Beijing is racing to accelerate the launch of yuan-backed stablecoins, aiming to ignite a surge in digital currency adoption and strengthen China’s financial influence amid mounting global competition, reports the South China Morning Post

Browsing: monetary policy

China is gearing up to turbocharge the yuan’s global reach with an exciting new operations centre, unveiled by the People’s Bank of China. This ambitious move aims to boost the currency’s international clout and speed up cross-border transactions like never before

Indian shares dipped on Monday, dragged down by escalating tensions in the Middle East and cautious investor sentiment as all eyes focus on the Federal Reserve’s upcoming policy decision. Traders are on high alert, searching for clear signals amid a storm of global uncertainties

The Bank of Japan held interest rates steady and announced a gradual easing of its bond purchase taper, signaling a cautious approach amid ongoing economic uncertainties, according to the Caledonian Record

The Bank of Japan kept interest rates unchanged and announced plans to slow down tapering bond purchases, signaling a cautious approach amid ongoing economic uncertainties. Markets are eagerly awaiting the next move

Japan has issued rare warnings about its bond market in the latest policy roadmap, highlighting growing concerns over rising yields and potential market turbulence, Reuters reports. This signals a careful shift in the nation’s traditionally steady monetary approach

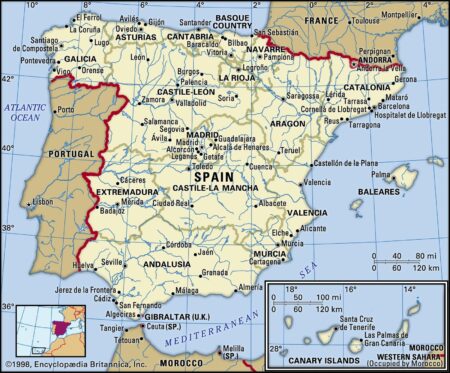

The IMF’s 2025 Article IV Consultation for Spain highlights robust economic growth and improved fiscal stability, while emphasizing the need for continued reforms to boost productivity and address labor market challenges decisively

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

Argentina’s inflation is set to ease to 28.6% by year-end, Reuters reveals. This encouraging decline marks a significant shift from earlier highs, showcasing the government’s relentless efforts to stabilize the economy amid ongoing challenges

China’s central bank has injected a fresh wave of liquidity to ease worries over a potential cash crunch, underscoring its dedication to maintaining stable credit conditions amid slowing economic growth, reports the Wall Street Journal

The Bank of Canada held its key interest rate steady at 2.75%, underscoring ongoing uncertainties tied to tariff negotiations. With trade talks remaining unpredictable, the central bank chose a cautious approach amid a clouded economic outlook

The RBA is poised to deliver rapid rate cuts if economic instability arises from Trump’s policies, according to minutes that highlight a determined commitment to strengthening Australia’s economy amid global uncertainties

Japan has launched an ambitious economic policy roadmap aimed at boosting domestic ownership of Japanese Government Bonds (JGBs). This bold move seeks to enhance financial stability and reduce reliance on foreign investors, Reuters reports

Brazil’s economy stunned analysts by posting robust growth despite high interest rates. Bloomberg reports that strong consumer demand and export gains are fueling a surprising economic surge.

Germany has firmly rejected a proposed ceasefire, overturned a recent tariff ruling, and launched efforts to repatriate its gold reserves. These decisive moves highlight a dramatic shift in the country’s economic and geopolitical priorities

The Bank of Spain has raised a red flag about a slowdown in the growth of lending income, signaling potential hurdles for the financial sector. This shift could pose challenges to economic recovery efforts, sparking worries among both investors and policymakers.

Argentina’s black market for dollars is witnessing a notable decline as the government takes steps to relax stringent currency controls. This strategic shift is designed to bring stability to the economy, yet hurdles remain. With inflation and economic uncertainty still looming large, public confidence continues to waver.

Japan and the United States are set to draw from their previous foreign exchange agreement in their upcoming discussions, as revealed by Finance Minister Shunichi Kato. This strategic approach highlights a strong commitment to fostering currency stability and enhancing trade relations between the two nations

The United States has expressed its strong support for Japan’s view that the dollar-yen exchange rate is primarily driven by economic fundamentals. This shared perspective seeks to bolster stability in financial markets during these times of global economic uncertainty, according to officials

China’s leading state banks are poised to lower deposit rates this Tuesday, according to insider sources. This pivotal change in the country’s monetary policy is designed to invigorate lending and spark economic growth as the nation navigates through persistent economic hurdles