Bitcoin’s recent surge throws a spotlight on Germany’s costly economic misstep, exposing missed opportunities in the thriving digital asset landscape. Experts caution this could become the nation’s most significant economic blunder of the decade, as the crypto market races to new heights

Browsing: investment

This week on Dalal Street, the spotlight is firmly on the US-India trade deal, Q1 corporate earnings, and FII movements-powerful forces set to steer market sentiment and propel key indices amid unfolding global economic events, experts reveal

Japan’s Interstellar has just raised an impressive $62 million in a Series F funding round, supercharging its quest to transform space propulsion technology. This fresh capital will drive rigorous testing and set the stage for an ambitious leap into international markets

A U.S. judge has ordered Argentina to surrender its stake in YPF, escalating the fierce battle over a colossal $16.1 billion judgment and turning up the heat in the high-stakes struggle over debt repayment and sovereign assets, Reuters reports

Berlin is set to unleash a massive €4 billion in subsidies aimed at supercharging Germany’s heavy industry. This bold initiative is designed to fuel economic growth and protect jobs, positioning the sector to thrive amid rising global challenges, reports the Financial Times

Italy’s M&A market is buzzing with fresh energy as A&O and Shearman highlight thrilling strategic growth opportunities. Industry experts report a surge in deal flow and lively cross-border activity, driving dynamic momentum throughout the sector

Nvidia shares skyrocketed after an analyst uncovered a game-changing design shift, sparking excitement about the company’s explosive growth potential. Investors are now abuzz: Is it time to buy Nvidia as demand surges, or sell to secure your recent gains?

Cargill is expanding its footprint in Brazil with an exciting new investment in soybean operations, poised to boost production and meet skyrocketing global demand. This bold step underscores the company’s commitment to driving sustainable agriculture forward

A controversial Brazilian credit product that once led to significant investor losses is making a surprising comeback, drawing renewed attention as market conditions shift. Experts warn investors to proceed with caution and thoroughly evaluate the risks before diving in

Japan is sending shockwaves through the crypto world with a bold proposal to redefine cryptocurrencies. This groundbreaking move could unlock the door for crypto ETFs and dramatically cut tax rates for investors, igniting fresh growth and attracting a wave of new participants to the market

Golden Arrow Resources has just launched its third thrilling project in Argentina, marking a dynamic expansion in the country’s booming mining industry. This bold move not only underscores growing investor confidence but also shines a spotlight on the region’s rich and untapped mineral treasures

A US think-tank report reveals China’s swift expansion of influence over key ports across Latin America, raising strategic alarms amid escalating competition with the United States, Financial Times reports

Australians are gearing up to turbocharge their retirement savings as the Superannuation Guarantee rises to 12%. This gradual increase is set to boost workers’ nest eggs, paving the way for a more secure and comfortable retirement

Japan is gearing up to reduce sales of super-long government bonds in its upcoming fiscal year revision, striving to better control debt issuance and foster greater stability in the market, Reuters reported via Investing.com

Ocado has elevated its partnership with Spain’s Bon Preu by launching a state-of-the-art automated warehouse. This thrilling advancement promises to turbocharge Bon Preu’s online grocery service, accelerating deliveries and meeting the surge in customer demand like never before

Amazon is investing a massive AU$20 billion to expand data center infrastructure across Australia, turbocharging the nation’s AI potential and driving its digital economy to new heights. This ambitious move is poised to establish Australia as a dominant force in the global tech landscape

Amazon is gearing up to transform Australia’s digital landscape with a staggering $13 billion investment in data center infrastructure over the next five years, Reuters reports. This ambitious initiative promises to boost cloud services and fuel the explosive growth of the nation’s digital economy

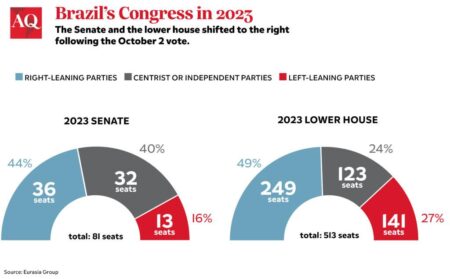

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

Brazil has chosen key critical mineral projects to receive a game-changing US$900 million investment through a dynamic BNDES-Finep partnership, set to turbocharge the country’s strategic mineral sector and dramatically reduce dependence on imports

Air France-KLM CEO expressed enthusiastic confidence in the Boeing 787, highlighting its remarkable fuel efficiency and exceptional reliability. This exciting announcement arrives as the airline prepares to expand its long-haul fleet with this state-of-the-art aircraft