Japanese businesses are now sounding the alarm on cyber threats and supply chain disruptions as their top risks, highlighting growing concerns amid global uncertainties, according to a recent Asia Insurance Review report

Browsing: risk management

As data centres spring up at an unprecedented pace across New Zealand and Australia, insurers are boldly reimagining their risk strategies and overhauling policies to confront rising threats such as cyberattacks and infrastructure vulnerabilities

Cyber breaches have skyrocketed to become a leading concern in Indian boardrooms, as relentless attacks put businesses at risk of massive financial damage and enduring reputational setbacks. Consequently, companies are now placing cybersecurity at the very heart of their strategic agendas

A Brazilian startup has joined forces with Nvidia to develop groundbreaking vegetation mapping technology aimed at protecting power grids. Leveraging the power of AI, this innovative solution enhances grid safety and reliability, BNamericas reports

Urgent warnings are flashing across Spain as severe weather is about to unleash its fury in the coming days. Authorities urgently urge everyone to stay alert and follow safety guidelines as powerful storms and heavy rainfall move in

Australia’s cyber insurance market is on the brink of a massive boom, expected to quadruple by 2034. This explosive growth is driven by escalating digital threats and a surge in business awareness. Experts highlight the skyrocketing demand for coverage as cyber risks intensify across the board

Tensions between Japan and China are soaring to unprecedented levels in 2026, raising alarm bells for risk managers across the globe. Major challenges like trade disruptions, escalating security threats, and mounting geopolitical instability in East Asia call for vigilant monitoring. Now more than ever, staying informed on these unfolding events is crucial

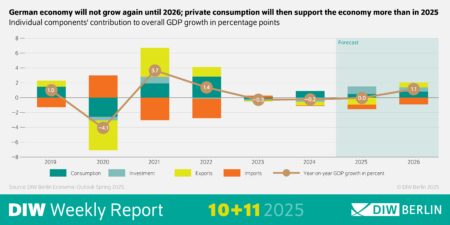

Germany stands at a pivotal crossroads, facing the risk of missing a golden opportunity. Delays in green energy investments and industrial reforms now threaten to stall its economic recovery and undermine its leadership in Europe’s urgent race toward a sustainable future, warns the Financial Times

Italy’s central bank is urging local banks to strengthen their reserves, gearing up for possible losses amid tough economic times. This proactive step underscores the critical push to safeguard financial stability amid persistent uncertainties, Reuters reports

ProShares Ultra MSCI Brazil Capped stock is poised for an exhilarating 2025 surge, driven by Brazil’s dynamic economic revival and unstoppable market momentum. Fundação Cultural do Pará highlights the critical role of strategic risk management in their latest portfolio updates

RSA takes bold strategic strides as Crawford expands its footprint across the US, Broadstone revolutionizes risk advisory services, and Kennedys sharpens its legal expertise-key developments shaping the future of America’s insurance industry

Argentina’s insurers are beginning to rebound as the economy stabilizes and fresh regulations come into effect. Industry experts point to robust premium growth and a decline in claim volatility, fueling cautious optimism about what lies ahead

Deloitte Canada has made a powerful move by acquiring Allevar, turbocharging its financial crime and compliance services for financial institutions. This game-changing acquisition is poised to enhance risk management and revolutionize regulatory solutions across the industry

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.

A recent report by Casino.org unveils a staggering revelation: Japanese gamblers placed an eye-popping $45 billion in bets on illegal online casino platforms in 2024. This dramatic increase raises significant alarms about the risks of unregulated gambling and its potential impact on public safety and financial stability across Japan.

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

Germany’s newly appointed economy chief is ready to transform the nation’s industrial scene with an audacious strategy that emphasizes bold risk-taking, swift decision-making, and significant investments. This dynamic approach seeks to breathe new life into the economy as it navigates through global challenges.

The UK’s Financial Conduct Authority (FCA) is inviting the public to share their thoughts on exciting new regulations for the cryptocurrency sector. This initiative is designed to bolster consumer protection and improve oversight of organizations, all while navigating the fast-paced world of digital assets.

A judge has turned down Imerys Italy’s choice for the future claims representative in its ongoing bankruptcy proceedings. This ruling casts doubt on the company’s approach to handling liability claims, which could complicate its restructuring efforts moving forward.

The UK’s National Cyber Security Centre (NCSC) has sounded the alarm for retailers amid a troubling rise in cyberattacks. These incidents not only disrupt operations but also erode consumer trust, highlighting an urgent call for stronger security measures throughout the industry.