Australia’s job market experienced a remarkable surge in April, with impressive job gains that took many by surprise. Yet, analysts caution that this strong performance might not be enough to stop the Reserve Bank from slashing interest rates next week, as ongoing inflation and economic pressures continue to loom large.

Browsing: monetary policy

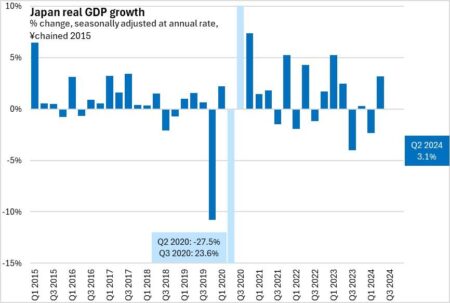

Japan’s economy has taken a surprising turn, contracting for the first time in a year and sparking worries among analysts. This unexpected downturn arrives just as looming tariff increases threaten to add more pressure on growth. Economists are sounding the alarm, suggesting that this trend could be an early warning of more significant economic hurdles on the horizon.

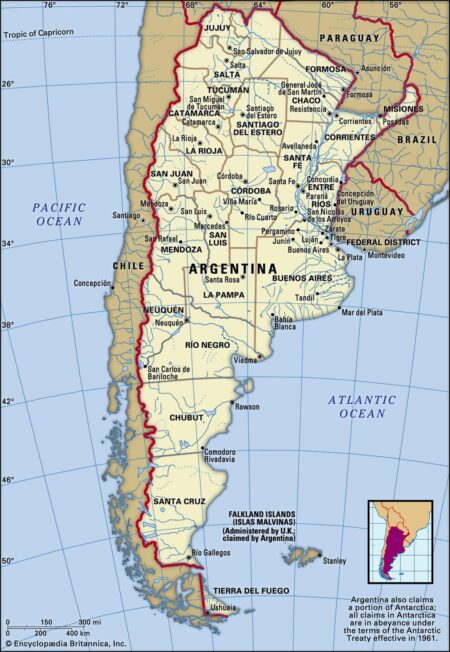

Argentina has triumphantly secured a staggering $42 billion in funding from the International Monetary Fund and various other sources, signaling a bold new chapter in its economic policy. By lifting long-standing currency controls, the country is taking decisive steps to stabilize its economy amidst persistent financial challenges. This pivotal move could pave the way for renewed growth and prosperity.

Japan’s Finance Minister Kato has proposed an intriguing idea: the nation’s substantial holdings of US Treasury securities might just become a powerful bargaining chip in trade negotiations. This bold statement highlights Japan’s strategic maneuvering as it navigates the complex landscape of economic discussions with the United States.

The Bank of Canada’s governing council recently explored the idea of slashing interest rates once more in April, highlighting their persistent worries about economic growth. This discussion is part of a larger strategy aimed at tackling inflation while bolstering the Canadian economy.

In a surprising turn, former President Donald Trump’s economic policies have contributed to a resurgence of Japan’s yen. With strategic trade negotiations and a focus on reshoring manufacturing, the yen is experiencing renewed strength against the dollar, raising optimism in Tokyo.

Argentina’s recent $20 billion financial rescue has sparked crucial discussions about its economic trajectory. Experts are diving deep into pressing topics like debt sustainability, strategies for controlling inflation, and the potential effects on social stability as the nation navigates ongoing challenges.

In a recent announcement, the Bank of Japan (BOJ) has chosen to keep its interest rates steady, highlighting the current economic stability. However, officials voiced their worries about looming risks from US tariffs that could pose challenges to Japan’s export-driven economy.

As we step into January 2025, the UK’s private capital market is navigating a vibrant and challenging macroeconomic landscape. With interest rates on the rise and inflation making its presence felt, investors are rethinking their strategies. They are on a quest for resilience in the face of market fluctuations while skillfully adapting to evolving regulatory changes.

In a pivotal meeting, finance leaders from Japan and the United States gathered to tackle the pressing issue of fluctuating currency rates. These discussions are not just about numbers; they aim to enhance economic stability and strengthen bilateral relations in the face of growing global financial uncertainties.

France has raised a red flag, cautioning that dismissing Federal Reserve Chair Jerome Powell could spell trouble for the U.S. dollar and shake up the economy. French economic officials warn that this drastic step might undermine market confidence and trigger financial upheaval.

The Bank of Japan is calling on local banks to stay alert amidst the rising tide of financial market volatility. In a recent statement, the central bank highlighted the crucial importance of enhancing risk management practices, empowering financial institutions to effectively steer through these unpredictable waters.

The Japanese Yen is set to soar as it gains strength against a faltering US Dollar. With trade uncertainties and economic hurdles weighing down the USD, experts believe this upward trend could accelerate in the weeks ahead. Buckle up for an exciting ride in the currency markets!

The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Inflation in Canada eased to 2.3% in March, largely due to a decline in gas prices, according to recent data. This marks a slight improvement, offering some relief to consumers as the cost of living remains a key concern nationwide.

Argentina’s recent IMF deal marks a critical financial maneuver aimed at stabilizing its economy. Negotiations involved stringent fiscal reforms and commitments to reduce inflation, showcasing the government’s resolve to navigate ongoing economic challenges.

India’s foreign exchange reserves have surged to $676.3 billion, according to the central bank governor, reflecting a robust external position. This increase highlights the country’s resilience amid global economic uncertainties, bolstering confidence in the Indian economy.