In a daring and visionary endeavor, an enterprising buyer has snapped up five €1 houses in Italy, setting the stage for the ultimate holiday getaway. This exciting project aspires to transform these charming properties into a single enchanting destination, highlighting the incredible potential of Italy’s affordable real estate market.

Browsing: investment strategy

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.

The Canada Pension Plan Investment Board has made a bold move by revising its net-zero emissions target, stepping away from its original goal set for 2050. This pivotal decision signals a dramatic shift in the organization’s strategy, reflecting the increasing scrutiny surrounding investment practices and climate commitments.

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

Investment banks are buzzing with optimism as they have upgraded their growth forecasts for China, thanks to an unexpected trade deal with the U.S. This landmark agreement is set to invigorate economic confidence and enhance trade flows, hinting at a promising recovery in bilateral relations and paving the way for greater market stability.

In a bold move towards stability, Japan’s asset managers are increasingly embracing domestic equities as a safer investment option. As uncertainties loom over China’s economic landscape, this strategic pivot underscores their quest for refuge in these turbulent market conditions.

China is making a strategic move to lessen its dependence on US Treasuries, redirecting its investments towards more dynamic options like commodities and emerging markets. This shift not only showcases a savvy financial strategy but also underscores China’s commitment to bolstering its financial stability in the face of rising geopolitical tensions

Exciting news from Brazil’s Meliuz! The company is gearing up to unveil a groundbreaking initiative designed to supercharge its Bitcoin buying strategy. This bold move aims to draw in a wave of cryptocurrency enthusiasts, harnessing Meliuz’s popular cashback platform to encourage crypto transactions in the booming digital economy.

Germany is on the brink of an exciting economic transformation as a fresh “stimulus wave” sweeps in, designed to spark growth and ignite innovation. Investors are eagerly focusing on pivotal sectors, with certain stocks set to thrive from this surge of government backing

The Net-Zero Circle unveiled a new Investor Guide focused on Brazil’s critical minerals sector at a high-profile UK-Brazil event. This initiative aims to attract investment in sustainable mining, aligning with global net-zero goals amid rising demand for green technologies.

In a surprising analysis, strategists suggest that Japan, rather than China, may have strong incentives to reduce its U.S. Treasury holdings. This shift could be driven by Japan’s need to stabilize its currency amidst ongoing economic challenges.

In a strategic move, Bessent has unveiled a ‘Grand Encirclement’ plan aimed at countering China’s influence. This ambitious initiative seeks to strengthen alliances and enhance regional stability, reflecting growing concerns over geopolitical tensions.

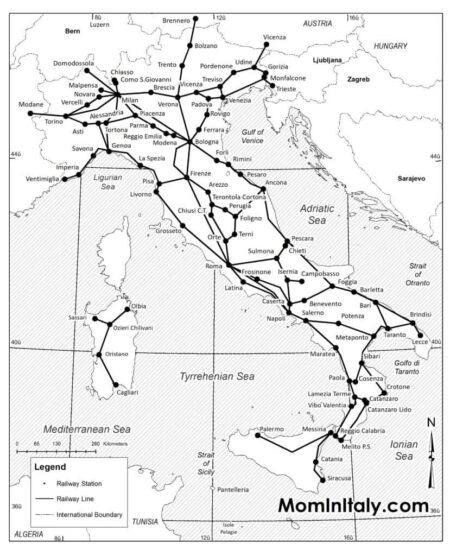

Italy’s ambitious €25 billion rail plan aims to modernize its infrastructure, emphasizing sustainability and efficiency. This initiative is seen as a blueprint for EU spending, showcasing how targeted investments can drive economic growth and connectivity across the bloc.

Canada holds billions in U.S. real estate, but recent threats from former President Trump regarding border policies and trade could jeopardize these investments. Experts warn that uncertainty may deter future Canadian buyers, impacting the market significantly.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

In a recent statement, JPMorgan CEO Jamie Dimon advised former President Trump to consider the resilience of countries like India as the U.S. faces potential recession risks. Dimon emphasized the importance of global economic dynamics amid domestic challenges.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

In March 2025, numerous UK stocks are trading below their estimated valuations, signaling potential investment opportunities. Analysts attribute this trend to market volatility and economic uncertainty, highlighting sectors poised for recovery amid evolving conditions.

The Commonwealth Bank of Australia has announced a new dividend distribution, signaling confidence in its financial stability. Investors can expect the payout to enhance returns, reflecting the bank’s robust performance amid a fluctuating market environment.

Tesla stock faced further declines following recent developments in China, raising investor concerns. Reports suggest increased regulatory scrutiny and competitive pressures in the electric vehicle market, prompting analysts to reassess the company’s growth outlook.