Argentina’s Central Bank has slashed reserve requirements to unleash a wave of liquidity into the financial system, sparking hopes for a much-needed boost in economic activity amid ongoing market hurdles, Bloomberg reports

Browsing: monetary policy

Australia’s unexpected surge in inflation has ignited fresh concerns, as markets now brace for a possible interest rate hike looming ahead. Economists and consumers alike are preparing for the hurdles that tighter monetary policy could introduce

The Bank of Canada has just cut its key interest rate to 2.25%, hinting at a potential pause in future cuts for now. This calculated step aims to strengthen the economy as it faces ongoing challenges, CBC reports

The euro edged higher against the dollar as the greenback softened, dragged down by cautious U.S. economic data. Meanwhile, France’s recent policy shifts ignited fresh investor confidence, boosting optimism for the eurozone’s economic outlook

The week ahead in FX and bonds is charged with excitement as the Federal Reserve prepares to unveil a long-anticipated rate cut, while pivotal U.S.-China trade talks take center stage. Investors are on high alert, hungry for clues on monetary policy changes and geopolitical developments that could reshape market dynamics

Japan’s likely next finance minister is signaling possible shifts in monetary policy, sparking both excitement and uncertainty among yen bears. Market experts are gearing up for moves that could strengthen the yen, challenging the recent downward momentum

The US Treasury Department has just sealed a groundbreaking economic stabilization deal with the Central Bank of Argentina, signaling a major leap forward in financial collaboration and reinforcing Argentina’s drive to stabilize its economy, Anadolu Ajansı reports

Japan’s Economy Minister Takaichi passionately urged the Bank of Japan to focus on achieving inflation by ensuring steady wage growth, emphasizing that boosting household income is key to powering a robust economic recovery

The Bank of Canada uncovers a cautious atmosphere among businesses and consumers ahead of its upcoming rate decision, spotlighting rising concerns over economic growth amid persistent inflation challenges

This week, investors are on high alert as key data drops, featuring CPI numbers from the US, UK, Japan, and Canada, along with the Flash Global PMIs. Attention is also riveted on Japan’s crucial upper house election. Markets are gearing up for significant shifts as inflation trends and growth indicators take center stage

Australia’s central bank labels its monetary policy as “little restrictive,” showcasing strong confidence in the nation’s economic growth despite persistent inflation concerns. This cautious stance signals potential future moves designed to sustain a steady and resilient recovery

Analysis reveals that while Takaichi’s win as Japan’s leader may delay Bank of Japan rate hikes, it won’t halt them entirely. Market watchers remain vigilant as the policy outlook stays unpredictable

Deutsche Bank calls on Germany to unleash its full fiscal strength to invigorate the economy during these uncertain times. Experts highlight that strategic government support is crucial to safeguard the bank’s stability and drive its growth forward

The Bank of Canada caught markets off guard by slashing interest rates, despite ongoing uncertainty surrounding the inflation outlook, according to minutes from the latest meeting. Officials weighed economic risks with caution before deciding to ease monetary policy

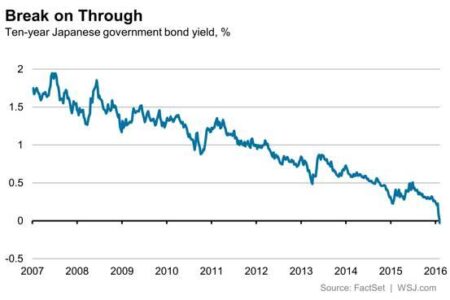

Japan’s bond yields have surged to a 16-year high, igniting a wave of speculation about a potential interest rate hike. Investors are on edge, closely watching the Bank of Japan’s next move as inflation pressures steadily mount

The Bank of Japan is gearing up for a pivotal rate hike as inflationary pressures intensify. Markets are buzzing with anticipation, bracing for a landmark policy shift that could finally bring an end to decades of ultra-loose monetary easing

The Bank of Japan is preparing to accelerate the sale of its asset holdings, signaling a decisive shift away from its ultra-loose monetary policy amid rising inflationary pressures, The Wall Street Journal reports

Brazil’s central bank decided to hold interest rates steady, signaling a strategic pause designed to fuel economic recovery as inflation eases. This choice reflects cautious optimism amid persistent global uncertainties

Argentina let the peso plunge sharply in early trading before stepping in to halt further losses, the Buenos Aires Times reports. This decisive action aims to stabilize a currency battling growing economic uncertainty

The IMF has unveiled its 2025 Article IV Consultation for the United Kingdom, highlighting a resilient economic recovery amid persistent global challenges. The report underscores the crucial need to uphold fiscal discipline and push forward with structural reforms to secure sustainable growth