Former US President Donald Trump revealed bold plans for the US to ‘take control’ of Venezuela and tap into its enormous crude oil reserves. Yet, experts remain skeptical, suggesting this move is unlikely to make a major dent in India’s oil costs due to minimal trade ties and India’s wide array of alternative suppliers

Browsing: oil prices

The recent capture of Nicolás Maduro has sparked a heated debate about U.S. intentions, with critics claiming Washington is strategically positioning itself to dominate the global oil market amid rising geopolitical tensions and surging energy demand

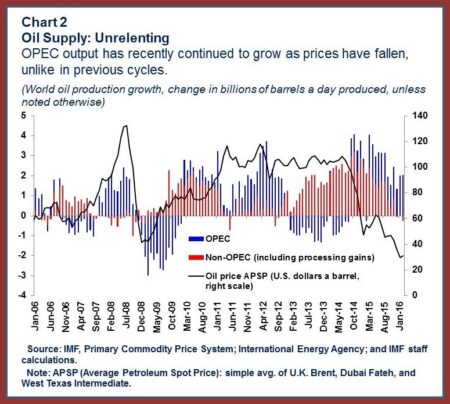

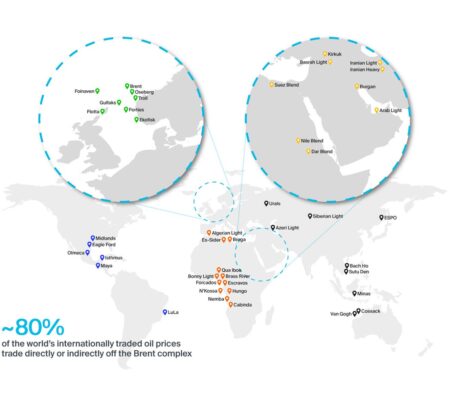

Oil prices soared as strong US economic growth sparked optimism for increased demand, while ongoing supply worries driven by geopolitical tensions and production cuts kept the markets on edge, Reuters reports

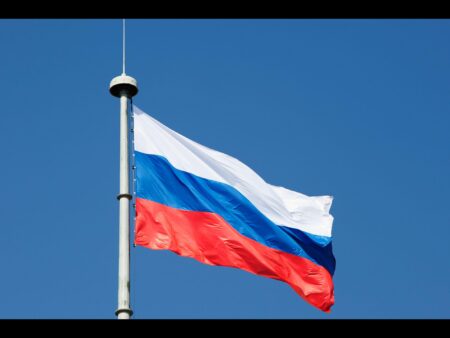

Russia’s oil and gas revenues tumbled by a staggering 34% year-on-year in November, revealing a sharp downturn driven by relentless sanctions and fading global demand, The Moscow Times reports. This steep drop is placing immense strain on the country’s economy

Alaska’s oil production is set to soar by 13% next year, the Energy Information Administration reveals. This exciting boost comes from intensified drilling activities and increased output from key fields, signaling a powerful resurgence for the state’s energy industry

US sanctions on Russian oil are set to disrupt global markets by tightening supply and driving prices upward. Energy experts warn this shift could unleash greater volatility, as countries rush to adjust trade routes and secure alternative energy sources

Canada’s oil sands are roaring back to life as U.S. shale production hits a plateau. Surging demand and soaring prices are fueling fresh investments, marking a powerful shift in the landscape of North American energy

A cutback in Reliance’s Russian crude imports could dramatically reshape India’s oil supply and pricing dynamics, especially amid rising global geopolitical tensions and the urgent drive to diversify import sources. This move might just redefine the future of India’s entire energy strategy

US and China signal easing tensions, igniting a powerful rally across global markets. Oil prices soar on upbeat demand forecasts, fueling investor excitement. Traders remain alert as shifting geopolitical dynamics reshape the economic landscape. Reuters reports

Oil prices slipped on Wednesday, dragged down by persistent concerns over a global supply glut. Heightening market unease, escalating US-China trade tensions added further strain, Reuters reports. Investors are proceeding with caution as demand forecasts remain uncertain

Crude oil prices surged dramatically on Wednesday as escalating sanctions and mounting geopolitical tensions ramp up pressure on Russia’s energy exports, fueling fears of widespread disruptions to the global supply, Yahoo Finance reports

Oil prices dipped as the US sharply criticized India’s newest energy policies, sparking concerns over a potential global supply glut. Market watchers remain on high alert, bracing for volatility amid geopolitical tensions and shifting demand forecasts

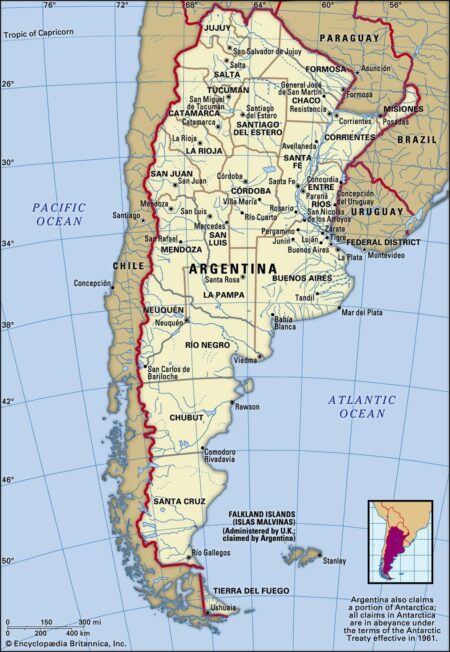

Argentina has boldly risen as a South American oil titan, dramatically boosting crude production and exports. With soaring output and strong policy support, the nation is rapidly becoming a dominant player on the global energy stage

Oil prices soared as a sharp decline in U.S. crude inventories ignited fresh market optimism, outshining concerns over new tariffs imposed by India. Traders are navigating a delicate balance between shrinking supply and escalating geopolitical tensions

India will continue to secure oil from the most competitive suppliers, stressed the Indian envoy, who strongly criticized US tariffs as “unfair” and “unjustified.” This powerful declaration underscores India’s steadfast determination to meet its energy demands despite escalating global tensions

Russia’s crude oil shipments have dropped to their lowest level since February, underscoring the ongoing challenges shaking the global energy market. This steep fall exposes growing export pressures driven by rising geopolitical tensions

U.S. crude oil inventories plunged by 4.3 million barrels last week, signaling a tightening supply amid robust demand, according to the latest data from the Energy Information Administration (EIA)

In a striking move, Russia has dramatically increased its budget deficit forecast for 2025, now tripling the previous estimate. This shift comes as worries mount over persistently low oil prices. The government is sounding the alarm, cautioning that ongoing fluctuations in the energy market could jeopardize the country’s fiscal stability.

The U.S. Energy Information Administration (EIA) has revised its Brent oil price forecast for 2025 and 2026, signaling a more cautious outlook amid fluctuating global demand and production challenges. This adjustment reflects ongoing volatility in the energy market.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.