Japan’s PM candidate Takaichi now faces a crucial test: convincing bond investors amid rising market concerns, Reuters reports. Her economic strategies will play a key role in building trust at home and abroad, paving the way for her to win voter backing

Browsing: investors

India’s startup funding soared to a staggering $11 billion in 2025, highlighting robust investor confidence despite a more selective investment landscape. The tech ecosystem is alive with excitement as investors channel their efforts into fueling sustainable growth and pioneering innovation, TechCrunch reports

Despite ambitious economic reforms, Argentina still struggles to regain investor trust. Persistent inflation, rising debt concerns, and unpredictable policies continue to spark skepticism, leaving foreign capital wary and reluctant to come back

Political unrest in France is sending shockwaves through the markets, as widespread protests and uncertainty over government policies create a cloud of doubt for businesses and investors alike. This turmoil is fueling rising fears about economic stability throughout the Eurozone

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

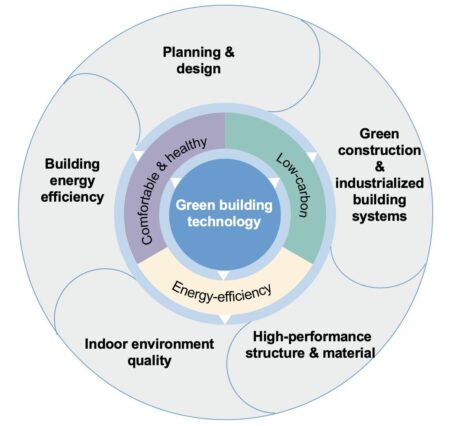

China’s ambitious green initiatives have ignited a wave of enthusiasm in ESG investing. However, investors remain cautious, highlighting ongoing concerns over transparency and enforcement gaps. Genuine market confidence will only emerge with clearer regulations and stronger accountability measures

UK shares soared as banks and consumer stocks led a powerful rally, confidently shrugging off fresh tariff threats. Investors remained optimistic, focusing on strong corporate earnings and promising economic data instead of trade worries

UK brings thrilling news for Nvidia stock investors as recent government tech initiatives and favorable market conditions spark a wave of fresh confidence in the chipmaker’s growth potential. Shares soar with an energetic surge driven by renewed optimism

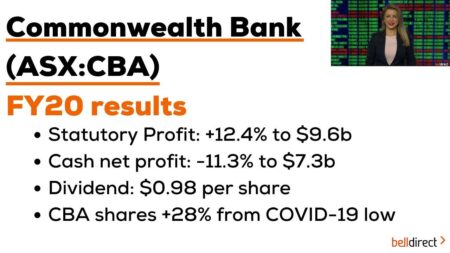

Australia’s Commonwealth Bank (CBA) has smashed records with a stellar annual profit, driven by soaring home loan growth and sharp cost control. However, despite this remarkable success, investors have been selling off pricey shares, revealing a cautious sentiment in the market

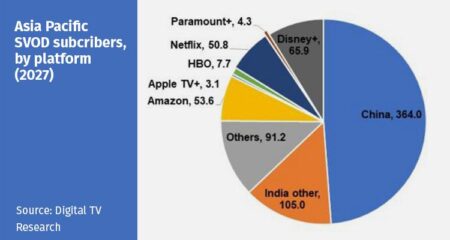

Asia-Pacific markets delivered a mixed bag of results as investors remained on edge, eagerly anticipating key updates from the high-stakes U.S.-China trade negotiations. Traders are intently focused on any clear signals about potential tariffs and groundbreaking agreements that could transform the landscape of global trade

Nvidia’s revenue from China is set to soar past $6 billion in Q1, even as worries mount over possible export bans that could affect the semiconductor powerhouse. Investors are on high alert, keenly observing how escalating geopolitical tensions might transform the tech landscape.

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.

Investors greeted the US-China tariff truce with enthusiasm, as the easing of trade tensions sparked a wave of optimism across global markets. Yet, analysts are sounding a note of caution, highlighting that the journey toward a comprehensive agreement is riddled with uncertainties. The ultimate outcome remains closely watched and open to interpretation.

In Canada, the leading election contenders are sparking a wave of investor enthusiasm for a new pro-business era. As parties roll out their platforms, enticing promises of tax reforms and simplified regulations are stealing the spotlight, with the potential to transform the nationﻗs economic landscape.

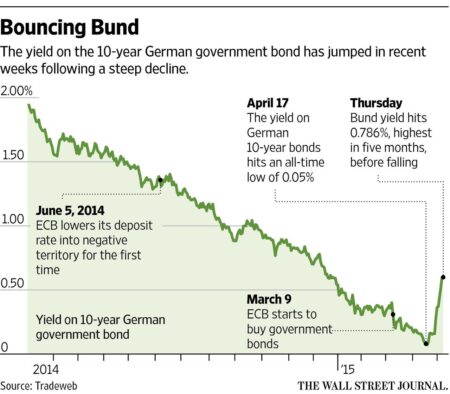

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

UK stocks remained largely unchanged amid ongoing concerns over tariffs, prompting a cautious approach from investors. As trade tensions escalate, market participants are closely monitoring developments that could impact economic stability.

Japan’s bond yields are rising as investors closely watch for the Bank of Japan’s (BoJ) next policy decision. The shift reflects growing expectations of tighter monetary policy amidst global inflation pressures, signaling potential changes in Japan’s economic landscape.

As trade tensions escalate under Trump’s tariff threats, Brazil’s bond market emerges as a potential haven for investors. With attractive yields and relative stability, it offers a compelling alternative amidst global economic uncertainty.