Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

Browsing: market trends

Tesla has recently hiked prices on its electric vehicles in Canada, a move prompted by new tariffs that have sparked worries about a possible demand slump. Industry experts are sounding the alarm, suggesting that these rising costs could discourage consumers in an already fierce EV market.

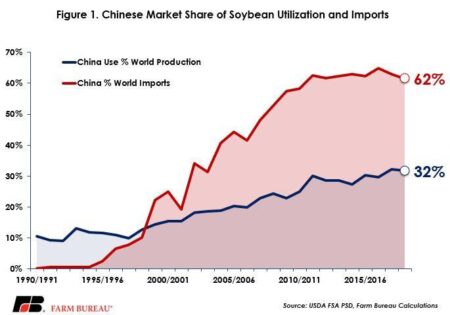

In March, China‚Äôs soybean imports from the U.S. skyrocketed, driven by a surge in demand as global supplies tighten. Yet, analysts believe that Brazil will maintain its stronghold in the market, capitalizing on its impressive production capabilities to satisfy China’s long-term requirements.

Nintendo’s eagerly awaited Switch 2 is set to make waves with a groundbreaking launch in Japan, as per industry reports. With pre-orders skyrocketing and excitement building among consumers, analysts are buzzing with predictions that it will shatter previous sales records during its opening weekend.

The Bank of Japan is calling on local banks to stay alert amidst the rising tide of financial market volatility. In a recent statement, the central bank highlighted the crucial importance of enhancing risk management practices, empowering financial institutions to effectively steer through these unpredictable waters.

India is on the brink of seizing a substantial portion of U.S. business that has long been under China’s influence, as companies actively search for alternatives in response to rising geopolitical tensions. With its competitive labor costs and an expanding market, India is set to become a pivotal player in the global supply chain landscape.

The UK’s soybean oilcake market is set to witness a steady rise, with an anticipated CAGR of 0.5% leading up to 2035, as highlighted in a recent report by IndexBox. This gradual growth underscores the persistent demand from the livestock sector and the shifting preferences of consumers.

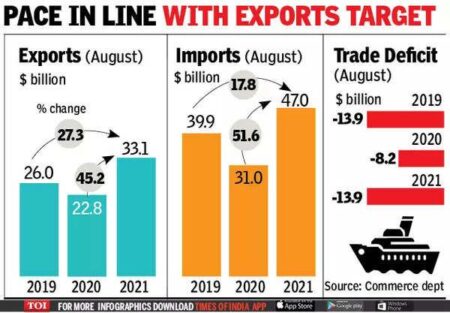

In 2024-25, India‚Äôs exports to the United States skyrocketed to all-time highs, showcasing the deepening economic partnership between the two nations. At the same time, imports from China surged to new peaks, underscoring the intricate and evolving landscape of India’s trade relationships.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

Nissan has revealed a major cutback in the production of its popular Rogue model for the US market, attributing this decision to the rising tariffs on imported vehicles. This shift highlights the hurdles that automakers are navigating in an ever-changing landscape of trade policies

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Germany is on the brink of an exciting economic transformation as a fresh “stimulus wave” sweeps in, designed to spark growth and ignite innovation. Investors are eagerly focusing on pivotal sectors, with certain stocks set to thrive from this surge of government backing

Ethena Crypto has been pushed out of Germany, igniting worries about the future of synthetic stablecoins and its native token, ENA. With regulatory pressures intensifying across Europe, the destiny of these digital assets teeters on a knife’s edge.

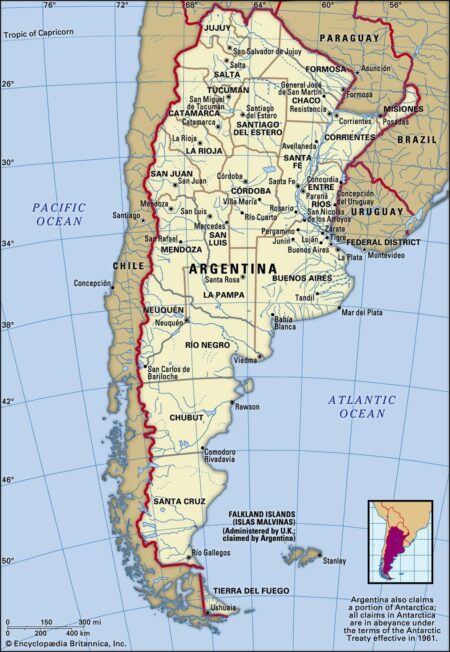

Ford Argentina reported a remarkable 99 percent increase in sales for March 2025, signaling a robust recovery in the automotive market. This surge reflects growing consumer demand and revitalized production efforts, positioning Ford for a strong year ahead.

Dimethylcyclosiloxane prices have declined in Germany and the U.S. due to soft demand and abundant supply, according to ChemAnalyst. The market’s shift reflects changing industrial needs amid a broader economic slowdown.

The Farnborough International Space Show 2025 is set to showcase groundbreaking advancements in aerospace and space technology. Attendees can expect major announcements, innovative patents, and discussions on the UK’s pivotal role in the future of space exploration.

India’s industrial output fell to a six-month low in February, raising concerns over economic momentum. Contraction in manufacturing and electricity sectors has contributed to the decline, signaling potential challenges ahead for growth prospects.

Australia’s median home value has surged by approximately $230,000 over the past five years, highlighting a significant shift in the housing market. This rise raises concerns over affordability and accessibility for potential buyers amidst ongoing economic challenges.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.