The United Kingdom’s cucumber and gherkin market is poised for steady growth, with a 2% CAGR in value projected through 2035. This promising rise is driven by strong, ongoing demand and evolving consumer preferences, reveals IndexBox

Browsing: market trends

Italy’s steadfast commitment to safeguarding its gold reserves is proving incredibly rewarding as global prices skyrocket. Experts praise Rome’s strategy as a powerful show of confidence in bullion amid volatile market conditions. Reuters reports

Stocks slipped as global investors reacted to the twists and turns in U.S. Treasury yields, while the Argentine peso surged on a fresh wave of market optimism. This Treasury shake-up sparked a cautious atmosphere across emerging markets

Japan’s average rice price has fallen for the third consecutive week, according to the latest data from nippon.com. Experts attribute this steady decline to a seasonal surplus and changing consumer tastes driving the market shift

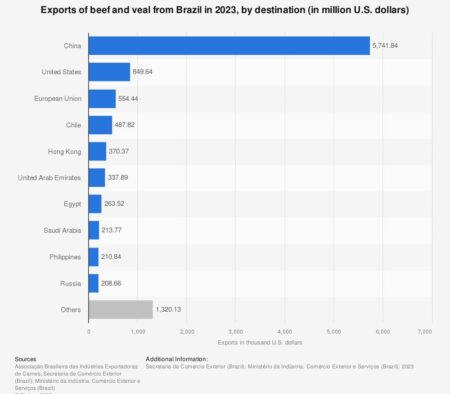

Brazil’s beef exports to China have soared, fueled by U.S. tariffs introduced during the Trump era that are reshaping global trade. This dramatic shift highlights how protectionist policies are steering demand away from traditional markets, opening exciting new doors for South American suppliers

Japan Inc is placing its bets on the new government to spark robust economic growth and tame inflation, a Reuters poll reveals. Businesses are eagerly awaiting bold policy actions to rein in soaring costs and drive a powerful recovery amid persistent global challenges

Brazil’s beef exports to China skyrocketed by 38% in September, driven by US tariffs that have made American meat less competitive, Reuters reports. This dramatic surge highlights the shifting dynamics of global trade amid ongoing US-China tensions

The Germany pet food market is on the rise, driven by a booming pet ownership trend and an increasing demand for premium, natural products. Industry experts highlight thrilling advancements in sustainability and innovation that are reshaping the future of this vibrant industry

Indian clothing retailer Trent has just announced its slowest revenue growth in over four years, underscoring the growing challenges facing the retail sector as evolving consumer preferences and intense competition continue to transform the market, Reuters reveals

The UK carbonated beverages market, now worth more than $25 billion, is poised for dynamic and steady growth through 2030. Driven by emerging health trends and cutting-edge innovations, the industry is alive with fresh competition and exciting new opportunities, according to GlobeNewswire

Russia’s private sector activity has plunged to its lowest point in three years, highlighting growing economic struggles amid persistent sanctions and escalating geopolitical tensions, reports The Moscow Times

Alibaba stock has skyrocketed, driven by a surge of investor enthusiasm surrounding China’s groundbreaking AI advancements. The tech giant’s ambitious AI initiatives, bolstered by strong government support, are igniting widespread excitement and sending shares climbing as the market focuses on the future of innovation

The UK jewelry market is set to skyrocket to $7.89 billion by 2030, driven by a surge in consumer passion and cutting-edge innovations. A recent Yahoo report highlights how fierce competition and thrilling new opportunities are reshaping the industry’s future

Spain has surged ahead as Europe’s shining economic star, outpacing rivals with remarkable growth and soaring employment. The Financial Times reveals that a dynamic mix of strong domestic demand and robust exports is fueling this impressive comeback

Japan’s emerging leaders are facing criticism for overlooking stock market investment as a vital driver of economic growth. Despite increasing demands for reform, their reluctance raises concerns about missed opportunities to revitalize the economy

The Italy Loyalty Programs Intelligence Report 2025, revealed via GlobeNewswire, offers an exciting and insightful exploration of market trends, consumer behavior, and the groundbreaking strategies reshaping Italy’s loyalty program landscape

Germany’s Volkswagen has slowed vehicle production amid softening demand, underscoring the significant challenges the automaker confronts in a fast-evolving global market. This move casts a sharp light on the ongoing uncertainties disrupting the industry

China stocks are sending mixed signals as Bilibili, Vipshop, and WeRide each showcase unique momentum in their latest charts. Analysts are eagerly watching to see if this rally can maintain its strength amid ongoing global uncertainties and evolving regulations

The United Kingdom’s chicory market is on the rise, projected to hit 1.8K tons and a stunning $7.2 million in value, according to IndexBox. Driven by an increasing enthusiasm for health-conscious choices, this market is gearing up for dynamic growth in the coming years!

The US may have pioneered the robot vacuum, but today, China dominates the global market. Powering this explosive growth are advanced manufacturing techniques, aggressive pricing strategies, and dynamic innovation hubs-combining to revolutionize the industry at an unprecedented pace