctuations, Beijing is on a mission to strengthen its financial stability and lessen its dependence on the U.S. dollar, all while establishing itself as a powerful contender in the international market.

Delta Air Lines is soaring to new heights by unveiling an exciting new route for its Airbus A350 to Japan, cleverly sidestepping the Trump-era tariffs. This bold move not only underscores the airline’s strategic growth but also demonstrates its ability to navigate trade challenges with finesse, showcasing remarkable resilience in a fiercely competitive market.

German markets surged dramatically as President Trump unveiled a temporary reprieve from auto tariffs, alleviating investor worries and turning around earlier losses from April. This strategic decision sent automotive sector shares soaring, igniting a wave of renewed optimism about the industry’s future.

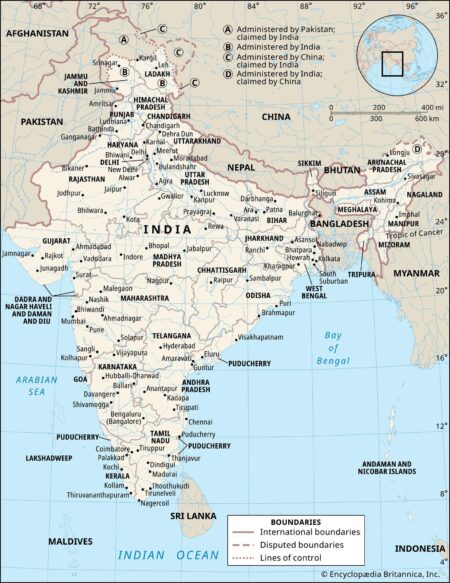

In a recent statement, President Trump expressed optimism about the ongoing tariff negotiations with India, declaring them as “going great” and highlighting significant strides in trade relations. At the same time, he took decisive action by signing an executive order designed to invigorate the auto industry, addressing growing concerns from manufacturers.

Vitol is ramping up its oil purchases from Venezuela as the clock ticks down on a crucial U.S. license that allows these transactions. This bold move highlights the trading giant’s strategic maneuvering to lock in supplies while navigating the increasingly stringent sanctions on Venezuelan crude.

Japan’s Komatsu is bracing for a significant 27% drop in profits this year, a setback they attribute to the rising strength of the yen and persistent tariffs. As global market dynamics evolve, this heavy machinery giant finds itself navigating an increasingly challenging landscape.

China’s factory activity is facing a downturn as escalating tariffs create a challenging trade environment. This contraction highlights rising worries about dwindling demand and soaring costs, all while international trade tensions cast a shadow over the manufacturing sector

In a recent announcement, the Bank of Japan (BOJ) has chosen to keep its interest rates steady, highlighting the current economic stability. However, officials voiced their worries about looming risks from US tariffs that could pose challenges to Japan’s export-driven economy.

Trump’s tariffs are shaking up global supply chains, causing a ripple effect of rising costs for both manufacturers and consumers. As businesses grapple with delays and the daunting maze of trade barriers, they find themselves in a state of heightened uncertainty. This turmoil not only complicates their operations but also poses significant challenges to our broader economic recovery efforts.

India is ramping up its efforts to seal a trade deal with the Trump administration, striving to strengthen economic connections in the face of escalating tensions. As discussions intensify, both countries are working diligently to tackle intricate trade challenges and align their mutual interests in the region

In a surprising twist, China has quietly lifted tariffs on select U.S.-made semiconductors, a strategic decision that may help to cool the simmering tensions between the two countries amidst ongoing trade disputes. The potential impact on the tech industry and the future of bilateral relations is yet to unfold.

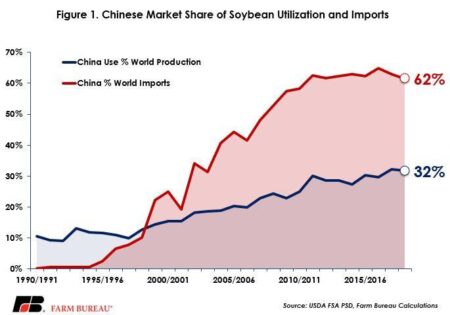

In March, China’s soybean imports from the U.S. skyrocketed, driven by a surge in demand as global supplies tighten. Yet, analysts believe that Brazil will maintain its stronghold in the market, capitalizing on its impressive production capabilities to satisfy China’s long-term requirements.

China is reportedly considering a bold step: exempting select U.S. products from tariffs. This strategic move could pave the way for a significant reduction in trade tensions between the two nations. As negotiations continue, this potential adjustment shines a glimmer of hope for stabilizing economic relations and fostering collaboration