Nvidia’s revenue from China is set to soar past $6 billion in Q1, even as worries mount over possible export bans that could affect the semiconductor powerhouse. Investors are on high alert, keenly observing how escalating geopolitical tensions might transform the tech landscape.

Browsing: investment strategies

In a captivating recent analysis, Ubuntu Economics (@Snacktrading) unveiled the dynamic market strategies of Binance, showcasing its remarkable ability to adapt in the face of shifting regulatory landscapes. These insights not only underscore Binance’s resilience but also hint at its significant potential to shape the future of crypto trading.

Economists are sounding the alarm, declaring that Canada has slipped into a recession. With consumer spending taking a hit and inflation on the rise, the outlook is concerning. Analysts predict that these persistent economic pressures may spell extended difficulties for Canadian households and businesses alike.

Statistics Canada reveals a striking surge in debt growth, raising alarms for Canadian households and businesses alike. As borrowing continues to climb, experts are sounding the cautionary bell, emphasizing the potential risks this trend poses to our economic stability and overall financial well-being across the nation.

New tariffs aimed at revitalizing American manufacturing are unexpectedly pushing businesses to seek opportunities in Canada. Companies are highlighting the allure of lower production costs and more favorable trade conditions as major reasons for their move, posing a significant challenge to U.S. policy objectives.

In an exciting development, China is poised to boost its investments in Brazil by a staggering $27 billion, as revealed by President Lula. This strategic initiative is designed to fortify economic connections and elevate collaboration in key areas such as infrastructure and energy, marking a significant step towards a dynamic partnership.

Foreign investment in Japan’s stock market has skyrocketed, sparking a wave of enthusiasm among local authorities to rally domestic participation. With global investors fueling the market’s momentum, exciting initiatives are being launched to enhance awareness and accessibility for Japanese citizens. This effort is set to cultivate a more vibrant and resilient economic landscape.

Despite U.S. sanctions designed to limit China’s access to cutting-edge semiconductor technology, new reports reveal that the nation is still managing to acquire Nvidia equipment through intricate supply chains and third-party intermediaries. This development has sparked significant concerns about the potential for technology proliferation

Dow Jones futures surged as investors eagerly anticipated fresh U.S.-China trade discussions. Excitement is in the air as all eyes turn to Federal Reserve Chairman Jerome Powell, whose forthcoming remarks could sway market sentiment amidst the backdrop of ongoing economic uncertainty.

European markets are experiencing a surge of volatility as political unrest in France and Germany sends ripples of concern through the investment community. With proposed reforms hanging in the balance and government stability under scrutiny, traders across the continent are adopting a more cautious approach.

Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

At Finovate Global Brazil, industry leaders gathered to dive into cutting-edge debt management solutions and the surging trend of Buy Now, Pay Later (BNPL) schemes. The event also highlighted exciting initiatives aimed at boosting Bitcoin reserves in a fast-changing financial landscape.

Nvidia CEO Jensen Huang emphasized the vital importance of the Chinese market during his recent trip to Beijing, according to reports from Chinese state media. His comments shine a spotlight on the tech giant’s strategic commitment to forging new partnerships in China’s booming AI sector

Japan has no intention of leveraging U.S. Treasurys amid ongoing tariff discussions, reaffirming its commitment to stable financial markets. Officials emphasize the importance of cooperative trade relations while navigating complex economic challenges.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

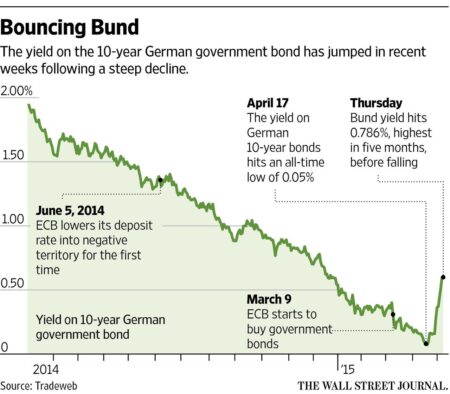

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

In 2025, the UK, Spain, France, and Italy are poised to lead hotel investments, with a significant shift towards ESG-certified properties. This trend reflects a growing emphasis on sustainability and responsible tourism in the European hospitality sector.

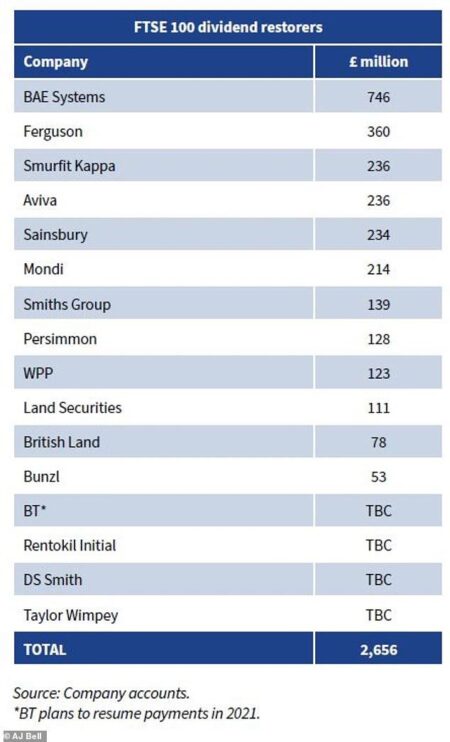

In a market where insider ownership can signal confidence, three UK growth companies stand out. These firms, highlighted by Yahoo Finance, showcase substantial insider stakes, suggesting robust faith in their future prospects as they pursue ambitious growth strategies.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

As March 2025 approaches, investors are eyeing top UK dividend stocks for reliable income. Companies such as BP, Unilever, and GlaxoSmithKline stand out, offering attractive yields and stability amid market fluctuations. Consider these options for a robust portfolio.