Watch Wall Street Week | Japan’s New Investment Horizon on Bloomberg as it dives into thrilling new opportunities within Japan’s markets, highlighting innovative sectors and the dynamic economic forces reshaping global investment strategies

Browsing: investment opportunities

As UK banks hike mortgage rates, investors are eagerly eyeing related ETFs poised to benefit from soaring yields and tightening credit conditions. These funds offer a smart strategy to navigate the shifting terrain of housing finance

India’s remarkable GDP growth is turning heads across the globe, but experts say there’s more beneath the surface. Watch closely as five key forces drive the economy forward: inflation trends, fiscal health, export performance, job creation, and the power of domestic demand

Discovering UK penny stocks, Yahoo Finance UK highlights ActiveOps as one of its top three picks. Celebrated for its remarkable growth potential, ActiveOps stands out as a shining star in the dynamic small-cap market-an ideal find for savvy investors seeking genuine value

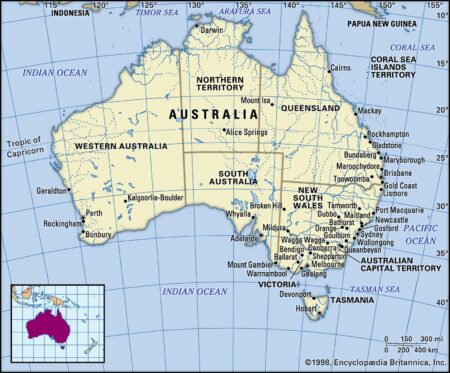

Soaring gold prices are igniting an exciting modern-day gold rush across Australia, attracting a new wave of fortune seekers. Adventurous prospectors are flocking to historic sites, eager to unearth hidden treasures and strike it rich as demand skyrockets and supplies grow scarce

India and Italy have supercharged their strategic partnership, paving the way for an exciting surge in trade, technology, and sustainable development. This powerful collaboration aims to spark economic growth and fuel groundbreaking innovation across key industries

China’s Nvidia, a leading AI chipmaker, has soared an incredible 425% amid a booming surge in demand for artificial intelligence technology. Experts say this explosive growth is only the beginning, signaling massive opportunities on the horizon for the AI industry

Italy and Spain are rapidly emerging as exciting new hotspots for direct lending deals, capturing the keen interest of alternative credit investors eager to lock in higher yields amid tightening traditional bank lending

Promising UK penny stocks are sparking excitement among investors this November 2025, as a wave of small-cap companies showcase remarkable growth potential despite market ups and downs. Analysts highlight the hottest sectors to watch on Yahoo Finance

UK investors are buzzing with excitement this November 2025, diving into promising penny stocks as market volatility creates thrilling new opportunities. At the forefront are innovative tech startups and dynamic green energy companies, both shining with remarkable growth potential

Italy’s vital economic data and political developments on October 24 are poised to seize investors’ full focus. Market reactions could send ripples through the euro and Italian stocks, with TradingView highlighting the essential factors shaping market sentiment

Investors are buzzing about three Canadian growth stocks that are set to explode in 2024. With strong fundamentals and incredible market potential, experts are urging buyers to act fast before prices skyrocket.

Efforts to reignite economic ties with India are gaining momentum as both nations eagerly explore thrilling new trade agreements and investment opportunities. Targeting vibrant sectors such as technology, manufacturing, and energy, these initiatives are set to turbocharge bilateral growth

As the U.S. and UK spark a thrilling new ‘nuclear golden age,’ investors are racing to seize the sector’s hottest stocks. TipRanks uncovers the top nuclear energy companies poised for explosive growth, driven by soaring demand and powerful government support

China’s $19 trillion stock market, once seen as off-limits to investors, is now capturing global attention like never before. With sweeping regulatory reforms and the country’s reopening fueling renewed confidence, excitement is building around the world’s second-largest equity market

Ignacio Galán met with the UK Prime Minister at Downing Street to unlock thrilling new investment opportunities, strengthening the energy partnership between the UK and Spain. Their conversation focused on advancing cutting-edge sustainable energy projects and enhancing bilateral cooperation for a greener future

Australia’s household spending is skyrocketing, fueling a vibrant wave of consumer-driven growth that’s breathing new life into the economy and opening the door to thrilling investment opportunities. Experts highlight a booming surge in retail and service demand as the dynamic engines propelling this optimistic market forecast

ASML is actively partnering with India as Prime Minister Modi spearheads an ambitious mission to create a vibrant local semiconductor industry, aiming to turbocharge chip production and reduce reliance on global supply chains, Bloomberg reports

Brazil has firmly established itself as the world’s leading soybean exporter, fueled by soaring demand from China. This explosive growth not only underscores Brazil’s vital role in the global agricultural landscape but also marks a significant turning point in international trade dynamics

UK’s tech scene is booming with high-growth stocks stealing the spotlight from eager investors. From revolutionary startups to pioneering industry giants, these companies are shaping the future of innovation. Yahoo Finance uncovers the top tech stocks you can’t afford to miss right now