As U.S.-China tensions escalate, investors are rushing to reduce their exposure to Chinese assets. Many are offloading Chinese stocks, shifting their attention to domestic markets, and seeking fresh opportunities in new regions to steer through the mounting geopolitical challenges

Browsing: Portfolio Management

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

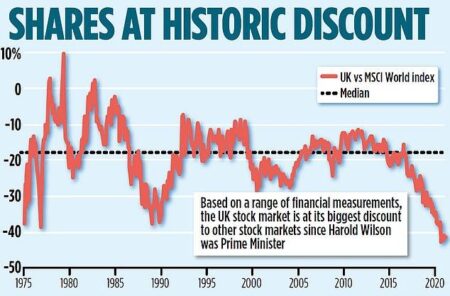

According to a recent analysis by Yahoo Finance, three UK stocks are reportedly trading significantly below their estimated fair value, with potential upside of up to 49.6%. Investors may want to explore these undervalued opportunities for future growth.

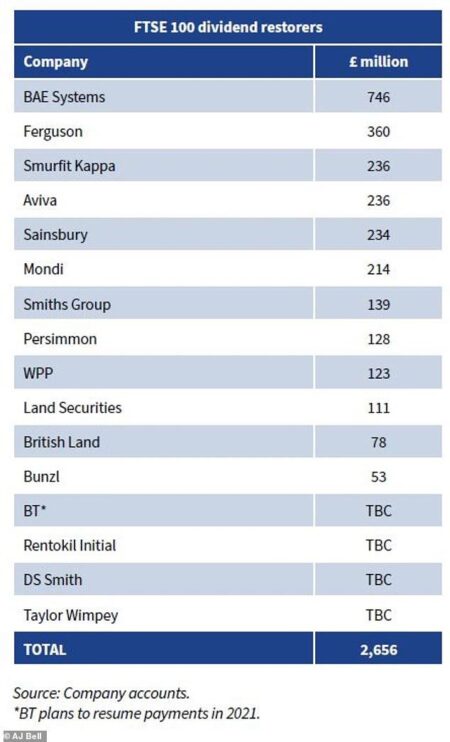

As March 2025 approaches, investors are eyeing top UK dividend stocks for reliable income. Companies such as BP, Unilever, and GlaxoSmithKline stand out, offering attractive yields and stability amid market fluctuations. Consider these options for a robust portfolio.