Iberian Lawyer proudly unveils its exclusive list of the 30 most influential trailblazers shaping Spain’s private equity landscape, spotlighting the visionary leaders who are fueling growth and igniting innovation across the Iberian market

Browsing: mergers and acquisitions

Organigram has made a bold move by acquiring Sanity Group, dramatically boosting its footprint in Germany’s booming cannabis market. This strategic acquisition arrives as the European cannabis industry surges ahead, drawing unprecedented investment and fueling rapid growth

Doctrine has made a bold leap by acquiring Maite.ai, Spain’s leading legal AI platform, dramatically boosting its presence across Europe. This thrilling development showcases Doctrine’s commitment to pioneering groundbreaking innovation in legal technology across the continent

Dains has expanded its presence across the UK by acquiring Hurst, dramatically strengthening its service offerings and regional reach. This thrilling move marks a major milestone in Dains’ bold growth journey, says the International Accounting Bulletin

Blackstone has won approval from India’s central bank to acquire a stake in Federal Bank, marking a significant milestone for private equity’s expanding influence in India’s banking sector, Reuters reports

Zurich Insurance has surged ahead of UK rival Beazley with a compelling $11 billion bid to acquire the company, Reuters reports, marking a bold move that could reshape the fiercely competitive insurance landscape

Russia’s Lukoil is in advanced talks to sell select assets to a U.S. investment firm, marking a daring move amid escalating geopolitical tensions. This deal could dramatically transform the energy sector landscape as sanctions keep reshaping the market

Chinese private equity powerhouse FountainVest has won Italy’s green light to acquire a stake in EuroGroup Laminations, a key player in the automotive supply chain-signaling a major leap forward in Sino-Italian investment collaboration

Major Western food giants like Starbucks and Burger King are making bold moves, handing over significant stakes to Chinese private equity firms. This strategic shift in ownership highlights their drive to accelerate growth and fully capitalize on the booming local market opportunities in China

Forbes explores how strategic corporate mergers are revolutionizing the digital energy sector, enabling companies to surpass China’s lead and spark a groundbreaking surge of innovation worldwide

Berlin is setting its sights on a majority stake in TenneT Germany, according to Boersen-Zeitung. This ambitious move aims to strengthen state control over critical energy infrastructure as the nation speeds up its energy transition

Mayer Brown is thrilled to have supported Travel Counsellors in their exciting acquisition of The Travel Agent Next Door in the UK. This bold move promises to boost their market presence and unlock fresh opportunities to connect with even more travelers across the industry

China’s Anta Sports and Li Ning are reportedly joining forces in a daring bid to acquire German sportswear powerhouse Puma, sources told Reuters. This bold move signals a fierce new rivalry set to reshape the global athletic apparel landscape

Iberdrola has kicked off an ambitious takeover bid to seize full control of Brazil’s Neoenergia, aiming to supercharge its presence in Latin America’s rapidly expanding renewable energy market, according to Yahoo Finance

Russia’s Lukoil is actively seeking buyers for its foreign assets, Reuters sources reveal. This bold strategy comes amid escalating geopolitical tensions and a swiftly evolving market landscape

Paramount has made a bold move by exiting the Argentine market through the sale of its TelefĂ© network, marking a significant turning point in its strategy for Latin America. This decision underscores the growing challenges reshaping the region’s media landscape

CVC Credit has joined forces with H.I.G. Capital to acquire Rentokil Workwear France, significantly strengthening H.I.G.’s presence in the European workwear market. This exciting partnership marks a bold strategic move, unlocking new growth and opportunities for both companies

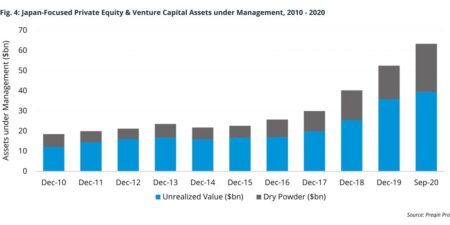

Japan is rapidly emerging as a prime destination for private equity firms, driven by an aging population and transformative corporate reforms. Investors are now setting their sights on this previously overlooked market, discovering thrilling new opportunities and heralding a promising surge of growth ahead

Baker Tilly Germany is considering selling a stake to private equity, Bloomberg reports. This bold strategy aims to supercharge growth and expand their service portfolio, positioning them strongly amid rising competition in the accounting industry

B4SI has made a bold leap in Spain by acquiring LBG España, significantly strengthening its foothold in the social impact measurement field. This thrilling expansion promises to enhance service quality and broaden its reach, bringing greater value to clients across the region