S&P Global has just boosted India’s sovereign credit rating to BBB-the first upgrade since 2007! This exciting milestone reflects stronger economic fundamentals and powerful fiscal reforms, sparking increased investor confidence even amid global uncertainties

Browsing: investment

China’s ambitious electric vehicle factories in Turkey have yet to ignite the spark of production, despite sky-high expectations. These setbacks raise concerns about supply chain hurdles and shifting market forces in the fast-evolving EV landscape

Former President Trump’s Nvidia deal has intensified U.S.-China tech tensions, with China fiercely condemning the agreement and signaling potential disruptions to semiconductor trade and global supply chains

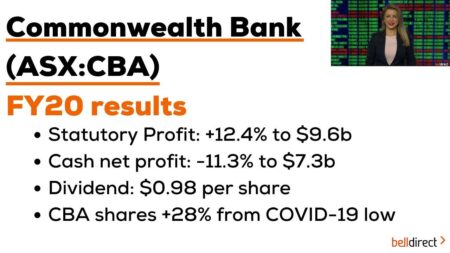

Australia’s Commonwealth Bank (CBA) has smashed records with a stellar annual profit, driven by soaring home loan growth and sharp cost control. However, despite this remarkable success, investors have been selling off pricey shares, revealing a cautious sentiment in the market

Metaplanet is poised to transform Japan’s fixed income market by seamlessly weaving Bitcoin into its fabric, igniting an exciting new growth engine. This daring leap highlights the unstoppable surge of crypto adoption reshaping traditional finance sectors

Japan’s 10-year government bond yield soared, driven by the Bank of Japan’s surprisingly hawkish signals. This unexpected shift toward tightening has sparked a surge of market excitement on TradingView

The US$1.3bn concession for a major Brazilian highway has sparked intense competition, drawing bids from top infrastructure giants. This exciting development highlights the growing investor enthusiasm sweeping through Latin America’s transport sector

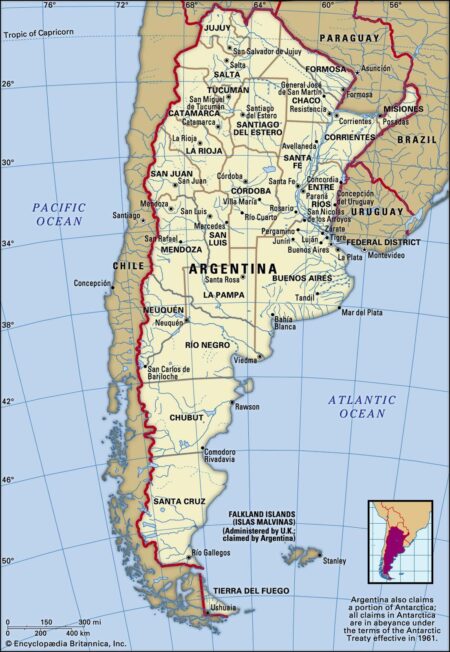

Lithium Argentina AG, featured on Baystreet.ca, is making impressive strides in its lithium exploration projects across Argentina, tapping into the booming demand for battery metals fueled by the worldwide transition to clean energy and electric vehicles

Germany’s Uniper is gearing up to unleash a massive $5.8 billion investment by 2030 in a bold strategic transformation aimed at turbocharging renewable energy expansion and dramatically cutting reliance on fossil fuels, Reuters reports

Brazil’s Petrobras has hinted that extra dividends this year are unlikely, citing market uncertainties and urgent investment needs, Reuters reports. The state-controlled oil giant is prioritizing capital expenditure as energy prices continue to fluctuate unpredictably

Japan’s stocks are poised to slip as disappointing U.S. economic data reignites concerns over global growth. Investors remain cautious, bracing for potential ripple effects throughout Asian markets, Bloomberg reports

Brazil’s US$55bn infrastructure boom is revolutionizing the nation’s economy like never before. Driven by robust government investment, vibrant private sector collaborations, and skyrocketing demand in transport and energy, this surge heralds an exhilarating era of growth ahead

Rising excitement around a popular options trade is sparking Japan’s bourse to roll out new ETF listings, aiming to boost market liquidity and attract a wave of eager traders, Bloomberg reports

Italy’s Banco BPM is actively seeking thrilling merger and acquisition opportunities, CEO Roberto Gabbiani revealed. The bank is set on expanding its market footprint and confidently steering through the dynamic financial landscape

Spotlight: Argentina’s electric power sector is electrified with fresh investment, fueled by groundbreaking renewable energy projects and state-of-the-art grid modernization. This vibrant landscape presents incredible growth opportunities for local pioneers and global investors alike

Argentina has unveiled powerful tax incentives for Galan Lithium, igniting a wave of investment in the country’s thriving lithium sector. This dynamic move is poised to accelerate production just as global demand for lithium skyrockets

Canada’s Enbridge is making a bold leap with a $900 million investment in a Texas solar project, dramatically expanding its renewable energy portfolio. This thrilling move underscores Enbridge’s unwavering commitment to clean energy as demand skyrockets

Italy’s markets seize the spotlight on July 23, with investors keenly awaiting key economic data, political developments, and the far-reaching impact of EU policy moves. Get ready for a wave of volatility as eurozone uncertainties continue to loom large

Italy’s UniCredit has officially withdrawn its bid for Banco BPM, marking a bold change in strategy. This move is poised to transform the banking landscape as both institutions adapt to evolving market dynamics

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions