Italy’s markets seize the spotlight on July 23, with investors keenly awaiting key economic data, political developments, and the far-reaching impact of EU policy moves. Get ready for a wave of volatility as eurozone uncertainties continue to loom large

Browsing: market analysis

The Germany gas turbine market is on track to skyrocket to USD 2.5 billion by 2035, driven by a strong CAGR of 4.42% from 2025 to 2035. This remarkable surge is fueled by soaring energy demands and swift industrial expansion, reveals openPR.com

Brazil has firmly established itself as the world’s leading soybean exporter, fueled by soaring demand from China. This explosive growth not only underscores Brazil’s vital role in the global agricultural landscape but also marks a significant turning point in international trade dynamics

Jim Cramer shines a spotlight on Novo Nordisk A/S (NVO) as “Canada’s backdoor” in a recent Insider Monkey report, highlighting the pharma giant’s daring strategies and thrilling growth prospects throughout North America

The UK’s crude maize oil market is set for steady and promising growth, with a CAGR of +1.8% projected from 2024 to 2035. According to IndexBox, the market value is expected to soar to an impressive $56 million by 2035

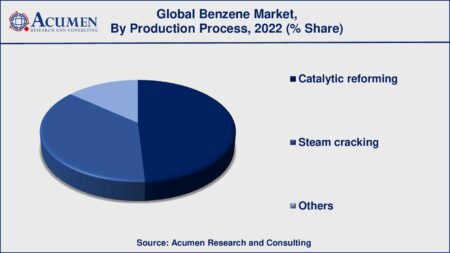

The UK’s benzene market is set for an exciting surge, projected to skyrocket to 2.1 million tons in volume and reach a staggering $1.6 billion in value by 2035, according to IndexBox’s latest report

Japan’s flash PMI shows a modest uptick in business activity, signaling cautious optimism among companies navigating ongoing economic uncertainties. Analysts expect a steady recovery ahead but stress the importance of staying vigilant as challenges persist

Italy’s construction output is skyrocketing, according to the latest report, showcasing a dynamic resurgence in the sector. Driven by soaring demand and robust government investments, this surge is igniting fresh optimism about Italy’s economic revival

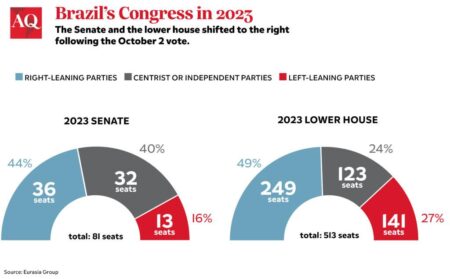

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

The UK’s manicure and pedicure preparations market is set to skyrocket, reaching an impressive 7.6K tons and $125 million by 2035. This rapid growth is driven by rising beauty consciousness and a booming demand for high-end nail care products, IndexBox reveals

India is surging ahead of China, the US, EU, and Germany in economic growth, driven by robust domestic demand, lightning-fast digital adoption, and groundbreaking manufacturing reforms-signaling a powerful shift in the global economic landscape

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

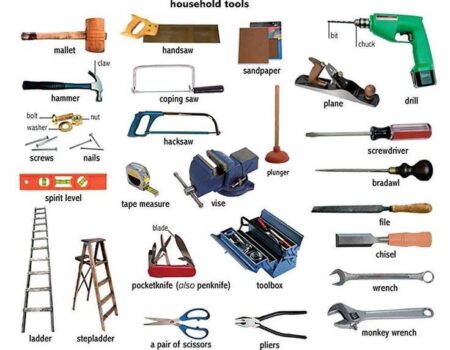

The UK household hand tools market is set for exciting growth, with a projected CAGR of +1.3% through 2035, according to IndexBox. Driven by a booming DIY culture and a wave of home improvement projects, demand is soaring to new heights!

Nvidia’s revenue from China is set to soar past $6 billion in Q1, even as worries mount over possible export bans that could affect the semiconductor powerhouse. Investors are on high alert, keenly observing how escalating geopolitical tensions might transform the tech landscape.

Brazil’s coffee exports are set to face a decline, even as the country celebrates record-breaking revenue. This shift is largely driven by a surge in Robusta production. Experts warn that unpredictable global demand could pose challenges for the future of Brazil’s coffee market, leaving many to wonder how this will affect one of the nation’s most beloved commodities.

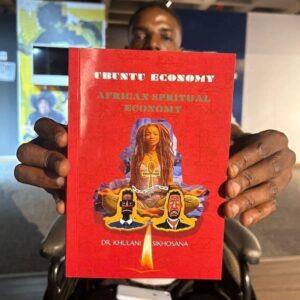

In a captivating recent analysis, Ubuntu Economics (@Snacktrading) unveiled the dynamic market strategies of Binance, showcasing its remarkable ability to adapt in the face of shifting regulatory landscapes. These insights not only underscore Binance’s resilience but also hint at its significant potential to shape the future of crypto trading.

Asia’s stock markets showcased a patchwork of performances as the shadow of Trump’s tariffs casts uncertainty over global trade. In a bright spot, Japan’s indices surged ahead, fueled by robust economic data, while other regional markets grappled with a wave of cautious investor sentiment.

In Italy, the spotlight on “lo spread”—the interest rate gap between Italian and German bonds—has started to fade as fresh priorities take center stage. Analysts suggest that this change signals deeper worries, emphasizing the importance of stability that goes beyond just figures

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.

The United States has expressed its strong support for Japan’s view that the dollar-yen exchange rate is primarily driven by economic fundamentals. This shared perspective seeks to bolster stability in financial markets during these times of global economic uncertainty, according to officials