The Bank of Canada has just revealed its 2026 calendar for policy interest rate announcements and key publications, providing markets and policymakers with clear, reliable guidance throughout the year

Browsing: monetary policy

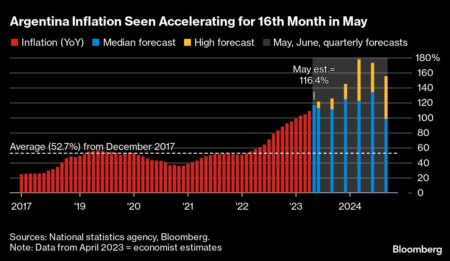

The IMF has eased Argentina’s reserves accumulation targets, signaling a more flexible stance ahead of the crucial review following October’s local elections. This shift arrives as the nation grapples with persistent economic hurdles and political uncertainties

Argentina is making daring moves to replenish its dangerously low cash reserves amid mounting economic challenges. The government’s bold shock therapy aims to steady the economy and spark renewed investor confidence, Bloomberg reports

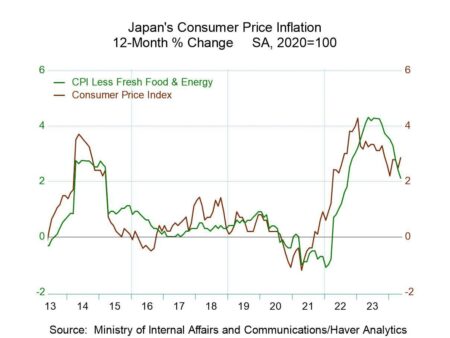

Japan is finally shedding its long-standing resistance to price hikes as inflation rises, signaling a powerful shift in both consumer and corporate mindsets. This change marks an exciting new era for Japan’s economy, long defined by the grip of deflation

Argentina’s Economy Minister Milei is taking bold action to rein in the currency market as the peso supply surges, aiming to stabilize the fragile economy amid soaring inflation and a sharp rise in capital flight, Bloomberg reports

China held its benchmark lending rates steady on Wednesday, exactly as markets anticipated. This move highlights Beijing’s cautious approach amid economic uncertainties, aiming to fuel growth while keeping inflation under control

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

China’s Premier has called for stronger price controls to combat rising deflationary pressures that pose a serious threat to the economy. This decisive move aims to stabilize markets and ignite economic growth amid these challenging times

Argentina’s inflation is poised to spike once more in June after a short-lived dip in May, Reuters reports. Skyrocketing prices continue to squeeze the economy, fueled by currency instability and unyielding consumer demand

China is intensifying its push to rein in the yuan’s surge, a daring move designed to protect its export advantage amid a storm of global economic uncertainties, reports the Council on Foreign Relations

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

UK inflation has soared to its highest level since January 2024, intensifying pressure on the Bank of England as it weighs potential rate cuts. Markets are navigating cautiously, with policymakers walking a delicate tightrope between curbing inflation and supporting economic growth

Argentina’s Finance Minister Javier Milei is staking his political future on a strong peso, fiercely committed to curbing inflation and reigniting investor confidence amid economic chaos-though this daring strategy could send shockwaves through the markets

Japan’s wholesale inflation took a breather in April, easing concerns over skyrocketing prices and reducing the urgency for the Bank of Japan to hike interest rates, Reuters reports. This cooling trend could signal a shift in the future path of monetary policy

Chinese President Xi Jinping is signaling a bold new strategy to put an end to the prolonged deflationary price wars, with the goal of stabilizing markets and sparking robust economic growth, Yahoo Finance reports. This move has the potential to reshape China’s competitive landscape in a profound way

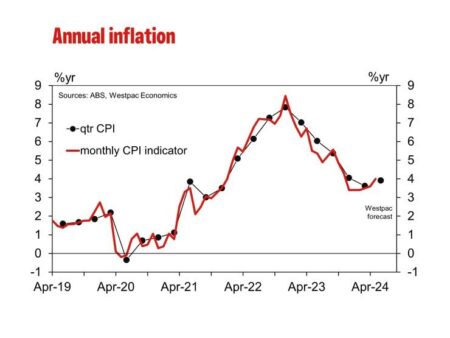

Australia’s central bank caught markets off guard by holding interest rates steady at 3.85%, bucking widespread expectations of a hike. The Reserve Bank highlighted economic uncertainty and easing inflation as the main reasons for pressing pause this time around

Breaking: In a surprising twist that stunned markets, the Reserve Bank of Australia has chosen to keep interest rates unchanged in a split decision, going against widespread predictions of a cut amid persistent economic uncertainty

China is accelerating its drive to transform the renminbi into a global powerhouse, expanding its influence across international trade and finance. This ambitious move aims to challenge the dominance of the US dollar and boost China’s economic impact worldwide

Argentina’s inflation rate has impressively dropped to 1.5% under Javier Milei’s dynamic leadership, signaling a remarkable economic turnaround. Bold reforms and strict fiscal discipline have been crucial in restoring stability to the nation’s economy

Australia’s CPI inflation slowed more than expected in May, easing pressure on the Reserve Bank and sparking renewed market optimism about potential rate cuts. Investors are now eagerly watching upcoming economic data for new clues