OPEC+ is reaching its breaking point as global oil markets react sharply to powerful forces beyond its control: former U.S. President Donald Trump’s policies and the unpredictable swings in Chinese import demand, Reuters reports

Browsing: oil market

Russia’s fuel oil exports to Asia faced a sharp decline in early 2026, as persistent Western sanctions continue to disrupt established trade routes, Reuters reports. Industry experts highlight dwindling demand and growing logistical hurdles as major forces squeezing the flow of shipments even more tightly

The recent capture of Nicolás Maduro has sparked a heated debate about U.S. intentions, with critics claiming Washington is strategically positioning itself to dominate the global oil market amid rising geopolitical tensions and surging energy demand

Canada’s oil sands are roaring back to life as U.S. shale production hits a plateau. Surging demand and soaring prices are fueling fresh investments, marking a powerful shift in the landscape of North American energy

Russia’s Lukoil is actively seeking buyers for its foreign assets, Reuters sources reveal. This bold strategy comes amid escalating geopolitical tensions and a swiftly evolving market landscape

The UK’s market for refined sunflower and safflower oils is on the rise, projected to skyrocket to an impressive 168K tons and $331M by 2035. Driving this surge are growing consumer demand and exciting new health trends, according to IndexBox’s latest report

India’s BPCL is set to launch a spot crude oil tender designed to replace Russian supplies, a source told Reuters. This bold step underscores India’s determination to diversify its crude oil sources amid the shifting dynamics of the global energy market

Russia’s oil industry stands on the edge of a dramatic shake-up as a fierce clash erupts between leading traders, Bloomberg reveals. This high-stakes rivalry threatens to disrupt supply chains and could deepen the already formidable challenges brought on by global sanctions

The United Kingdom’s sunflower and safflower oil market is on the rise, poised to hit an impressive 334,000 tons worth $535 million. This exciting growth is driven by soaring demand and a significant boost in import volumes, reveals IndexBox

Gasoline shortages in Russia, which recently drove prices up, are expected to ease soon, the energy minister told Reuters, citing stronger supply chains and increased refinery production

Sanctions-hit Nayara Energy has reignited its fuel sales to Brazil and Turkey, making a bold strategic move to reclaim market share amid mounting geopolitical challenges, Bloomberg reports. This marks a pivotal milestone in the company’s ambitious push for a global trade comeback

Volatility surged on China’s oil futures following the US sanctions on Yangshan Port, Reuters reports. Traders sprang into action as market uncertainty escalated amid mounting geopolitical tensions

Venezuela has announced daring plans to deploy naval vessels to its vital oil export hub, responding decisively to recent U.S. sanctions. This bold strategy aims to protect shipments and tighten control amid escalating geopolitical tensions

Oil prices soared as a sharp decline in U.S. crude inventories ignited fresh market optimism, outshining concerns over new tariffs imposed by India. Traders are navigating a delicate balance between shrinking supply and escalating geopolitical tensions

Indian Oil and BPCL have reignited their Russian oil purchases for September, sources told Reuters, marking a bold strategic shift as global sanctions continue to disrupt supply chains. This move highlights India’s agile energy strategy in the face of escalating geopolitical tensions

U.S. crude oil inventories plunged by 4.3 million barrels last week, signaling a tightening supply amid robust demand, according to the latest data from the Energy Information Administration (EIA)

Germany has decisively turned down the idea of splitting Europe’s power market into zones, asserting that this approach would jeopardize both market efficiency and stability. This bold stance emerges during a critical period of discussions surrounding energy security and pricing, especially in light of the ever-changing crude oil prices

The U.S. Energy Information Administration (EIA) has revised its Brent oil price forecast for 2025 and 2026, signaling a more cautious outlook amid fluctuating global demand and production challenges. This adjustment reflects ongoing volatility in the energy market.

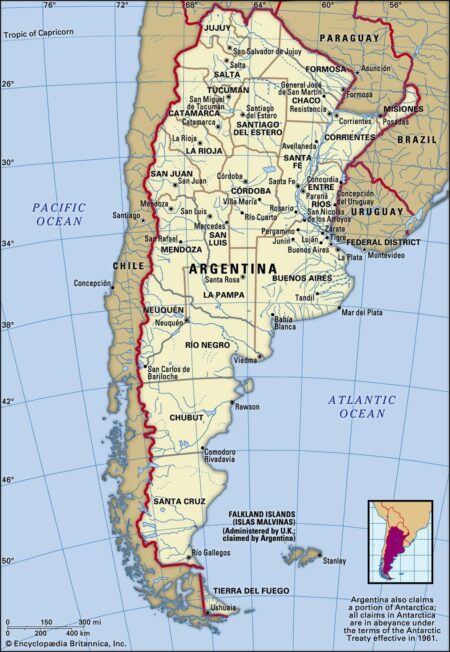

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

The Kremlin is experiencing heightened concern as the price of Russian Urals crude oil approaches the critical $50 threshold. This significant drop could hamper state revenues, further exacerbating the economic challenges faced amid ongoing sanctions.