This week on Dalal Street, the spotlight is firmly on the US-India trade deal, Q1 corporate earnings, and FII movements-powerful forces set to steer market sentiment and propel key indices amid unfolding global economic events, experts reveal

Browsing: stock market

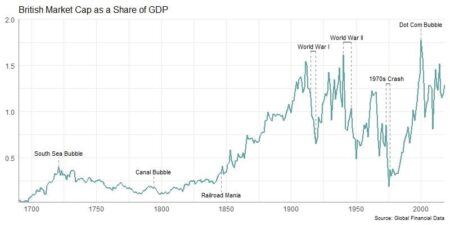

UK’s tech scene is booming with high-growth stocks stealing the spotlight from eager investors. From revolutionary startups to pioneering industry giants, these companies are shaping the future of innovation. Yahoo Finance uncovers the top tech stocks you can’t afford to miss right now

Jim Cramer shines a spotlight on Novo Nordisk A/S (NVO) as “Canada’s backdoor” in a recent Insider Monkey report, highlighting the pharma giant’s daring strategies and thrilling growth prospects throughout North America

Germany’s stock market closed the day in the red, with the DAX index falling 0.89% by the final bell. Investors remained cautious, navigating ongoing economic uncertainties and a flood of mixed corporate earnings that dampened market sentiment

Japan is buzzing with an electrifying investing frenzy as both retail and institutional investors dive headfirst into stocks and funds. Fueled by hopes of a strong economic recovery and easing monetary policies, the market pulses with unprecedented energy and boundless optimism

Dow Jones futures slipped as President Trump announced new tariffs on Canada, rattling the market after the S&P 500’s recent record-breaking surge. Meanwhile, CoreWeave shares plunged amid growing investor concerns

Shares of Indian brokers and the Bombay Stock Exchange (BSE) tumbled sharply after the securities regulator dealt a major blow by banning global trading powerhouse Jane Street from operating in India, citing serious regulatory concerns, Reuters reports

Nvidia shares skyrocketed after an analyst uncovered a game-changing design shift, sparking excitement about the company’s explosive growth potential. Investors are now abuzz: Is it time to buy Nvidia as demand surges, or sell to secure your recent gains?

Shares soared on renewed optimism about China-US trade talks, igniting a surge of investor excitement. Meanwhile, the dollar slipped against major currencies, reflecting a cautious atmosphere amid ongoing geopolitical uncertainties

Former President Trump announced that the U.S. and China have struck a groundbreaking trade deal, igniting a powerful rally in Chinese stock markets. This landmark agreement marks a major step forward in easing years of economic tensions between the two global powers

U.K. stocks edged lower, with the Investing.com United Kingdom 100 index falling 0.57% by the close of trading. Investor confidence took a hit, mirroring a cautious atmosphere amid ongoing economic uncertainties

Chip stocks tumbled sharply after reports surfaced that the U.S. could revoke export waivers for Taiwan Semiconductor and other industry giants, igniting fears of supply chain disruptions and escalating trade tensions

Indian shares dipped on Monday, dragged down by escalating tensions in the Middle East and cautious investor sentiment as all eyes focus on the Federal Reserve’s upcoming policy decision. Traders are on high alert, searching for clear signals amid a storm of global uncertainties

U.K. stocks surged on Thursday, with the Investing.com United Kingdom 100 index rising a solid 0.20%. Robust corporate earnings and promising economic data sparked investor confidence, driving the market to new heights

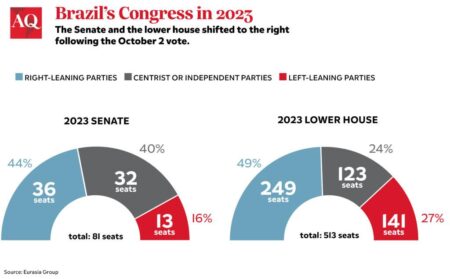

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

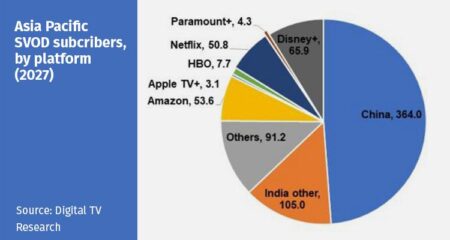

Asia-Pacific markets delivered a mixed bag of results as investors remained on edge, eagerly anticipating key updates from the high-stakes U.S.-China trade negotiations. Traders are intently focused on any clear signals about potential tariffs and groundbreaking agreements that could transform the landscape of global trade

U.K. stocks closed the day on a high, with the Investing.com United Kingdom 100 index rising 0.15% by the end of trading. Investors remained cautiously optimistic, skillfully navigating a mix of mixed economic data and ongoing global uncertainties

Argentina’s markets surged with excitement after Javier Milei’s impressive performance in local elections, sparking investor enthusiasm for his bold libertarian economic vision. Experts believe his victory paves the way for promising market-friendly reforms

U.K. stocks slipped into the red as the Investing.com United Kingdom 100 index fell 0.63% by the close of trading. Investor sentiment stayed cautious, weighed down by economic worries and persistent global uncertainties