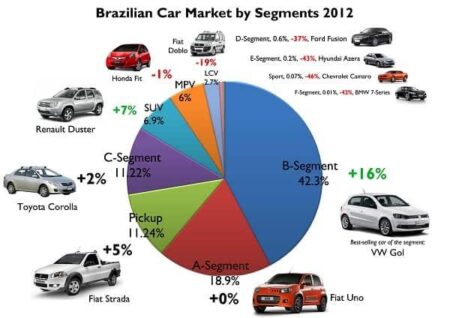

Brazil’s auto market is sparking serious worries about U.S. tariff policy as automakers grapple with soaring costs and dwindling competitiveness. With tariffs on the rise, industry experts caution that these challenges could jeopardize American jobs and lead to higher prices for consumers.

Browsing: market analysis

TelefĂłnica is setting its sights on a significant opportunity in Spain’s rapidly expanding €10.5 billion defense sector. As the government ramps up military spending, this telecom powerhouse is poised to harness its cutting-edge technological expertise to bolster national security.

Germany is grappling with a pressing dilemma as consumer spending struggles to keep pace with soaring savings. Amidst economic uncertainty and persistent high inflation, many Germans are choosing to prioritize their financial security over splurging on non-essential items. This shift in mindset is casting a shadow over retail growth and complicating recovery efforts across the nation.

The International Monetary Fund has adjusted its growth forecast for the UK, reflecting the persistent influence of Trump’s tariffs on the global economy. This revised outlook raises alarms about escalating trade tensions and their far-reaching consequences for economic stability.

Italy is pushing UniCredit to divest from its Russian operations as part of the negotiations to wrap up its deal with Banca Popolare di Milano (BPM), a source reveals. This strategic shift is designed to ensure compliance with European sanctions in light of the escalating geopolitical tensions

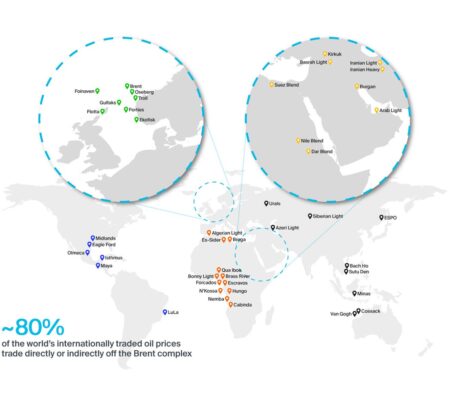

Data from Reuters reveals that Russian oil shipments have dramatically slashed OPEC’s share of India’s crude imports to an all-time low. This significant shift underscores India’s increasing reliance on non-OPEC sources as the global energy landscape continues to evolve and fluctuate

Canada is rapidly establishing itself as a global powerhouse for raw materials, fueled by its abundant reserves of essential minerals and a strong commitment to sustainable practices. Experts believe this trend not only highlights Canada’s potential but also positions it as a crucial player in satisfying the world’s ever-growing demand for resources.

America’s wine industry is grappling with significant hurdles as global tariffs tighten their grip on profits. In a bold retaliatory action, Canada has slapped extra duties on U.S. wines, intensifying a crisis that puts small vineyards and the entire sector at risk.

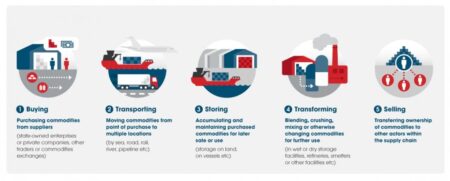

Exciting news for commodity traders! They are gearing up to submit their bids for Italy’s vital gas storage facility, the Interconnector Pipeline (IP), by May. This strategic initiative is a key part of Italy’s mission to bolster energy security in response to the surging demand for resources.

Exciting news from Brazil’s Meliuz! The company is gearing up to unveil a groundbreaking initiative designed to supercharge its Bitcoin buying strategy. This bold move aims to draw in a wave of cryptocurrency enthusiasts, harnessing Meliuz’s popular cashback platform to encourage crypto transactions in the booming digital economy.

Wall Street kicked off the day on a positive note, with the S&P 500 and Nasdaq climbing higher as exciting US-Japan tariff discussions began. However, a 1.5% drop in UnitedHealth cast a shadow over the Dow, highlighting the persistent challenges facing the healthcare sector.

USA Rare Earth stock soared dramatically after news broke that the Trump administration is set to stockpile essential metals. This development has sparked a wave of optimism among investors, who are eager about the prospects of heightened demand in light of persistent global supply chain challenges.

Exciting news from Pacific Bay Minerals! The company has officially announced the resumption of trading for its highly anticipated Brazil Gold Property, following a significant update. Investors are on the edge of their seats, eagerly awaiting more details as Pacific Bay advances its exploration and development initiatives in this promising region.

Homebuyers in Canada are facing tough times as soaring interest rates and escalating housing costs force many to step back from the market. This shift is not just tightening household budgets; it also poses a risk of cooling the overall economy, raising alarms among policymakers and economists alike.

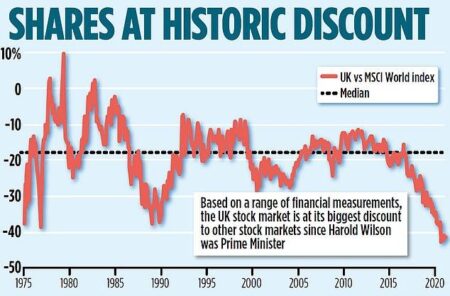

According to a recent analysis by Yahoo Finance, three UK stocks are reportedly trading significantly below their estimated fair value, with potential upside of up to 49.6%. Investors may want to explore these undervalued opportunities for future growth.

The U.S. Energy Information Administration (EIA) has revised its Brent oil price forecast for 2025 and 2026, signaling a more cautious outlook amid fluctuating global demand and production challenges. This adjustment reflects ongoing volatility in the energy market.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Prices for the PlayStation 5 have surged in Europe and Australia, raising concerns that U.S. gamers could face similar increases. Industry analysts suggest rising production costs and economic factors may lead to price adjustments in the coming months.

In a surprising analysis, strategists suggest that Japan, rather than China, may have strong incentives to reduce its U.S. Treasury holdings. This shift could be driven by Japan’s need to stabilize its currency amidst ongoing economic challenges.

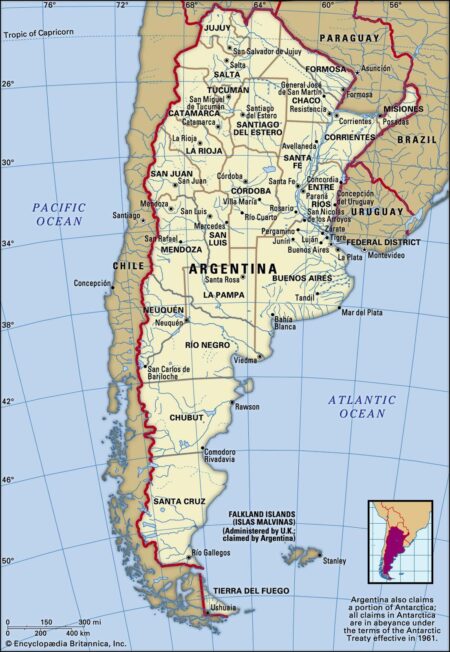

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.