A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Browsing: monetary policy

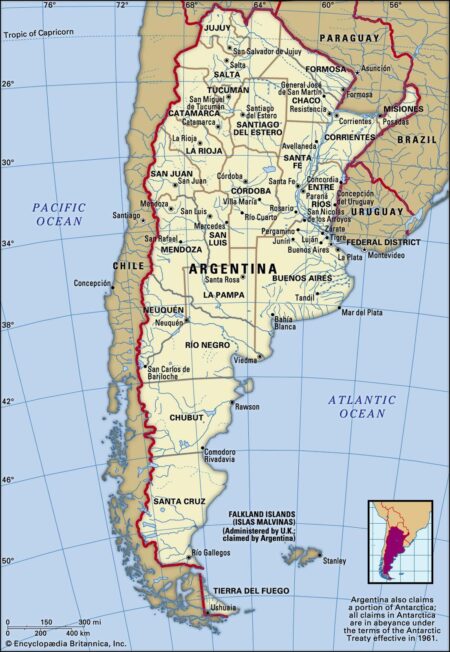

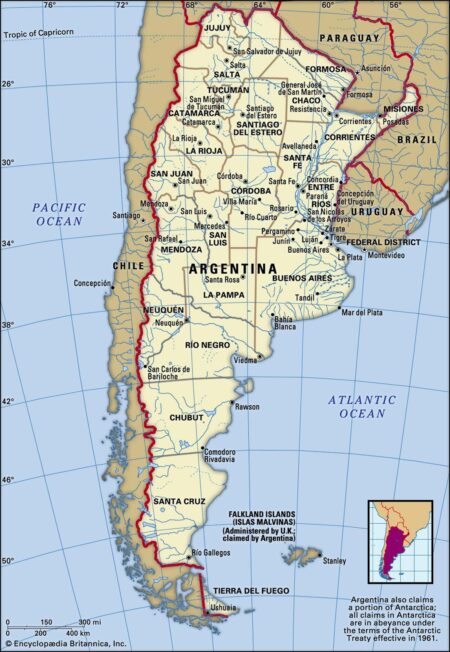

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

In a significant economic shift, President Javier Milei has announced the end of Argentina’s strict currency controls, known as the “cepo,” following the IMF board’s approval of a US$20-billion bailout. This move aims to restore market confidence amid ongoing financial turmoil.

Central bank deputies from China, Japan, and South Korea convened to discuss the implications of U.S. tariffs on their economies. The meeting, reported by Reuters, highlights growing concerns over trade tensions and their potential impact on regional stability.

Argentina has secured a $20 billion deal with the International Monetary Fund (IMF) to support President Javier Milei’s ambitious economic reforms. The agreement aims to stabilize the nation’s economy amid ongoing inflation and fiscal challenges.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

Argentina has formally requested the first tranche of over 40% of its $20 billion loan program from the International Monetary Fund (IMF). This financial assistance aims to stabilize the country’s economy amid ongoing fiscal challenges and inflation concerns.

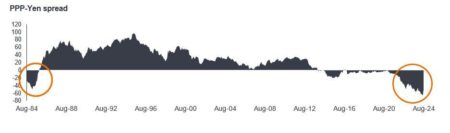

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

Recent inflation data from France and Spain, coupled with insights from the ECB survey, strengthen the argument for potential rate cuts. Analysts suggest that easing monetary policy could address persistent economic challenges in the Eurozone.

In a recent statement, Deutsche Bank Chairman revealed that Germany received approximately $1 trillion in financial support without cost. This significant figure highlights the country’s economic strategies and the ongoing impact of fiscal policies in Europe.

Former Bank of Canada governor, Stephen Poloz, has cautioned that Canada is at a significant disadvantage in the ongoing trade war, stating, “We’re seriously outgunned.” His remarks highlight the challenges facing Canada’s economy amidst escalating global tensions.

U.K. inflation fell to 2.8% in February, offering a temporary reprieve for consumers and policymakers. However, analysts warn that factors such as rising energy costs and supply chain disruptions could drive prices up again shortly.

In today’s ForexLive Asia-Pacific FX news wrap, Bank of Japan Governor Kazuo Ueda addressed key monetary policy issues, underscoring the central bank’s commitment to maintaining its accommodative stance. His remarks influenced market sentiment, impacting the yen’s fluctuations.

Javier Milei’s economic policies in Argentina have garnered attention as a potential “inflation miracle,” but analysis indicates that outdated items in the inflation index may skew perceptions of economic recovery. As critics examine the data, the true impact remains uncertain.

Argentina’s inflation rate is projected to increase marginally in February, according to a Reuters poll. Analysts anticipate ongoing economic challenges will contribute to persistent price rises, keeping inflationary pressures at the forefront of national concerns.

Japan’s inflation rate has slowed more than anticipated, yet remains elevated, prompting speculation about the Bank of Japan’s potential interest rate hikes. Analysts suggest that persistent price pressures may force the central bank to act sooner than expected.

Brazil’s central bank has raised interest rates to their highest level since 2016, signaling a cautious approach towards future hikes. With inflation concerns in mind, officials indicate that smaller increases may be on the horizon to balance economic growth and stability.

Germany has reached a landmark agreement on a fiscal package that includes significant changes to its debt brake policy. This reform aims to enhance budget flexibility while ensuring fiscal stability, addressing both economic challenges and future investments.

Asia-Pacific markets opened mixed following the decision of both China and the U.S. to maintain steady interest rates. Investors are closely monitoring economic indicators and global trends as they navigate uncertainties in the financial landscape.