A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Browsing: investment

Apple is poised to increase its iPhone production in India, as reported by the Wall Street Journal. This strategic move aims to mitigate potential tariffs and bolster the company’s supply chain resilience amid global trade tensions.

France has signed multiple agreements to boost Egypt’s economy amid a turbulent regional climate. The deals aim to strengthen economic ties and support crucial sectors, reflecting France’s commitment to stability and cooperation in the Middle East.

Manitoba has announced a significant investment in Cereals Canada‚Äôs Gate initiative, aimed at enhancing the province’s grain sector. This funding is expected to bolster research and development, improving quality and market access for local producers.

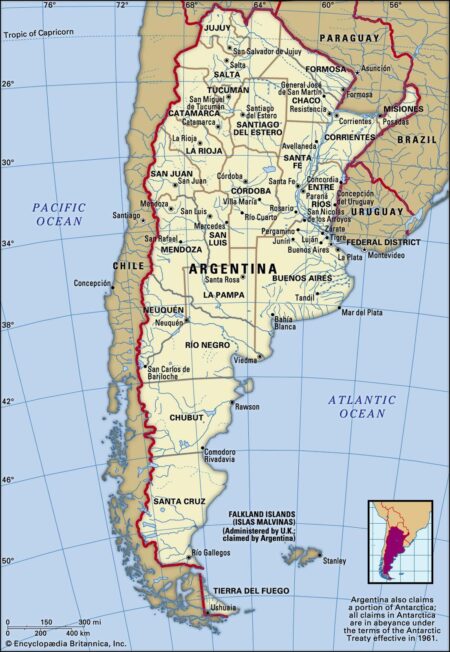

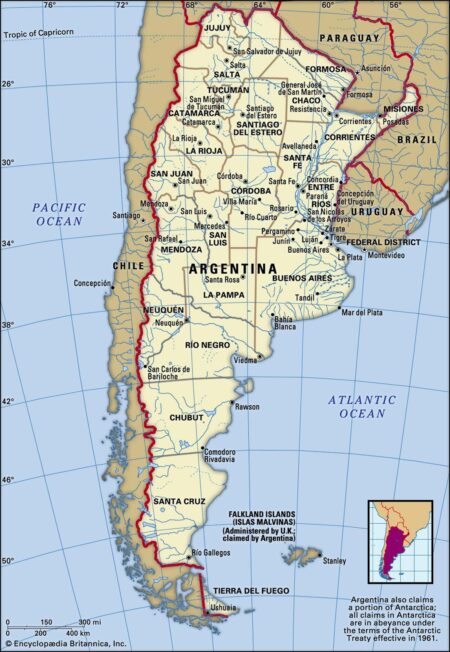

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

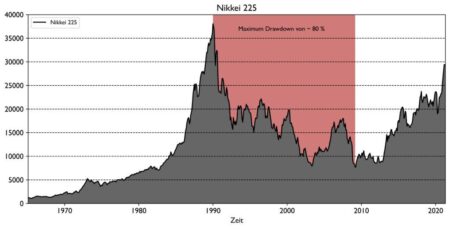

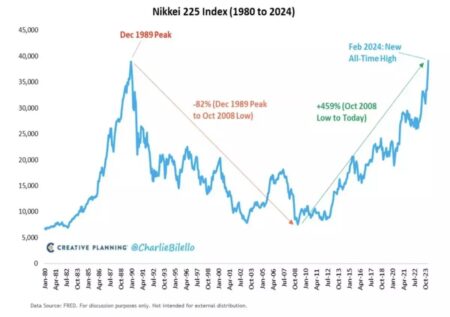

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation‚Äôs escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

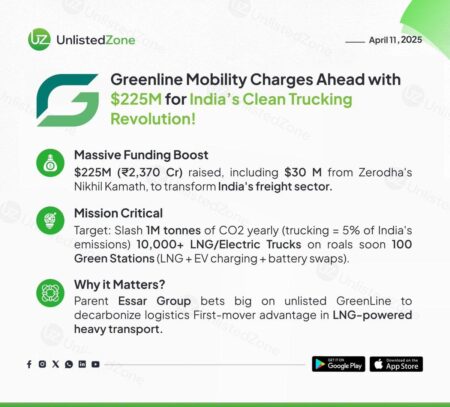

India’s GreenLine Mobility announced a significant investment of $275 million aimed at decarbonizing its heavy truck fleet. This initiative underscores the country’s commitment to sustainability and reducing carbon emissions in the transportation sector.

Australia’s median home value has surged by approximately $230,000 over the past five years, highlighting a significant shift in the housing market. This rise raises concerns over affordability and accessibility for potential buyers amidst ongoing economic challenges.

Brazil’s electric power reform faces critical challenges, including outdated infrastructure, high tariffs, and a reliance on hydropower. Addressing these issues is crucial for ensuring energy security and attracting investment in a diverse energy mix.

Hyatt is strategically positioning itself to leverage India’s burgeoning population as a catalyst for growth. With increasing domestic travel and business opportunities, the hotel chain aims to expand its footprint, tapping into the vibrant hospitality market.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

In a recent roundtable discussion, Japan’s Sovereign Socially Responsible Allocators (SSAs) expressed concerns over rising geopolitical tensions and fluctuating tariffs. Experts highlighted the need for strategic adaptations to navigate this volatile landscape and safeguard investments.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

Argentina has secured a $20 billion deal with the International Monetary Fund (IMF) to support President Javier Milei’s ambitious economic reforms. The agreement aims to stabilize the nation‚Äôs economy amid ongoing inflation and fiscal challenges.

Germany has officially formed a new government, unveiling plans to reduce corporate taxes as part of its economic strategy. The move aims to boost investment and competitiveness amid global economic challenges, signaling a shift in fiscal policy.

Brazil’s Petrobras announced plans to resume operations at its Paran√° fertilizer plant in June, aiming to boost domestic production. The move aligns with the company’s strategy to enhance Brazil’s agricultural sector amidst rising global fertilizer demands.

MercadoLibre has announced a significant investment of $5.8 billion in Brazil for 2023, underscoring its commitment to expanding its operations in the region. This move aims to enhance logistics, technology, and customer service in the fast-growing e-commerce market.

Japanese stocks are poised for a significant rise following former President Trump’s decision to pause higher tariffs. Investors are optimistic, anticipating a boost in trade relations and economic stability, as markets react positively to this unexpected development.

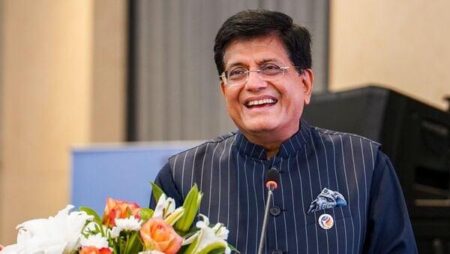

In a recent address, Commerce Minister Piyush Goyal’s remarks on Indian start-ups have ignited a heated debate among entrepreneurs and industry experts. His comments critiquing the challenges and responsibilities of start-ups reflect growing scrutiny of India’s burgeoning tech ecosystem.