The United Kingdom’s non-chicken table egg market is poised for steady growth, driven by a rising passion for alternative eggs. With a modest 0.2% CAGR, this sector is gaining momentum despite market challenges, as highlighted by industry analyst IndexBox

Browsing: market analysis

Yum China Holdings, Inc. (NYSE:YUMC) just revealed its Q3 earnings, thrilling investors with standout same-store sales growth that surpassed analyst expectations. Following this strong performance, analysts have enthusiastically raised their revenue and profit forecasts

The UK’s market for refined sunflower and safflower oils is on the rise, projected to skyrocket to an impressive 168K tons and $331M by 2035. Driving this surge are growing consumer demand and exciting new health trends, according to IndexBox’s latest report

Japan Tissue Engineering (TSE:7774) has sharply reduced its losses, igniting fresh investor enthusiasm as the company moves closer to a significant profitability milestone. This exciting development is driving robust bullish momentum ahead of the upcoming earnings report

A recent uproar around a coffee startup has catapulted Germany’s venture capital scene into the spotlight, igniting lively debates about its appetite for risk and commitment to fueling groundbreaking innovation, Financial Times reports

The UK car rental market is set to accelerate dramatically through 2030, driven by a booming wave of domestic and international tourism and a bold shift toward electric and sustainable vehicle fleets, reveals the 2025 GlobeNewswire report

ResearchAndMarkets.com is excited to introduce the “Germany Cardiology KOLs Fair-Market Value Compensation Rates Report 2025” – your go-to independent benchmark for confidently negotiating with top key opinion leaders and healthcare providers in cardiology

The United Kingdom’s ceramic sanitary fixtures market is on an exciting upward trajectory, poised to grow steadily at a 1.9% CAGR in value, according to IndexBox. This promising momentum is driven by strong, consistent demand and continuous infrastructure advancements

Germany’s retail sector is boldly navigating uncharted waters as Covid-19 restrictions and store closures transform the landscape. This ICE365 Content Series article explores the creative strategies retailers are deploying to survive and thrive, offering a glimpse into what the future holds in a post-pandemic world

Argentina’s data center colocation market is exploding with growth, driven by an unprecedented demand for state-of-the-art digital infrastructure. GlobeNewswire reveals the supply hurdles that are surfacing as cloud services and tech investments soar to new heights

The United Kingdom’s processed meat market is poised for steady growth, with a projected CAGR of +0.8% through 2035. This upward trend is driven by evolving consumer preferences and groundbreaking innovations, according to IndexBox’s latest forecast report

The United Kingdom’s market for copper bars, wire, and plates is poised for steady growth, with a projected 1.2% CAGR driven by robust demand from the booming construction and manufacturing industries, according to IndexBox’s latest forecast report

Italy’s vital economic data and political developments on October 24 are poised to seize investors’ full focus. Market reactions could send ripples through the euro and Italian stocks, with TradingView highlighting the essential factors shaping market sentiment

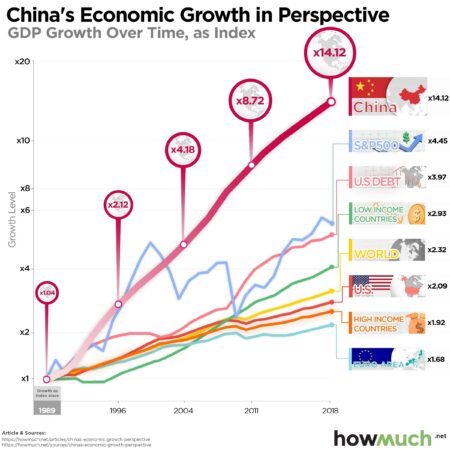

China’s economy continues its steady march forward with consistent growth, but beneath the surface, consumer confidence is starting to waver amid persistent uncertainties. Analysts point to cautious spending habits as households grapple with rising costs and increasing pressures from global markets

Comfort Systems USA (NYSE:FIX) shines with a premium valuation driven by consistent, high-quality growth. Powered by strong operational performance and savvy strategic acquisitions, the company is poised to seize exciting market opportunities ahead, according to Seeking Alpha

China’s latest clampdown on rare earth exports is sending shockwaves through global markets. Traders are rapidly reshuffling their portfolios as fears of tightening supply escalate, highlighting just how crucial these critical minerals are to the global economy

The United Kingdom’s cucumber and gherkin market is poised for steady growth, with a 2% CAGR in value projected through 2035. This promising rise is driven by strong, ongoing demand and evolving consumer preferences, reveals IndexBox

The United Kingdom’s construction sands market is set to soar, growing at an exciting 4.9% CAGR through 2035. This dynamic expansion is driven by a surge of new infrastructure projects and fast-paced urban development, according to a recent report by IndexBox

Oil prices slipped on Wednesday, dragged down by persistent concerns over a global supply glut. Heightening market unease, escalating US-China trade tensions added further strain, Reuters reports. Investors are proceeding with caution as demand forecasts remain uncertain

Investors are buzzing about three Canadian growth stocks that are set to explode in 2024. With strong fundamentals and incredible market potential, experts are urging buyers to act fast before prices skyrocket.