Novo Nordisk (NVO:NYSE) has boldly cut the price of its weight-loss drug Wegovy in India, making it more affordable and set to take the lead in the fast-growing obesity treatment market

Browsing: stock market

Yum China Holdings, Inc. (NYSE:YUMC) just revealed its Q3 earnings, thrilling investors with standout same-store sales growth that surpassed analyst expectations. Following this strong performance, analysts have enthusiastically raised their revenue and profit forecasts

SMX (NASDAQ: SMX) has teamed up with CARTIF to revolutionize Valladolid into a state-of-the-art circularity proof hub, sparking groundbreaking sustainable innovation and supercharging the region’s green economy like never before

Japan’s Itochu Corp has announced an impressive 14% surge in its half-year net profit, fueled by robust growth in its trading and retail divisions, Reuters reports. This outstanding performance highlights the company’s ability to thrive despite ongoing global uncertainties

Japan Tissue Engineering (TSE:7774) has sharply reduced its losses, igniting fresh investor enthusiasm as the company moves closer to a significant profitability milestone. This exciting development is driving robust bullish momentum ahead of the upcoming earnings report

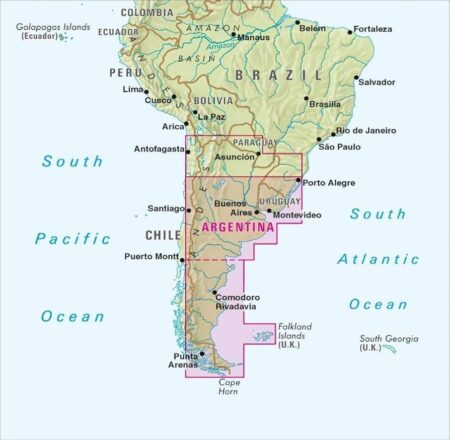

Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

Global stock markets surged to breathtaking new heights today, driven by a dynamic rally in the tech sector. Apple took center stage, shattering records as it soared to an incredible $4 trillion market value for the very first time-an extraordinary milestone that redefines corporate success

Argentina’s markets skyrocketed following Javier Milei’s electrifying electoral victory, easing worries of a looming economic crisis. Investors enthusiastically backed Milei’s bold pro-market agenda, sparking a powerful surge in stocks and a robust rally for the peso on Bloomberg.com

USA Rare Earth, Iren, Novartis, and Softbank are capturing attention with remarkable stock surges this week. Investors are abuzz as market experts reveal the hottest trends and key breakthroughs driving their shares on Yahoo Finance

Argentina’s President Milei scored a stunning midterm victory, fueling market excitement and drawing comparisons to Trump’s political rise-signaling potential new waves in global populist movements

The Nikkei 225 skyrocketed past the 50,000 mark for the very first time, marking a historic breakthrough in Japan’s stock market. Investors erupted with excitement, driven by strong corporate earnings and a surge of economic optimism

Italy’s vital economic data and political developments on October 24 are poised to seize investors’ full focus. Market reactions could send ripples through the euro and Italian stocks, with TradingView highlighting the essential factors shaping market sentiment

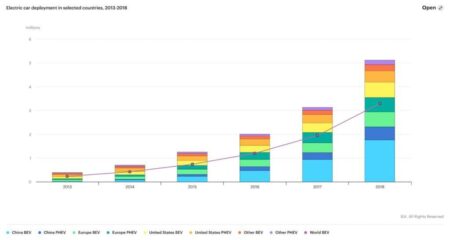

China EV stocks dipped following Tesla’s disappointing Q3 earnings report, sparking fresh concerns among investors about the sector’s growth prospects. Attention now turns to upcoming sales numbers and production updates as market watchers eagerly await the next move

U.K. stocks closed the day on an upbeat note, with the Investing.com United Kingdom 100 index rising 0.23% by the final bell. A surge of positive market sentiment boosted investor confidence, driving gains across major sectors throughout the session

Argentina’s bullish investor sentiment faces a crucial test as uncertainty builds ahead of the midterm elections, despite strong backing from the US. Market experts warn that political risks could derail economic reforms and stall the surge in investment momentum

Dow Jones futures soared as President Trump signaled an “eternity” stance before imposing a staggering 100% tariff on Chinese goods, igniting fierce trade tensions and sending shockwaves through the markets

Markets plunged sharply after former President Trump announced a daring 100% tariff on Chinese goods, doubling the existing rates. This bold escalation has intensified trade tensions, rattling the global economy with far-reaching impact

Wall Street plunged sharply in its steepest slide since April, as former President Trump’s threat to impose new tariffs on China escalated trade tensions, sending shockwaves through the market and stoking fears of an impending economic slowdown

Investors are buzzing about three Canadian growth stocks that are set to explode in 2024. With strong fundamentals and incredible market potential, experts are urging buyers to act fast before prices skyrocket.

MercadoLibre (MELI) shares dipped after the e-commerce giant made a daring move into Brazil’s pharmacy market. With competition intensifying, investors are closely watching to see what this bold step means for the company’s future. Could this be your next big chance to buy in?