Argentina has just made a staggering US$4.3 billion debt payment, the Buenos Aires Herald reveals. This bold move aims to stabilize the economy amid ongoing financial challenges and spark renewed investor confidence

Browsing: sovereign debt

Argentina has boldly settled its latest debt installment, easing investor worries and highlighting a powerful comeback in financial resilience. This achievement marks a crucial step forward in the nation’s quest to restore economic confidence and stability

Argentina’s central bank has secured a $3 billion repo agreement right before a crucial debt payment, aiming to inject liquidity and stabilize the markets amid ongoing economic challenges, Reuters reports

Italy attracted a staggering €190 billion in bids during its first bond sale of 2026, Bloomberg reports. This overwhelming demand showcases rising investor confidence amid persistent economic challenges

Argentina remains $2.4 billion short of meeting its January bond payments, fueling growing concerns about its escalating debt crisis. This substantial shortfall highlights the country’s ongoing financial struggles as it fights to honor its commitments, Bloomberg reports

The IMF is set to launch a groundbreaking $20 billion financial program for Argentina this Wednesday, Bloomberg reports. This ambitious move aims to strengthen Argentina’s economic stability in the face of ongoing fiscal challenges

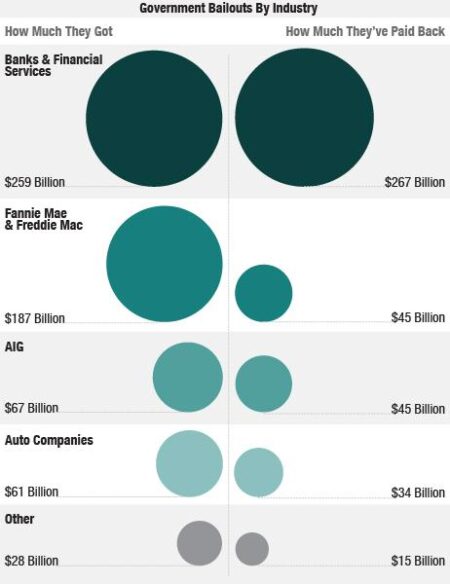

A dynamic team of JPMorgan Chase bankers, famously known as the “JPMorgan Boys,” stepped into the spotlight to mastermind the U.S. bailout for Argentina, leveraging their formidable influence to stabilize the nation’s struggling economy during a critical financial crisis

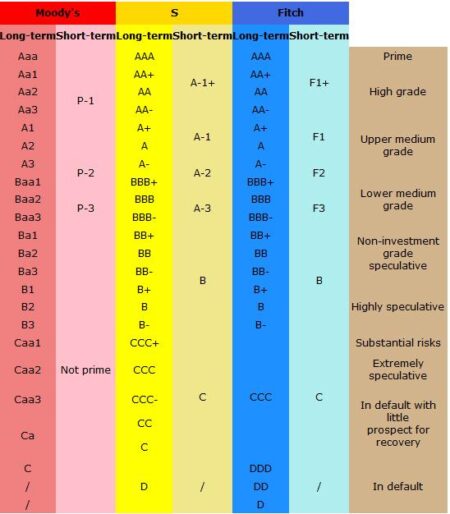

Italy finds itself at a critical crossroads as Moody’s prepares to review its credit rating after seven intense years hovering on the edge of junk status. This vital decision has the power to transform borrowing costs and steer the future of the nation’s economic stability amid ongoing challenges

Italy, France, and Belgium are grappling with the highest debt levels in the EU, a new report from a leading bank reveals. This sharp rise in public debt across these countries raises urgent questions about their economic stability and the future security of their pension systems

The Peterson Institute highlights Argentina’s credibility trap, where persistent economic turmoil and constant policy reversals chip away at investor confidence, making it ever harder to achieve stable growth and attract foreign investment

Despite ambitious economic reforms, Argentina still struggles to regain investor trust. Persistent inflation, rising debt concerns, and unpredictable policies continue to spark skepticism, leaving foreign capital wary and reluctant to come back

Exclusive: U.S. banks are scrambling to secure collateral for a staggering $20 billion bailout package for Argentina, The Wall Street Journal reveals. This high-stakes move aims to guarantee vital funding as the country battles a worsening economic crisis

Brazil’s debt stability has surged ahead, surprising analysts and boosting market confidence. According to TipRanks, robust fiscal indicators and prudent management showcase a more resilient economy poised to tackle future challenges with strength

The U.S. is ramping up financial support for Argentina, signaling that this focused aid is a strategic move-not an indication of widespread economic issues in the region, reports MarketWatch

Finance Minister seals a groundbreaking bilateral debt restructuring agreement with the United Kingdom, set to ease repayment terms and strengthen economic ties. This transformative deal offers crucial fiscal relief, opening the door to a more resilient and prosperous financial future

U.S. Treasury Secretary signals potential financial aid for Argentina as it faces economic hurdles, emphasizing a strong commitment to collaborate on stabilizing the nation’s debt and accelerating its recovery, The Wall Street Journal reports

Argentina is in a high-stakes race against the clock to secure new funding amid a sharp market plunge, driven by a fierce determination to stabilize its economy and win back investor confidence. This critical push comes as regional financial turmoil intensifies, challenging the country’s recovery plans like never before

France is facing a pivotal moment in its credit rating journey, as ongoing political unrest fuels growing concerns about the country’s economic future. Investors and rating agencies remain on edge, scrutinizing every government decision amid escalating uncertainty

France now faces the startling prospect of borrowing costs overtaking those of Italy, highlighting growing investor concerns about its fiscal outlook. This surprising development reveals changing tides in the Eurozone debt markets, reports Le Monde.fr

Ireland’s High Court has refused to enforce a staggering $16 billion judgment against Argentina, citing jurisdictional issues. This decision deals a significant setback to creditors determined to claim their winnings