Brazilian markets plunged sharply after the announcement that former President Jair Bolsonaro plans to support his son, Eduardo Bolsonaro, as a presidential candidate-igniting concerns over potential political upheaval and economic instability

Browsing: market reaction

The Indian rupee teeters on the edge of sharp declines as upcoming liquidity and growth reports threaten to rattle market confidence. At the same time, bond yields are set to move, reflecting investors’ changing economic outlook

Cattle ranchers express a mix of concerns and optimism about the new beef price plan, highlighting both the hurdles ahead and promising opportunities. Meanwhile, former President Trump-often hailed as a champion for ranchers-remains a key figure in industry discussions

Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

Argentina’s President Milei scored a stunning midterm victory, fueling market excitement and drawing comparisons to Trump’s political rise-signaling potential new waves in global populist movements

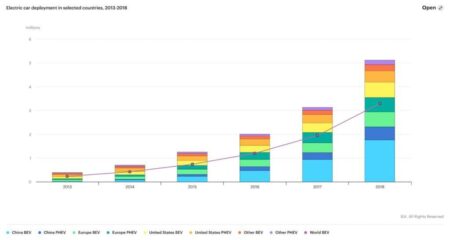

China EV stocks dipped following Tesla’s disappointing Q3 earnings report, sparking fresh concerns among investors about the sector’s growth prospects. Attention now turns to upcoming sales numbers and production updates as market watchers eagerly await the next move

Political unrest in France is sending shockwaves through the markets, as widespread protests and uncertainty over government policies create a cloud of doubt for businesses and investors alike. This turmoil is fueling rising fears about economic stability throughout the Eurozone

Dow Jones futures soared as President Trump signaled an “eternity” stance before imposing a staggering 100% tariff on Chinese goods, igniting fierce trade tensions and sending shockwaves through the markets

Argentina’s sudden cut in export duties has sent shockwaves through the Chicago Board of Trade (CBOT), sparking a surge of volatility as traders race to predict shifts in global commodity supply and prices

Argentina’s Javier Milei, once hailed by markets for his daring free-market vision, is now facing a sharp decline in investor confidence. Confronted with growing economic hurdles, he has turned to Donald Trump’s populist playbook in a desperate effort to regain support

Argentina’s assets plunged sharply as President Javier Milei convened an urgent cabinet meeting following a significant electoral setback. Market nerves are mounting, with investors on edge, eagerly watching for the government’s next move, Bloomberg reports

Argentina’s markets tumbled sharply following Javier Milei’s defeat in the Buenos Aires election, sparking investor concerns over political uncertainty and the fate of crucial economic reforms, Reuters reports via Investing.com

A surprise trade deal with Japan has sparked a wave of excitement across the globe, igniting hopes for wider and more powerful economic alliances. This unexpected agreement signals major changes on the horizon for regional trade dynamics

Australia’s central bank caught markets off guard by holding interest rates steady at 3.85%, bucking widespread expectations of a hike. The Reserve Bank highlighted economic uncertainty and easing inflation as the main reasons for pressing pause this time around

Former President Trump announced that the U.S. and China have struck a groundbreaking trade deal, igniting a powerful rally in Chinese stock markets. This landmark agreement marks a major step forward in easing years of economic tensions between the two global powers

Argentina’s markets surged with excitement after Javier Milei’s impressive performance in local elections, sparking investor enthusiasm for his bold libertarian economic vision. Experts believe his victory paves the way for promising market-friendly reforms

Italy’s Finance Minister has dropped hints about a possible resignation, as the government grapples with escalating divisions regarding the future of UniCredit. This growing rift presents serious challenges for the administration, sparking worries about economic stability and investor confidence.

Investors greeted the US-China tariff truce with enthusiasm, as the easing of trade tensions sparked a wave of optimism across global markets. Yet, analysts are sounding a note of caution, highlighting that the journey toward a comprehensive agreement is riddled with uncertainties. The ultimate outcome remains closely watched and open to interpretation.

European markets are experiencing a surge of volatility as political unrest in France and Germany sends ripples of concern through the investment community. With proposed reforms hanging in the balance and government stability under scrutiny, traders across the continent are adopting a more cautious approach.

Shares of India’s IndusInd Bank surged as investors reacted positively to news that the impact of a recent accounting lapse was less severe than anticipated. What initially sparked concern has now been largely addressed, calming investor anxieties and restoring confidence in the market.